100% Financing Zero Down, 2021 Kentucky USDA Income and Property Guidelines, 2021 Kentucky USDA Income Limits Increased, 2021 Kentucky USDA Mortgage Guides Updated, 502 Guaranteed Loan, Current USDA and RHS Guidelines, Debt Ratio and Deferred Student Loans, debt ratios

2021 Welcome Home Program for Kentucky Home Buyers

$5,000 Welcome Home Grant Kentucky First Time Home Buyers

Louisville Kentucky Mortgage Loans

$5,000 Welcome Home Grant Kentucky First Time Home Buyers

2021 Welcome Home Program for Kentucky Home Buyers Kentucky Welcome Home Grant for $5,000

2021 Welcome Home Program for Kentucky Home Buyers Kentucky Welcome Home Grant for $5,000

Louisville Kentucky Mortgage Rates for First Time Home Buyers

Do I qualify as a Kentucky first-time home buyer?

You are typically considered eligible to apply for first-time home buyer loans and benefits if you haven’t owned your principal residence within the past three years.

Some first-time home buyer assistance programs are even more lenient, offering financial aid in specific areas targeted for redevelopment, even to repeat buyers.

Kentucky First-time home buyer benefits

Benefits can include low- or no-down-payment loans, grants or forgivable loans for closing costs and down payment assistance, as well as federal tax credits with the Kentucky Housing Agency or KHC

Is there an income limit to qualify as a first-time home buyer?

Income limits come into play when you are applying for local, state or federal government assistance. Some national mortgage programs, such as loans issued or backed by the U.S. Department of Agriculture, also have household income limits.

Some low-down-payment conventional loans do, too.

In these cases, your income may be benchmarked to local county limits for low- and moderate-income households.

Lenders, even those working with loan programs authorized by a state housing agency, will likely consider your debt-to-income ratio when determining if you qualify.

How to qualify for a first-time home buyer grant

Grants or forgivable loans that typically don’t require repayment are available to low- and moderate-income borrowers through state first-time home buyer programs. Approval standards vary by program and location but often include household income and home sale price limits.

How to qualify for down payment assistance

Just as for grants, down payment and closing cost assistance is often offered by local and state housing authorities. Again, qualifications vary. Look for income and home sale price caps here, too.

Don’t be surprised if a first-time home buyer class is required to qualify for a grant or down payment assistance. These classes are designed to help you navigate the homebuying process, and can be a good idea to take whether they’re mandatory or not.

What are the requirements to qualify for a first-time home buyer loan?

Qualifications required for approval of a loan vary by the type of mortgage — and even by the lender — but here are some general guidelines:

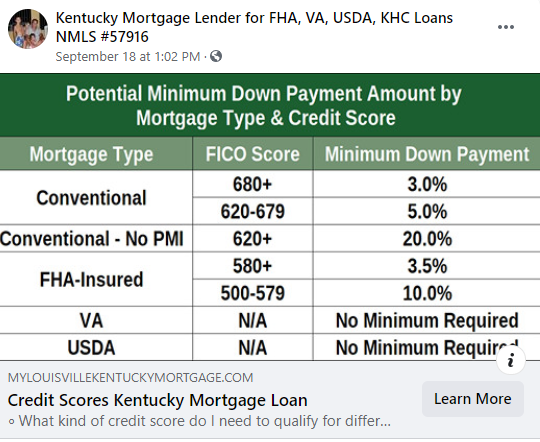

Kentucky Conventional loans:

For a 3% down payment, you’ll need at least a 620 FICO and a debt-to-income ratio below 50%. The higher your credit score or the lower your debt, the better your chances are for approval.

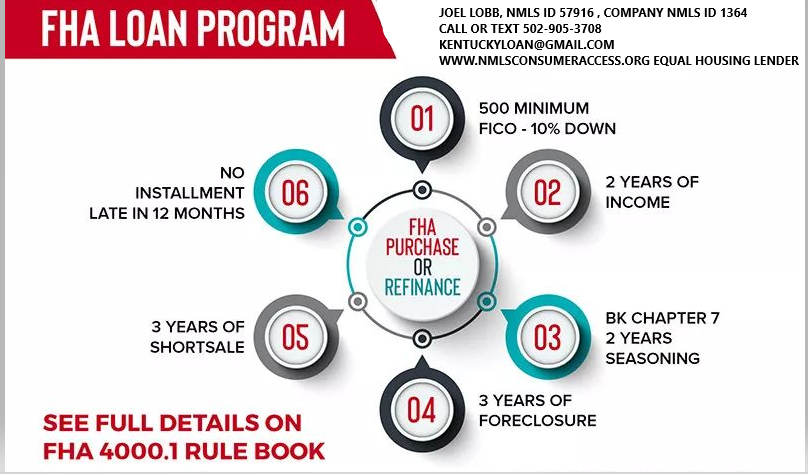

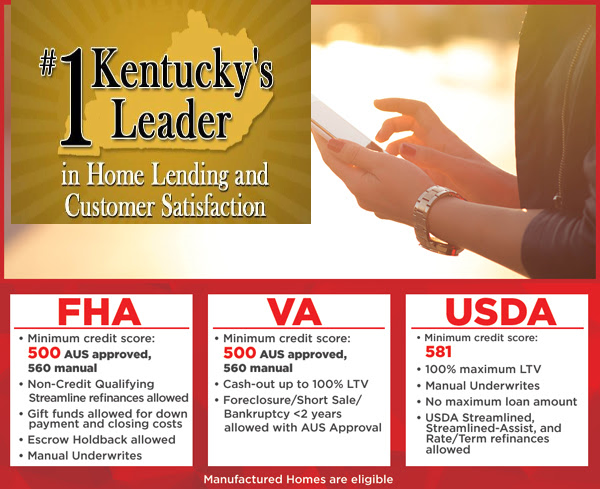

Kentucky FHA loans:

If you want a down payment as low as 3.5%, you’ll need a FICO score of 580 or higher. With 10% down, your required credit score may go as low as 500.

Kentucky VA loans:

Down payments aren’t generally required for a loan backed by the Department of Veterans Affairs. And while VA-backed loans don’t have a minimum FICO score as a part of their official requirements, many lenders look for a score of 620 or better.

KentukcyUSDA loans:

Another no-down-payment option, USDA-backed loans are typically issued for rural or suburban properties. Income limits apply. A FICO score of 640 or better is generally required, though exceptions with documentation can allow a lower score.

Lenders can add additional conditions, called “overlays,” to loan approval. This is another good reason to shop for more than one lender.

Mortgage Loan Officer

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

Kentucky USDA Mortgage Funds for 2021 Available.

Fiscal Year 2021 SFH Guaranteed Funds Now Available!

As of Sunday, December 27, 2020, funding for Rural Development’s Single-Family Housing Guaranteed Loan Program authorized by the “Consolidated Appropriations Act, 2021”, is available.

Files in Process:

All files processed “Subject to Availability of Funds” have been obligated and the updated Conditional Commitments were generated by the Agency to remove the “contingent upon” language.

Lender receipt of the updated Conditional Commitment will signal the request has been successfully obligated by the Agency.Loan Closing:

Once the loan has closed (including loans that were closed prior to the obligation of funds by the Agency), the lender may submit their request for Loan Note Guarantee along with a closing package.

Lenders using the Agency’s automated Lender Loan Closing (LLC) system will complete the lender certification electronically (i.e. no manual signature/date required).

For manually submitted loan closing packages, ensure the lender certification on the Conditional Commitment is signed and dated after the Agency’s obligation date (the issuance date on the updated Conditional Commitment). Use of the Lender Loan Closing system is highly recommended.For current Kentucky USDA Mortgage turn time information on files,

please check the SFH Guarantee Lender page at 👇👇 click

https://www.rd.usda.gov/page/sfh-guaranteed-lender

Current Underwriting Turn Times on Rural Housing USDA Loans in Kentucky – Kentucky USDA Rural Housing Mortgage Lender

current Kentucky USDA Mortgage turn time information on files

Louisville Kentucky Mortgage Loans

2021Available.

Fiscal Year 2021 SFH Guaranteed Funds Now Available!

As of Sunday, December 27, 2020, funding for Rural Development’s Single-Family Housing Guaranteed Loan Program authorized by the “Consolidated Appropriations Act, 2021”, is available.

Files in Process:

All files processed “Subject to Availability of Funds” have been obligated and the updated Conditional Commitments were generated by the Agency to remove the “contingent upon” language.

Lender receipt of the updated Conditional Commitment will signal the request has been successfully obligated by the Agency.

Loan Closing:

Once the loan has closed (including loans that were closed prior to the obligation of funds by the Agency), the lender may submit their request for Loan Note Guarantee along with a closing package.

Lenders using the Agency’s automated Lender Loan Closing (LLC) system will complete the lender certification electronically (i.e. no manual signature/date required).

For manually submitted loan closing packages, ensure the lender certification on the…

View original post 57 more words

Kentucky FHA Loan Requirements for 2021

KENTUCKY FHA LOANS

Louisville Kentucky Mortgage Loans

What are Kentucky FHA Loans?

FHA stands for Federal Housing Authority. FHA Loans provide low-cost insured Home Mortgage Loans that suit a variety of purchasing options. Whether you’re buying a home or want to refinance your mortgage, FHA loans might be right for you. If you’re unsure about your credit rating, or have concerns about a down payment, FHA loans can give you piece of mind with super low closing costs and flexible payment options.

What factors determine if I am eligible for an FHA Loan in Kentucky?

To be eligible for FHA Mortgage Loans, your monthly housing costs (mortgage principal and interest, property taxes, and insurance) must meet a specified percentage of your gross monthly income. Your credit background will be fairly considered. You must be able to make a down payment, cover closing costs and have enough income to pay your monthly debt.

What is the maximum amount…

View original post 890 more words

First Time Home Buyer Louisville Kentucky Mortgage Programs

First Time Home Buyer Louisville Kentucky Mortgage Programs

First Time Home Buyer Louisville Kentucky Mortgage Programs

THERE ARE 4 BASIC THINGS THAT A BORROWER NEEDS TO SHOW A LENDER IN ORDER TO GET APPROVED FOR A MORTGAGE.

Kentucky FHA Loan Requirements for 2021

Kentucky FHA Loan Requirements for 2021 to include Credit Fico Scores, Down Payment, Income and Job history

FHA

An FHA loan is a mortgage issued by federally qualified lenders and insured by the Federal Housing Administration (FHA). FHA loans are designed for low-to-moderate income borrowers who are unable to make a large down payment.

Minimum Credit Score is 500 with at least 10% down

Minimum Credit Score is 580 if you put less than 10% down

The maximum loan amount varies by Geographical Area, for 2021 it is as follows:

The FHA Kentucky Maximum loan for 2021 is $356,362 is set at 65 percent of the national conforming loan limit. Federal Housing Administration (FHA) is increasing its 2021 loan limit in most of the U.S. to $356,362, an increase of nearly $25,000 over 2020’s loan limit of $331,760.

• One-unit: $356,362

• Two-unit: $456,275

• Three-unit: $551,500

• Four-unit: $685,400

Louisville Kentucky Mortgage Loans

Kentucky FHA Loan Requirements for 2021 to include Credit Fico Scores, Down Payment, Income and Job history

FHA

AnFHA loanis a mortgage issued by federally qualified lenders and insured by the Federal Housing Administration (FHA). FHA loans are designed for low-to-moderate income borrowers who are unable to make a large down payment.

- Minimum Credit Score is 500 with at least 10% down

- Minimum Credit Score is 580 if you put less than 10% down

- The maximum loan amount varies by Geographical Area, for 2021 it is as follows:

- TheFHA Kentucky Maximum loan for 2021 is $356,362is set at 65 percent of the national conforming loan limit.Federal Housing Administration (FHA)is increasingits 2021 loan limit in most of the U.S. to $356,362, an increase of nearly $25,000 over2020’s loan limitof $331,760.

- • One-unit: $356,362

• Two-unit: $456,275

• Three-unit: $551,500

• Four-unit: $685,400

KENTUCKY FHA MORTGAGE GUIDELINES FOR 2020

- FHA – 620+ Min Fico Approve Eligible / NO OVERLAYS-NONE!

- FHA – 620+ FICO for PURCH, RT, C/O including Flips & High Balance

- FHA – 640+ REFERS OK!—no overlays -u/w directly to 4000.1

- FHA – 640+ MANUALS up to 50% DTI (with 2 comp factors)

- FHA – 620+ No DTI CAP – Follow AUS Findings!!! (with approved eligible)

- FHA – 620+ NO Minimum Credit History or Trades with AUS Approval!

- FHA – 620+ – No VOR Unless Required by DU Findings!

- FHA – Transfer appraisals from ANY lender/AMC OK!

- FHA – ORDER YOUR APPRAISAL FROM 20+ AMCs YOU CHOOSE!

- FHA – Collections – HUD Guides Apply –

- FHA – Mortgage Lates OK if AUS Approved!!!

- FHA – ESCROW STATE – Non Purchasing Spouse derogs ignored – only affects DTI

- FHA – Borrower w/ Work Permits, Non-Resident Alien OK!

- FHA – 1 Day off Market for Cashout Refi! – Must be off market before date of loan application!

- FHA – Rental Income on 2-4 units ok FTHB

- FHA – STREAMLINE – 620 Minimum

- FHA – Streamline – 620 Score – No Appraisal, No Income, No AVM, No Credit Qualifying!!!

- FHA – Streamline -Investment and 2nd Homes OK!

- FHA – Streamline – Mtg only on subject property only!

MINIMUM CREDIT SCORES REQUIRED FOR KENTUCKY FHA, VA, USDA MORTGAGE LOANS

What is the minimum credit score I need to qualify for a Kentucky FHA, VA, USDA and KHC Conventional mortgage loan?

What is the minimum credit score I need to qualify for a Kentucky FHA, VA, USDA and KHC Conventional mortgage loan?

What is an FHA Loan and Is It Right for You?

Source: What is an FHA Loan and Is It Right for You?

What Is An FHA Loan And Is It Right For You?

The Federal Housing Administration insures what are called FHA loans. These mortgage loans provide opportunities for buyers with less-than-perfect credit or limited down payments to purchase homes, but they aren’t without potential pitfalls.

FHA loans are available to borrowers with a credit score of at least 580, and you have to make a minimum 3.5% down payment. They’re a popular option for first-time home buyers.

Lenders such as banks and credit unions issue the mortgages, which are insured by the FHA. That protects the lender if the borrower defaults, which is why the terms are more favorable than a traditional mortgage.

Around eight million single-family homes have loans insured by the FHA.

What Can an FHA Loan be Used For?

You can use an FHA loan to refinance single-family houses, to buy a single-family home, to buy some multifamily homes and condos and certain mobile and manufactured homes. There are particular types of FHA loans that can be used to renovate an existing property or for new construction.

How is an FHA Loan Different from a Conventional Mortgage Loan?

The biggest differentiator between an FHA loan and a conventional mortgage is that it’s easier to qualify for an FHA loan. You may get a loan with a lower credit score than you would otherwise, and your mortgage insurance payments may be lower too.

There are also fewer restrictions as far as using gifts from family or donations for your down payment.

If you have a FICO score of at least 580, you have to make a 3.5% down payment. With a FICO score between 500 and 579, you’re required to make a 10% down payment, and mortgage insurance is required. Your debt-to-income ratio needs to be less than 43% whereas with a conventional loan it’s usually 36%. You do need to have proof of income and steady employment, as you would need with a conventional loan.

Are There FHA Loan Limits?

There are limits on the mortgage amount you can get with an FHA-guaranteed loan. The limits vary based on your county, and in 2020 these ranged from $331,760 to $765,600. The limit amounts are updated by the FHA each year based on fluctuations in home prices.

The Benefits of the FHA Loan

The primary benefits of an FHA loan are that buyers who wouldn’t otherwise qualify may be able to own a home and for a lower down payment. Sometimes the FHA will help facilitate coverage of closing costs. If you have problems making payments on an FHA loan you may be eligible for a forbearance period if you qualify.

What Are the Downsides of an FHA Loan?

You will have to pay an upfront mortgage insurance premium with an FHA loan to protect the lender. The fee is due when you close and it’s 1.75% of your loan. You will also have to pay an annual mortgage insurance premium for the life of your loan. The amount can range between 0.45% and 1.05%.

When you buy a home with an FHA loan, it has to meet strict standards in terms of health and safety.

Also, while there are set standards from the FHA, approved lenders can create their own requirements.

Applying for an FHA Loan

You’ll have to first find an FHA-approved lender to get one of these home loans. You’ll need some documents, including proof of U.S. citizenship, legal permanent residency, or eligibility to work in America. You’ll need bank statements for at least the past 30 days, and you’ll probably need to show pay stubs.

Some of the information your lender may be able to obtain on your behalf, such as your credit reports, tax returns and employment records.

There are advantages to an FHA loan because it expands homeownership to more people than conventional loans. It’s just important that if you’re considering this loan you understand the costs and that you’re not taking on more than you’re financially prepared for because of the less stringent approval requirements.

Written by Ashley Sutphin for http://www.RealtyTimes.com Copyright © 2020 Realty Times All Rights Reserved.