Kentucky FHA Mortgage Loans Guidelines

Types of Kentucky Mortgage Loans to Consider After Bankruptcy

Types of Kentucky Mortgage Loans to Consider After Bankruptcy

If you want to try to get a Kentucky mortgage after bankruptcy, you can research a number of different types of loans. Each mortgage loan has its own unique requirements for bankruptcy filers.

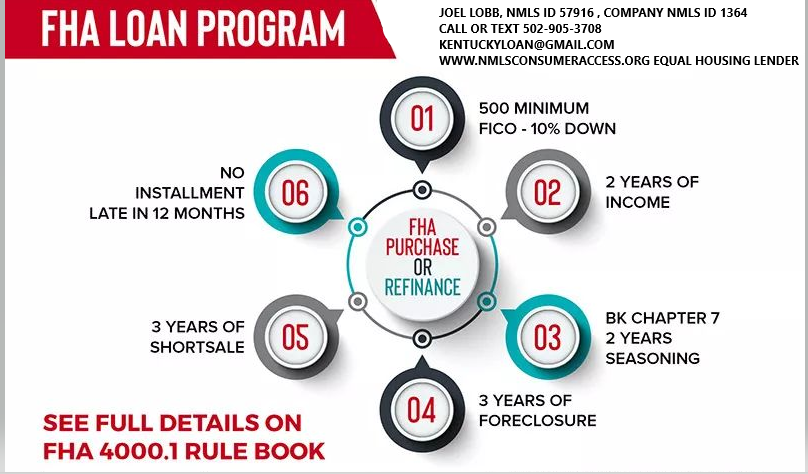

Kentucky FHA Loans

Federal Housing Administration (FHA) loans are managed by the federal government and may allow you to buy a house with a down payment that’s as little as 3.5% of the purchase price. The downfall of FHA loans, however, is that you’ll have to pay for mortgage insurance, which will result in higher monthly payments.

To get a mortgage after bankruptcy using an FHA loan, you’ll have to adhere to these waiting periods:

- Chapter 7: Two years from your discharge date

- Chapter 11: No waiting period

- Chapter 13: One year from your discharge date

Kentucky USDA Loans

U.S. Department of Agriculture (USDA) loans are designed for rural borrowers who meet certain income requirements. It may be a good option if you’d like to buy a house in a rural area, have a low or modest income, and aren’t eligible for a conventional loan. If you go this route, you may not have to put any money down and you may be able to secure a low interest rate.

Keep these waiting requirements in mind if you’re interested in getting a USDA mortgage after bankruptcy:

- Chapter 7: Three years from your discharge date

- Chapter 11: No waiting period

- Chapter 13: One year from your discharge date

Kentucky VA Loans

If you’re a veteran or currently serving in the military, you may be eligible for a Department of Veterans Affairs (VA) loan. A VA loan doesn’t require a down payment or charge private mortgage insurance and can give you the chance to lock in a low interest rate. If you pursue a VA loan, however, you’ll have to pay a funding fee, which will be a percentage of your home price.

Here are the waiting requirements you should be aware of if you’d like to get a VA loan after bankruptcy:

- Chapter 7: Two years from your discharge date

- Chapter 11: No waiting period

- Chapter 13: One year from your discharge date

Kentucky Conventional Loans

Since conventional loans are not guaranteed or insured by government agencies, you can expect stricter requirements, such as having a good credit score, if you apply for one. If you get a conventional loan and put down less than 20% of the cost of your new home, you’ll need to pay private mortgage insurance.

The waiting requirements for taking out a conventional loan after bankruptcy are as follows:

- Chapter 7: Four years from your discharge date

- Chapter 11: Four years from your discharge date

- Chapter 13: Two years from your discharge date or four years from your dismissal date

Chapter 7 Bankruptcy

A four-year waiting period is required, measured from the discharge or dismissal date of the bankruptcy action until the application date.

Chapter 13 Bankruptcy

two years from the discharge date to the application date, or four years from the dismissal date to the application date.

The shorter waiting period based on the discharge date recognizes that borrowers have already met a portion of the waiting period within the time needed for the successful completion of a Chapter 13 plan and subsequent discharge.

A borrower who was unable to complete the Chapter 13 plan and received a dismissal will be held to a four-year waiting period.

Exceptions for Extenuating Circumstances

A two-year waiting period is permitted after a Chapter 13 dismissal, if extenuating circumstances can be documented. There are no exceptions permitted to the two-year waiting period after a Chapter 13 discharge.

Foreclosure / Short Sale

A seven-year waiting period is required. In all instances, the “date of foreclosure” is considered the date of the foreclosure deed. The end date of the waiting period is the application date.

Foreclosure / Short Sale – Extenuating Circumstance A three-year waiting period is permitted if extenuating circumstances can be documented. Additional requirements apply between three and seven years, which include:

FHA Loan Guidelines for Bankruptcy and Foreclosure

Chapter 7

Chapter 7 bankruptcy discharged more than 24 months prior to the application date may be allowed.

Chapter 7 bankruptcy discharged between 12 and 24 months prior to the application date requires satisfactorily established credit and documentation showing the circumstances which caused the bankruptcy were beyond the borrower’s control (i.e. unemployment, medical bills not covered by insurance). In these instances, the file must be manually downgraded to a refer and manually underwritten. It falls upon the underwriter to make a final determination as to the overall quality of the file.

Chapter 7 bankruptcy discharged less than 12 months prior to the application date is not allowed.

Chapter 13

Loans where the borrower is currently in a Chapter 13 bankruptcy or had a Chapter 13 bankruptcy which was discharged within the previous 2 years require manual downgrade and must be underwritten manually. Note that manual underwrites require Underwriting Management approval.

A borrower who is currently in a Chapter 13 bankruptcy may be eligible for FHA financing provided all of the following conditions are met in addition to standard manual underwriting requirements:

Foreclosure / Short Sale

A foreclosure less than 3 years ago is not allowed.

In all instances, the “date of foreclosure” is considered the date of the foreclosure deed. The end date of the time frame is determined by the application date.

Kentucky VA Loan Guidelines for Bankruptcy and Foreclosure

Chapter 7

Chapter 7 bankruptcy discharged more than 24 months prior to application date may be disregarded.

Chapter 7 bankruptcy discharged between 12 and 24 months prior to application date requires satisfactorily established credit and documentation showing the circumstances which caused the bankruptcy were beyond the borrower’s control (i.e. unemployment, medical bills not covered by insurance). In these instances, the file must be manually downgraded to a refer and manually underwritten. It falls upon the underwriter to make a final determination as to the overall quality of the file.

Chapter 7 bankruptcy discharged less than 12 months prior to application date is not allowed.

Note that for High Balance Transactions a minimum of 7 years must have elapsed since the discharge date regardless of AUS findings.

Chapter 13

The borrower’s credit history since the bankruptcy, the circumstances behind the bankruptcy, and the discharge date all factor in to the final determination by the underwriter.

A borrower who is currently in a Chapter 13 bankruptcy may be eligible for VA financing

Foreclosure / Short Sale

Foreclosure more than 36 months prior to application date may be disregarded.

Foreclosure less than 36 months prior to application date is not allowed.

Note that for High Balance Transactions a minimum of 7 years must have elapsed since the foreclosure date regardless of AUS findings.

In all instances, the “date of foreclosure” is considered the date of the foreclosure deed.

USDA Guidelines for Bankruptcy and Foreclosure

Chapter 7

The Discharge date and GUS findings both play an important role in determining the viability and future repayment of the new loan. As such, Chapter 7 bankruptcy seasoning is evaluated by GUS.

Chapter 13

Loans where the borrower is currently in a Chapter 13 bankruptcy or had a Chapter 13 bankruptcy which was discharged within the previous 3 years require a manual downgrade and must be underwritten manually.

A borrower who is currently in a Chapter 13 bankruptcy may be eligible for RD financing provided all of the following conditions are met in addition to standard manual underwriting requirements:

• At least 12 months of payments have been made satisfactorily

• The Trustee or bankruptcy judge’s approval to enter into the mortgage transaction is documented

• Bankruptcy payments are included in the borrower’s debt ratio

Foreclosure / Short Sale

The foreclosure date and GUS findings both play an important role in determining the viability and future repayment of the new loan. As such, foreclosure seasoning is evaluated by GUS.

A foreclosure does not automatically disqualify a borrower from RD financing. In all instances, the “date of foreclosure” is considered the date of the foreclosure deed.

You can obtain a copy of your bankruptcy paperwork from the website below:

Bankruptcy Courts http://www.pacer.psc.uscourts.gov/

Joel Lobb (NMLS#57916)

Senior Loan Office

American Mortgage Solutions, Inc.

10602 Timberwood Circle Suite 3

Louisville, KY 40223

Company ID #1364 | MB73346

Text/call 502-905-3708

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant’s eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916http://www.nmlsconsumeraccess.org/

— Some products and services may not be available in all states. Credit and collateral are subject to approval. Terms and conditions apply. This is not a commitment to lend. Programs, rates, terms and conditions are subject to change without notice. The content in this marketing advertisement has not been approved, reviewed, sponsored or endorsed by any department or government agency. Rates are subject to change and are subject to borrower(s) qualification.Posted by Joel Lobb, Mortgage Broker FHA, VA, KHC, USDA Email ThisBlogThis!Share to TwitterShare to FacebookShare to PinterestLabels: 100% Financing, bad credit, bankruptcy, fico scores first time home buyer, foreclosure, Kentucky First Time Home buyer zero down payment

FHA Announces COVID-19 Temporary Guidance for Kentucky FHA Mortgage Loans

Kentucky FHA Temporary Guideline Changes:

Rental Income & Self-Employment Income

FHA Announces COVID-19 Temporary Guidance for Kentucky FHA Mortgage Loans

Due to the ongoing effect of COVID-19, FHA has announced in ML 2020-03, updates to the following temporary guidelines below effective with case number assignments on or after 8/12/2020 -11/30/2020:

Rental Income for Kentucky FHA Mortgage Loans

- When qualifying utilizing rental income, for each property generating rental income the following is required:

- Reduce the effective income associated with the calculation of rental income by 25%, or

- Verify 6 months PITI reserves, or

- Verify the borrower has received the previous 2 months rental payments as evidenced by borrower’s bank statements showing the deposit. (This option is applicable only for borrowers with a history of rental income from the property).

Self Employment Income for Kentucky FHA Mortgage loans

- Self-employment income must be stable with a reasonable expectation that it will continue. Verification of the existence of the borrower’s business within 10 calendar days prior to the date of the Note to confirm that the Borrower’s business is open and operating. One (1) of the following to verify and confirm that the business is open and operating:

- Evidence of current work (executed contracts or signed invoices that indicate the business is operating on the day the lender verifies self-employment);

- Evidence of current business receipts within 10 days (Note Fairway Policy) of the note date (payment for services performed);

- Lender certification that the business is open and operating (lender confirmed through a phone call or other means) (Note Fairway Policy); or

- Business website demonstrating activity supporting current business operations (timely appointments for estimates or service can be scheduled).

Mortgage Loan Officer

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

KENTUCKY USDA RURAL HOUSING LOAN PROGRAM GUIDELINES

2020 USDA Income limits, the Jefferson County Louisville, KY

Louisville Kentucky Mortgage Loans

via KENTUCKY USDA RURAL HOUSING LOAN PROGRAM GUIDELINES

View original post 99 more words

FHA or USDA?

FHA or USDA?

Leave a comment

I’m a first time home buyer looking to buy an owner occupied income property. I’m still in the researching options phase and have not spoken with a lender. Though, I actually have a private lender that I can use and have spoken with them but I would get cheaper interest rates with FHA or USDA so I’m looking for general advice, insight, information, knowledge or personal experience with those loans.I’m not sure what the better option would be. I can do the 3.5% down for an FHA but it would break the bank. For obvious reasons I’m not comfortable with this.

I would prefer a USDA with no money down but it seems the stipulations for income property are that you must offer low income housing. I’m not against that at all as long as the numbers work. I’m just curious how that works? How is a cap on rent set? Is it a condition for the duration of the loan or just a certain amount of years? If I refinanced down the road would it be still be a stipulation? What are the pros and cons of this stipulation?

I’m just curious what others have done if in a similar situation or what you would recommend in general in this situation.

I should add that where I’m currently renting has gone into foreclosure and at some point (this year I imagine but with the virus who knows) I will have to move so waiting to save more money isn’t something I can really do or want to. I hate to hit my savings to move to another rental and would really like to purchase an income property instead. If your advice is to wait and keep renting though then tell me.

Thank you for any words of wisdom! They are appreciated.

More real estate tips at Program Realty Wix site

I’m a first time home buyer looking to buy an owner occupied income property. I’m still in the researching options phase and have not spoken with a lender. Though, I actually have a private lender that I can use and have spoken with them but I would get cheaper interest rates with FHA or USDA so I’m looking for general advice, insight, information, knowledge or personal experience with those loans.

I’m not sure what the better option would be. I can do the 3.5% down for an FHA but it would break the bank. For obvious reasons I’m not comfortable with this.

I would prefer a USDA with no money down but it seems the stipulations for income property are that you must offer low income housing. I’m not against that at all as long as the numbers work. I’m just curious how that works? How is a cap on…

View original post 162 more words

Kentucky FHA Home loan programs for people with bad credit

Score Requirement on Kentucky FHA Loans for people with bad credit

Kentucky FHA Home loan programs for people with bad credit

Kentucky FHA Loans with 580 Credit scores and – Low Down Payment – 3.5% which can be gifted from relatives or borrowed off one’s retirement account. If your scores is between 500-579, 10% down needed for home loan and subject to underwriting approval.

- Low down payment

- 500 minimum credit score from 10% down, to 580 above credit score with 3.5% down payment

- Can be used with Grants for Down payment through Eligible Sources

- FHA max loan – $336,750 in the State of Kentucky

- FHA approved condos eligible

- Entire Down payment can be a gift, a down payment assistance program or grant funds

- Seller can pay 6% of purchase price toward closing costs

Quick guide to checking your credit score for Kentucky FHA loans

- 800-plus: Exceptional

- 740-799: Very good

- 670-739: Good

- 580-699: Fair

- 579 and lower: Poor

Kentucky FHA loans

|

Kentucky FHA Loan Details

|

|

|---|---|

|

Credit score required

|

500, but banks have minimum underwriting

standards |

|

Down payment required

|

Credit score between 500-579: 10 percent

Credit score above 580: 3.5 percent |

|

Upfront financing fee

|

1.75 percent, which can be financed

|

|

Mortgage insurance

|

0.45 to .85 percent

|

|

Mortgage limits

|

Generally, $336,766 for single-family units, but it

varies by location and you should check the limits in your area |

|

Fine print

|

Mortgage insurance premiums are paid for the life of the loan,

except when putting 10 percent or more down. If your down payment is less than 20 percent but 10 percent or more, you must have mortgage insurance for 11 years. |

Quick take

Pros:

Cons:

|

What Costs to Expect When Buying a Home – Cape Gazette

Complete Guide to Closing Costs in Kentucky

A Complete Guide to Closing Costs

Louisville Kentucky Mortgage Loans

If you’re researching the finances of buying your first home, the term “closing costs” likely keeps popping up. Closing costs are the charges and fees related to buying a house in your state and county and getting a home loan. It’s a vague term, we…

Source: What Costs to Expect When Buying a Home – Cape Gazette

Kentucky FHA Mortgage Loans Impacted by COVID-19

FHA Mortgagee Letter ML-2020-05

FHA has published guidance for lenders during the current market environment.

Appraisal Guidance

FHA will allow the Exterior Only and Desktop appraisal options. Originators and appraisers are expected to familiarize themselves with FHA’s adaptation requirements. All appraisals must still be run through FHA’s EAD portal. (Please note that a 2055 or 1072 cannot be sent through the EAD portal).

If a Desktop appraisal is deemed to be the best option – Home Point will require a photo of the exterior of the home and each comparable. Appraisers may use public records or other reliable sources (such as MLS) for these photos.

Income Guidance

FHA will allow the use of an email correspondence from the employer’s work email as reverification of employment.

The existing Home Point requirement for an additional Reverification dated within 48 business hours of closing still applies and only the email option listed above is eligible for that verification.

Summary of Changes

1. Changes to FHA’s re-verification of employment:

• FHA is allowing flexibilities related to the Mortgagee’s process of completing re-verification of employment, which includes verbal verification of employment. This is applicable for all FHA Title II forward and reverse mortgage programs, where re-verification of employment is required.

2. Changes to FHA’s Appraisal Protocols are as follows:

• Most Single Family forward and HECM for Purchase transactions may utilize an optional Exterior-Only or Desktop-Only Appraisal inspection scope of work.

• Traditional HECM, HECM-to-HECM refinances, Rate and Term Refinances and Simple Refinances of properties may utilize an optional Exterior-Only inspection scope of work.

• All appraisals made in connection with the servicing of FHA’s forward or reverse mortgage portfolios may utilize either the Exterior-Only or Desktop-Only Appraisal inspection scope of work.

• No changes are made to Streamline Refinances, which do not require appraisals or to the appraisal requirements for FHA’s Cash-Out refinance, 203(k), and certain purchase transactions.

Re-verification of Employment

Mortgagees do not need to provide a re-verification of employment within 10 days of the Note date as described in Handbook 4000.1, Sections II.A.4.c.ii(C)(1)-(2) and II.A.5.b.ii(C)(1)-(2) Traditional and Alternative Current Employment Documentations, provided that the Mortgagee is not aware of any loss of employment by the borrower and has obtained:

• For forward purchase transactions, evidence the Borrower has a minimum of 2 months of Principal, Interest, Taxes and Insurance (PITI) in reserves; and

• A year-to-date paystub or direct electronic verification of income for the pay period that immediately precedes the Note date, or

• A bank statement showing direct deposit from the Borrower’s employment for the pay period that immediately precedes the Note date.

Appraisal Policy

Mortgagees do not need to provide a re-verification of employment within 10 days of disbursement as described in Section 3.8 and 3.9 of the HECM Financial Assessment and Property Charge Guide, provided that the Mortgagee is not aware of any loss of employment by the borrower and has obtained:

• A year-to-date paystub or direct electronic verification of income for the pay period that immediately precedes the Note date, or

• A bank statement showing direct deposit from the Borrower’s employment for the pay period that immediately precedes the Note date

When applicable, as described below, the appraiser may amend the scope of work to perform an Exterior-Only (viewing from the street) or Desktop-Only. The Appraiser may rely on supplemental information from other reliable sources such as Multiple Listing Service (MLS), and Tax Assessor’s Property Record to prepare an appraisal report. The Appraiser may rely on information from an interested party to the transaction (borrower, real estate agent, property contact, etc.) with clear appraisal report disclosure when additional verification is not feasible. The appraisal report must contain adequate information to enable the intended users to understand the extent of the inspection that was performed.

The Exterior-Only and Desktop-Only Appraisal options must continue to be reported on the current FHA approved appraisal forms with amended certifications and scope of work disclosures.

Appraisal Forms and Amended Certifications

The optional Exterior-Only and Desktop-Only appraisals must be reported on the existing Acceptable Appraisal Reporting Forms by Property and Assignment Type. These forms will require amended certifications and clear scope of work disclosures. Mortgagees are reminded that Exterior Appraisal forms Fannie Mae 2055 and Fannie Mae 1075 are not FHA approved forms and are not compatible with FHA’s Electronic Appraisal Delivery (EAD) portal.

The appraisal report must include a signed certification indicating whether the Appraiser did or did not personally inspect the subject property and the extent of the inspection. FHA has provided model certifications for the Exterior-Only and Desktop-Only scope of work.

COVID-19 Questions and Answers

Last revised: March 27, 2020

Q1. What is FHA’s Office of Single Family Housing doing to prepare for possible disruptions in its business operations should the Coronavirus (COVID-19) warrant office closures?

A1. All of FHA, including Single Family, is prepared to operate remotely to ensure our business operations continue with as little disruption as possible in the event of office closures.

Q2. Is FHA continuing to endorse loans?

A2. Insurance endorsements for all FHA Title I loans and Title II forward and reverse mortgages continues; however, there may be processing delays if staff is working remotely.

Q3. Is the FHA Resource Center continuing normal operations?

A3. Yes. However, if the Homeownership Centers (HOCs) are closed there will not be FHA staff members available to receive escalated calls. If this occurs, we recommend that stakeholders email their questions to the FHA Resource Center at: answers@hud.gov for a quicker response.

Q4. (REVISED 3.18.20) Must lenders still complete the annual recertification by March 31, 2020?

A4. (REVISED 3.18.20) FHA has extended the due date for annual recertification to April 30, 2020 for those lenders with a December fiscal year end. However, lenders that can complete the annual recertification before April 30th are encouraged to do so.

Q5. Are requests for lender insurance (LI) authority being processed?

A5. Yes. The LI approval process is electronic, so lenders may continue to submit these requests.

Q6. Can lenders still submit applications to become FHA-approved lenders?

A6. Yes. The FHA lender approval process is electronic, so lenders may continue to submit these requests.

Q7. Will FHA still conduct lender monitoring and/or loan reviews?

A7. Yes. FHA staff will conduct these reviews remotely. All on-site reviews are suspended until further notice.

Q8. Will the Credit Alert Verification Reporting System (CAIVRS) be available if there are office closures?

A8. Yes. CAIVRS will be available to determine if a borrower has a delinquent federal debt.

Q9. Will the FHA TOTAL Scorecard be available for lenders?

A9. Yes. The FHA TOTAL Scorecard will be available.

Q10. (Revised 3.27.20) Will FHA still conduct in-person lender trainings?

A10. (Revised 3.27.20) No. All FHA Single Family in-person trainings are suspended. Online webinar trainings will continue. FHA will continue to assess the situation to determine when in-person trainings can resume.

Q11. Are there special loss mitigation program options available to borrowers who may be negatively impacted by the Coronavirus?

A11. As with any other event that negatively impacts a borrower’s ability to pay their monthly mortgage payment, FHA’s suite of loss mitigation options provides solutions that mortgagees should offer to distressed borrowers – including those that could be impacted by the Coronavirus – to help prevent them from going into foreclosure. An example of one of these options is our Special Forbearance for unemployed borrowers. The SFB-Unemployment Option is a Home Retention Option available when one or more of the Borrowers has become unemployed and this loss of employment has negatively affected the Borrower’s ability to continue to make their monthly Mortgage Payment. These home retention options are located in FHA’s Single Family Housing Policy Handbook 4000.1 (SF Handbook) Section III.A.2. See FHA INFO 20-18 for more details. FHA is closely monitoring the situation and will provide updated guidance, as needed.

Q12. Is FHA requiring servicers to conduct occupancy exterior inspections during this time?

A12. Yes. The standard in FHA’s SF Handbook states that the mortgagee must perform a visual exterior inspection. No physical contact with the borrower and/or occupants is required. For more information, please see SF Handbook, Section III.A.2.h.xi — Occupancy Inspection.

Q13. Does FHA require physical contact with the borrower and/or occupants when acquiring possession of a property in connection with occupied conveyances?

A13. No. When identifying property occupants, FHA does not require physical contact with the borrower and/or occupants. For more information, please see SF Handbook, Section III.A.2.s. —Acquiring Possession.

Q14. Will I be able to place a bid on a HUD-owned property via the HUD Homestore bid site?

A14. Yes. The bidding site is available.

Q15. Is FHA continuing to process claims?

A15. FHA will continue to process claims; however, servicers may experience slightly longer processing timeframes if there are office closures, particularly for any claims submitted manually and Title I claim submissions and Title I manufactured housing endorsements.

Q 16. Is HUD suspending credit reporting for FHA-Insured mortgages?

A 16. FHA requires servicers to comply with the credit reporting requirements of the Fair Credit Reporting Act (FCRA); however, FHA encourages servicers to consider the impacts of COVID-19 on borrowers’ financial situations and any flexibilities a servicer may have under the FCRA when taking negative credit reporting actions.

Q17. (REVISED 3.27.20) Is FHA continuing to require appraisals with interior property inspections for Single Family programs?

A17. (REVISED 3.27.20) In accordance with Mortgagee Letter 2020-05, exceptions for two additional appraisal inspection scope of work options may be used for certain cases. The exterior-only appraisal and the desktop-only appraisal options are permitted when circumstances warrant. The FHA roster appraiser must complete all required appraisals in accordance with acceptable Appraisal Reporting Forms and Protocols. See ML 2020-05 for more program specific details.

Q18. Are face-to-face interviews still required under FHA’s Default Servicing early default intervention requirements?

A18. FHA has published a regulatory waiver and an accompanying SF Handbook waiver to allow mortgagees to utilize alternative methods for contacting borrowers, in lieu of face-to-face interviews, to meet the requirements of SF Handbook, Section III.A.2.h.xii. For more information, please see Regulatory Waiver and Handbook Waiver.

Q&As (3.18.2020)

Q19. Will lenders be penalized if they are unable to submit case binders to FHA within 10 business days of the binder request as a result of temporary lender office closures or reductions in on-site staff?

A19: No. Lenders should make every effort to submit case binders to FHA as quickly as possible, but they will not be penalized for overdue binder requests caused by their temporary office closures or staff reductions related to Coronavirus disease 2019 (COVID-19).

Q20. Will FHA suspend foreclosures and evictions on single family properties now that a Presidentially-Declared COVID-19 National Emergency has been declared? A20. Yes. FHA published Mortgagee Letter (ML) 2020-04, “Foreclosure and Eviction Moratorium in connection with the Presidentially-Declared COVID-19 National Emergency,” on March 18, 2020. This ML announced an immediate foreclosure and eviction moratorium for all FHA-insured single family mortgages for a 60-day period.

Q21: Is FHA providing an automatic extension to foreclosure deadlines following the expiration of this moratorium? A21: Yes. FHA is providing mortgagees an automatic 60-day extension following the moratorium expiration date to commence or recommence foreclosure action or evaluate the borrower under HUD’s Loss Mitigation Program.

Q22. Why is FHA granting a foreclosure moratorium for HECMs instead of an extension to the HECM foreclosure timelines?

A22. FHA is authorizing a foreclosure moratorium for Home Equity Conversion Mortgages (HECMs) through guidance in ML 2020-04, which is being provided in response to the unprecedented national emergency and the exigent circumstances surrounding the COVID-19 crisis. HUD’s

Presidentially-declared major disaster rea (PDMDA) guidance concerning extensions of HECM foreclosure timelines as provided in FHA INFO 18-40 is unaffected by the guidance.

New Q&As (3.27.2020)

Q24. When are exceptions to the appraisal inspection protocols for the use of exterior-only and desktop-only scope of work permitted?

A24. An exception for the exterior-only option is limited to purchase cases, rate and term refinances, simple refinances, and HECMs. An exception for the desktop-only option is limited to purchase cases.

Q25. What precautions should appraisers take while conducting a property appraisal report with inspection?

A25. Appraisers are advised to establish safety policies and procedures for their clients per the current guidance and recommendations provided by the Centers for Disease Control (CDC) as well as local, state, and federal resources. When scheduling property inspections, appraisers should discuss established protocols to reduce the risk of COVID-19 exposure.

Q26. Does the appraiser have to perform an interior inspection of the subject property?

A26. Certain FHA cases may now be completed with exterior-only or desktop-only scope of work. The appraiser should monitor the client’s engagement letters and instructions. For cases requiring the standard protocols of a complete interior and exterior viewing, the appraiser should follow safe practices and keep the client informed.

Q27. When performing an exterior-only or desktop-only scope of work, should the appraisal subject to inspection be completed at a later date?

A27. The appraisal does not need to be subject to an inspection at a later date solely because an interior or physical inspection was not performed. The appraiser must identify any necessary extraordinary assumptions based on the limited inspection scope of work and complete the appraisal based upon these assumptions. The appraisal will be completed “AS IS” unless deficiencies in Minimum Property Requirements (MPR) are observed or known to the appraiser based on the scope of inspection.

Q28. Which appraisal forms will be used for the exterior-only and desktop-only appraisals?

A28. The current acceptable appraisal reporting forms based on property/assignment type will continue to be used for all appraisals, including those with limited inspection scope of work. The appraiser must include the amended model certification and scope of work with the appraisal form. See acceptable reporting forms below:

Q29. Where should the appraiser get the subject property data necessary to complete the appraisal form for an exterior-only or desktop-only scope of work?

A29. To identify the property characteristics necessary to develop the appraisal, the appraiser may rely on third party data from the following sources: prior appraisals, tax assessor’s property record, and the Multiple Listing Service (MLS). The Appraiser may also obtain and rely on information from the homeowner with disclosures. Extraordinary assumptions are permitted when necessary in the development of a credible appraisal and should be clearly stated.

Q30. Are there any additional changes to the appraisal form data requirements to clearly communicate that a modified scope of work was completed?

A30. Yes. To better identify a modified scope of work appraisal, the Map Reference text field within the subject section of the form should be used to state “desktop” or “exterior,” when applicable.

Q31. Is the appraiser still responsible for identification of property deficiencies and minimum property requirements?

A31. While the FHA minimum property requirements (MPR) has not changed, the appraiser is required to observe, analyze, and report only what is evident based on the assignment scope of work.

Property/Assignment

Type

Acceptable Reporting Form

Single Family, Detached, Attached or Semi-Detached Residential Property

Fannie Mae Form 1004/Freddie Mac Form 70, Uniform Residential Appraisal Report (URAR); Mortgage Industry Standards Maintenance Organization (MISMO) 2.6 Government-Sponsored Enterprise (GSE) format

Single Unit Condominium

Fannie Mae Form 1073/Freddie Mac Form 465, Individual Condominium Unit Appraisal Report; MISMO 2.6 GSE format

Manufactured (HUD Code) Housing

Fannie Mae Form 1004C/Freddie Mac Form 70B, Manufactured Home Appraisal Report; MISMO 2.6 Errata 1 format

Small Residential Income Properties(Two to Four Units)

Fannie Mae Form 1025/Freddie Mac Form 72, Small Residential Income Property Appraisal Report; MISMO 2.6 Errata 1 format

Update of Appraisal(All Property Types)

Summary Appraisal Update Report Section of Fannie Mae Form 1004D/Freddie Mac Form 442, Appraisal Update and/or Completion Report; MISMO 2.6 Errata 1 format

Compliance or Final Inspection for New Construction or Manufactured Housing

Form HUD-92051, Compliance Inspection Report, in Portable Document Format (PDF)

Compliance or Final Inspection for Existing Property

Certification of Completion Section of Fannie Mae Form 1004D/Freddie Mac Form 442, Appraisal Update and/or Completion Report; MISMO 2.6 Errata 1 format

KENTUCKY VA HOME LOANS

Kentucky VA Loan Refinance and Purchase Guidelines

In “Guidelines”

Overview of the Kentucky VA Home Loan Program

Louisville Kentucky Mortgage Loans

KENTUCKY VA LOAN FEATURES

✓ Up to 100% financing available**

✓ No monthly private mortgage insurance

✓ Seller concessions up to 4% of the reasonable value of the property

✓ Credit scores as low as 580 FICO in Kentucky

✓ Must be a veteran, active duty or reserve member to be eligible

✓ Manufactured homes allowed

✓ 90% cash out refinance available

✓ Non traditional credit

✓ Consistently one of the top 5 Kentucky loan officers…

✓ Has helped hundreds of VA families find their home in Kentucky

✓ Personal ties to veterans and active duty members and former Army Tanker that has a VA loan and done over 200 Kentucky VA loans.

View original post 1 more word

Louisville Ky FHA Mortgage Loans

Louisville Ky FHA Mortgage Loans.

Louisville Ky Mortgage LoansDo you have the ability to repay your Louisville Ky mortgage loans? Your banks and lenders are sure to ascertain that. You have to give them enough reasons to agree that you are indeed capable of repaying mortgage loans in Louisville. Start the “confidence building measure” by reducing your debts. Pay all the credit card balances in order to get qualified for Louisville Ky mortgage loans. If you have too many debts, try to delay your loan application. A positive certification by your credit bureau would ensure that you obtain mortgage loans in the Louisville Kentucky area.

Best terms and rates on a Louisville Ky home loans is now just a mouse click away. Apply now and secure the best terms and rates on your preferred mortgage program. We deal in a variety of Louisville home loans, including Louisville first residential mortgage, Louisville home loan refinance, and more…

Kentucky First-Time Home Buyer Programs | USDA, FHA, VA & KHC Loans

Louisville Ky FHA Mortgage Loans.

Louisville Ky Mortgage Loans

Do you have the ability to repay your Louisville Ky mortgage loans? Your banks and lenders are sure to ascertain that. You have to give them enough reasons to agree that you are indeed capable of repaying mortgage loans in Louisville. Start the “confidence building measure” by reducing your debts. Pay all the credit card balances in order to get qualified for Louisville Ky mortgage loans. If you have too many debts, try to delay your loan application. A positive certification by your credit bureau would ensure that you obtain mortgage loans in the Louisville Kentucky area.

Best terms and rates on a Louisville Ky home loans is now just a mouse click away. Apply now and secure the best terms and rates on your preferred mortgage program. We deal in a variety of Louisville home loans, including Louisville first residential mortgage, Louisville…

View original post 402 more words