What Credit Score Do You Need to Buy a House in Kentucky?

There is no single “magic number.” The credit score needed depends on the loan program (Conventional, USDA, FHA, VA, or Kentucky Housing Corporation down payment assistance). Here’s how it works in the real world for Kentucky buyers.

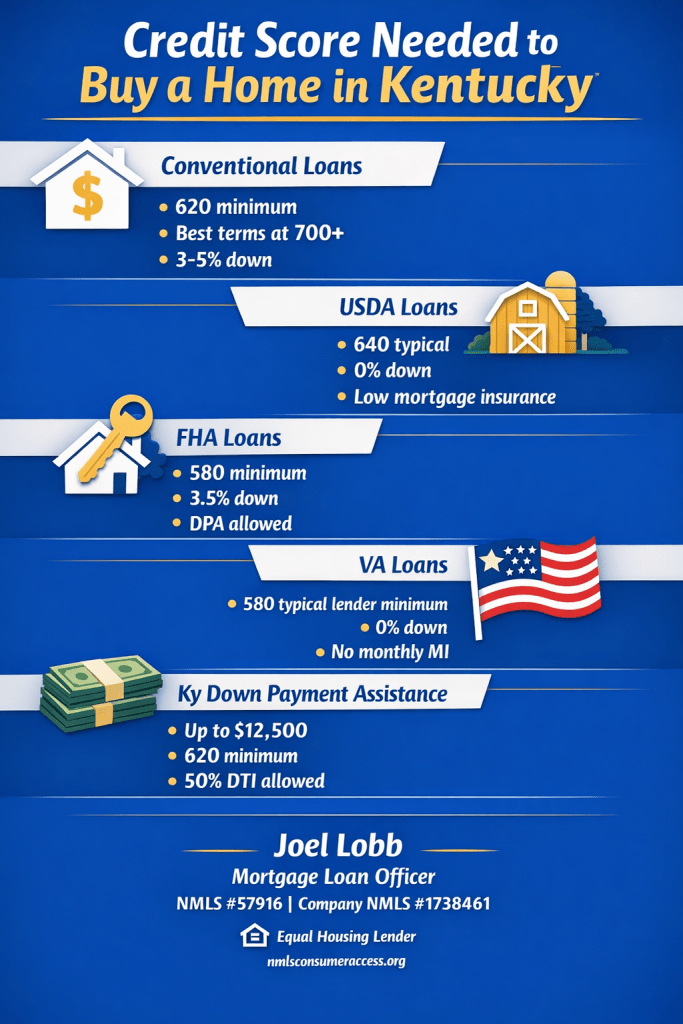

Conventional Loans in Kentucky

- Minimum credit score generally starts at 620.

- Most lenders prefer higher scores for 3%–5% down options.

- Best pricing and easier approvals are typically with strong credit (often 700+).

- Mortgage insurance (PMI) usually improves as scores increase.

USDA Rural Housing Loans in Kentucky

- Many lenders target around 640 for automated approval through GUS (Guaranteed Underwriting System).

- Manual underwriting may be possible when automated approval is not available.

- 0% down payment required (eligible rural/suburban areas).

- Typical fees include a 1% upfront guarantee fee and 0.35% annual fee (paid monthly).

USDA can be one of the best value options for Kentucky buyers with limited cash, provided the property is in an eligible area and the file meets income and underwriting requirements.

Kentucky FHA Loans

- As low as 580 credit score with 3.5% down (typical baseline).

- Gift funds, grants, and down payment assistance may be allowed.

- Mortgage insurance is generally higher than USDA or VA, but rates can still be competitive.

- Common waiting periods: 2 years after bankruptcy and 3 years after foreclosure (standard guideline).

Kentucky VA Loans

- VA does not set a minimum credit score in its guidelines, but most lenders do.

- Many VA lenders target around 580+ (lender overlay varies).

- 0% down and no monthly mortgage insurance.

- Clear CAIVRS is required (for federal delinquency screening).

Kentucky Down Payment Assistance (KHC)

- Kentucky Housing Corporation (KHC) often offers up to $12,500 down payment assistance (program terms and funding can change).

- Typically structured as a second mortgage paid back over 15 years.

- Minimum credit score is commonly 620 across many KHC options; KHC conventional often requires 660.

- Maximum debt-to-income ratios are commonly around 50/50 (program and investor rules apply).

Next step: get a clear pre-approval target

If you share your approximate credit score range, income type, and whether you’re looking in Louisville, Lexington, or rural Kentucky, I can point you to the most realistic program and the exact score threshold that will matter for approval.