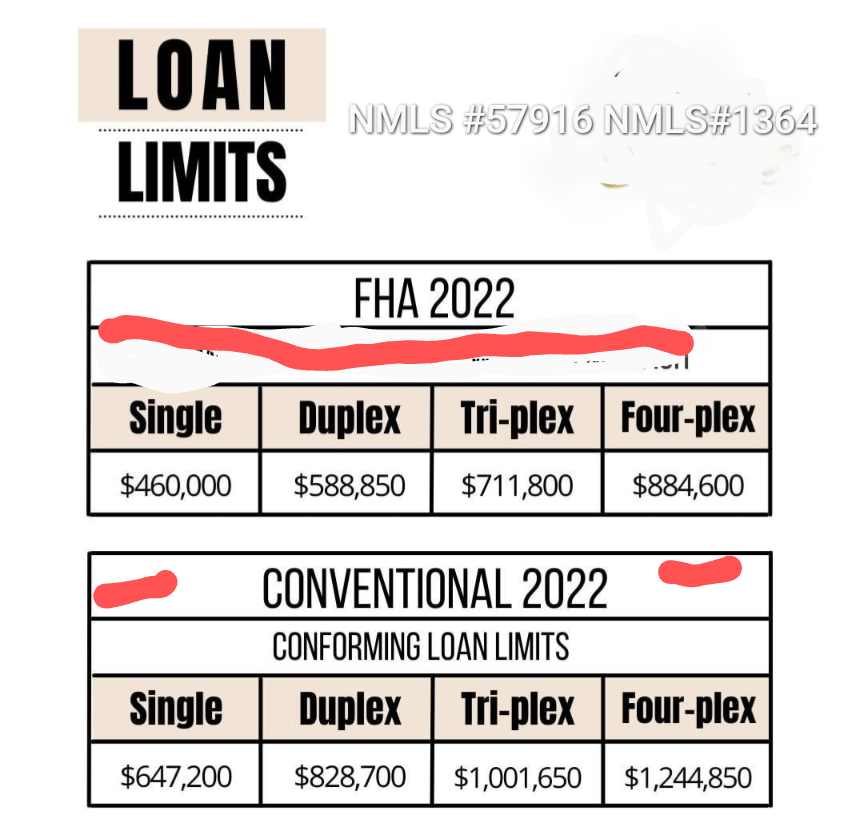

Kentucky FHA Loan Limits for 2022

Every county in Kentucky has the base FHA loan limit for single family residences in Kentucky for most counties is $420,680.

Use this FHA loan limit lookup tool to see what the FHA loan limits are in your county.

County Name Single Family 2 Units 3 Units 4 Units

ADAIR $420,680 $538,650 $651,050 $809,150

ALLEN $420,680 $538,650 $651,050 $809,150

ANDERSON $420,680 $538,650 $651,050 $809,150

BALLARD $420,680 $538,650 $651,050 $809,150

BARREN $420,680 $538,650 $651,050 $809,150

BATH $420,680 $538,650 $651,050 $809,150

BELL $420,680 $538,650 $651,050 $809,150

BOONE $420,680 $538,650 $651,050 $809,150

BOURBON $420,680 $538,650 $651,050 $809,150

BOYD $420,680 $538,650 $651,050 $809,150

BOYLE $420,680 $538,650 $651,050 $809,150

BRACKEN $420,680 $538,650 $651,050 $809,150

BREATHITT $420,680 $538,650 $651,050 $809,150

BRECKINRIDGE $420,680 $538,650 $651,050 $809,150

BULLITT $420,680 $538,650 $651,050 $809,150

BUTLER $420,680 $538,650 $651,050 $809,150

CALDWELL $420,680 $538,650 $651,050 $809,150

CALLOWAY $420,680 $538,650 $651,050 $809,150

CAMPBELL $420,680 $538,650 $651,050 $809,150

CARLISLE $420,680 $538,650 $651,050 $809,150

CARROLL $420,680 $538,650 $651,050 $809,150

CARTER $420,680 $538,650 $651,050 $809,150

CASEY $420,680 $538,650 $651,050 $809,150

CHRISTIAN $420,680 $538,650 $651,050 $809,150

CLARK $420,680 $538,650 $651,050 $809,150

CLAY $420,680 $538,650 $651,050 $809,150

CLINTON $420,680 $538,650 $651,050 $809,150

CRITTENDEN $420,680 $538,650 $651,050 $809,150

CUMBERLAND $420,680 $538,650 $651,050 $809,150

DAVIESS $420,680 $538,650 $651,050 $809,150

EDMONSON $420,680 $538,650 $651,050 $809,150

ELLIOTT $420,680 $538,650 $651,050 $809,150

ESTILL $420,680 $538,650 $651,050 $809,150

FAYETTE $420,680 $538,650 $651,050 $809,150

FLEMING $420,680 $538,650 $651,050 $809,150

FLOYD $420,680 $538,650 $651,050 $809,150

FRANKLIN $420,680 $538,650 $651,050 $809,150

FULTON $420,680 $538,650 $651,050 $809,150

GALLATIN $420,680 $538,650 $651,050 $809,150

GARRARD $420,680 $538,650 $651,050 $809,150

GRANT $420,680 $538,650 $651,050 $809,150

GRAVES $420,680 $538,650 $651,050 $809,150

GRAYSON $420,680 $538,650 $651,050 $809,150

GREEN $420,680 $538,650 $651,050 $809,150

GREENUP $420,680 $538,650 $651,050 $809,150

HANCOCK $420,680 $538,650 $651,050 $809,150

HARDIN $420,680 $538,650 $651,050 $809,150

HARLAN $420,680 $538,650 $651,050 $809,150

HARRISON $420,680 $538,650 $651,050 $809,150

HART $420,680 $538,650 $651,050 $809,150

HENDERSON $420,680 $538,650 $651,050 $809,150

HENRY $420,680 $538,650 $651,050 $809,150

HICKMAN $420,680 $538,650 $651,050 $809,150

HOPKINS $420,680 $538,650 $651,050 $809,150

JACKSON $420,680 $538,650 $651,050 $809,150

JEFFERSON $420,680 $538,650 $651,050 $809,150

JESSAMINE $420,680 $538,650 $651,050 $809,150

JOHNSON $420,680 $538,650 $651,050 $809,150

KENTON $420,680 $538,650 $651,050 $809,150

KNOTT $420,680 $538,650 $651,050 $809,150

KNOX $420,680 $538,650 $651,050 $809,150

LARUE $420,680 $538,650 $651,050 $809,150

LAUREL $420,680 $538,650 $651,050 $809,150

LAWRENCE $420,680 $538,650 $651,050 $809,150

LEE $420,680 $538,650 $651,050 $809,150

LESLIE $420,680 $538,650 $651,050 $809,150

LETCHER $420,680 $538,650 $651,050 $809,150

LEWIS $420,680 $538,650 $651,050 $809,150

LINCOLN $420,680 $538,650 $651,050 $809,150

LIVINGSTON $420,680 $538,650 $651,050 $809,150

LOGAN $420,680 $538,650 $651,050 $809,150

LYON $420,680 $538,650 $651,050 $809,150

MADISON $420,680 $538,650 $651,050 $809,150

MAGOFFIN $420,680 $538,650 $651,050 $809,150

MARION $420,680 $538,650 $651,050 $809,150

MARSHALL $420,680 $538,650 $651,050 $809,150

MARTIN $420,680 $538,650 $651,050 $809,150

MASON $420,680 $538,650 $651,050 $809,150

MCCRACKEN $420,680 $538,650 $651,050 $809,150

MCCREARY $420,680 $538,650 $651,050 $809,150

MCLEAN $420,680 $538,650 $651,050 $809,150

MEADE $420,680 $538,650 $651,050 $809,150

MENIFEE $420,680 $538,650 $651,050 $809,150

MERCER $420,680 $538,650 $651,050 $809,150

METCALFE $420,680 $538,650 $651,050 $809,150

MONROE $420,680 $538,650 $651,050 $809,150

MONTGOMERY $420,680 $538,650 $651,050 $809,150

MORGAN $420,680 $538,650 $651,050 $809,150

MUHLENBERG $420,680 $538,650 $651,050 $809,150

NELSON $420,680 $538,650 $651,050 $809,150

NICHOLAS $420,680 $538,650 $651,050 $809,150

OHIO $420,680 $538,650 $651,050 $809,150

OLDHAM $420,680 $538,650 $651,050 $809,150

OWEN $420,680 $538,650 $651,050 $809,150

OWSLEY $420,680 $538,650 $651,050 $809,150

PENDLETON $420,680 $538,650 $651,050 $809,150

PERRY $420,680 $538,650 $651,050 $809,150

PIKE $420,680 $538,650 $651,050 $809,150

POWELL $420,680 $538,650 $651,050 $809,150

PULASKI $420,680 $538,650 $651,050 $809,150

ROBERTSON $420,680 $538,650 $651,050 $809,150

ROCKCASTLE $420,680 $538,650 $651,050 $809,150

ROWAN $420,680 $538,650 $651,050 $809,150

RUSSELL $420,680 $538,650 $651,050 $809,150

SCOTT $420,680 $538,650 $651,050 $809,150

SHELBY $420,680 $538,650 $651,050 $809,150

SIMPSON $420,680 $538,650 $651,050 $809,150

SPENCER $420,680 $538,650 $651,050 $809,150

TAYLOR $420,680 $538,650 $651,050 $809,150

TODD $420,680 $538,650 $651,050 $809,150

TRIGG $420,680 $538,650 $651,050 $809,150

TRIMBLE $420,680 $538,650 $651,050 $809,150

UNION $420,680 $538,650 $651,050 $809,150

WARREN $420,680 $538,650 $651,050 $809,150

WASHINGTON $420,680 $538,650 $651,050 $809,150

WAYNE $420,680 $538,650 $651,050 $809,150

WEBSTER $420,680 $538,650 $651,050 $809,150

WHITLEY $420,680 $538,650 $651,050 $809,150

WOLFE $420,680 $538,650 $651,050 $809,150

WOODFORD $420,680 $538,650 $651,050 $809,150