Kentucky First-Time Home Buyer Programs in 2026: Your Complete Guide to FHA, VA, USDA, Conventional, and KHC Loans

Buying your first home in Kentucky in 2026? You’re entering a market with more options than ever before. Updated loan limits, competitive interest rates, and powerful down payment assistance programs are making homeownership more accessible for Kentucky families across all 120 counties.

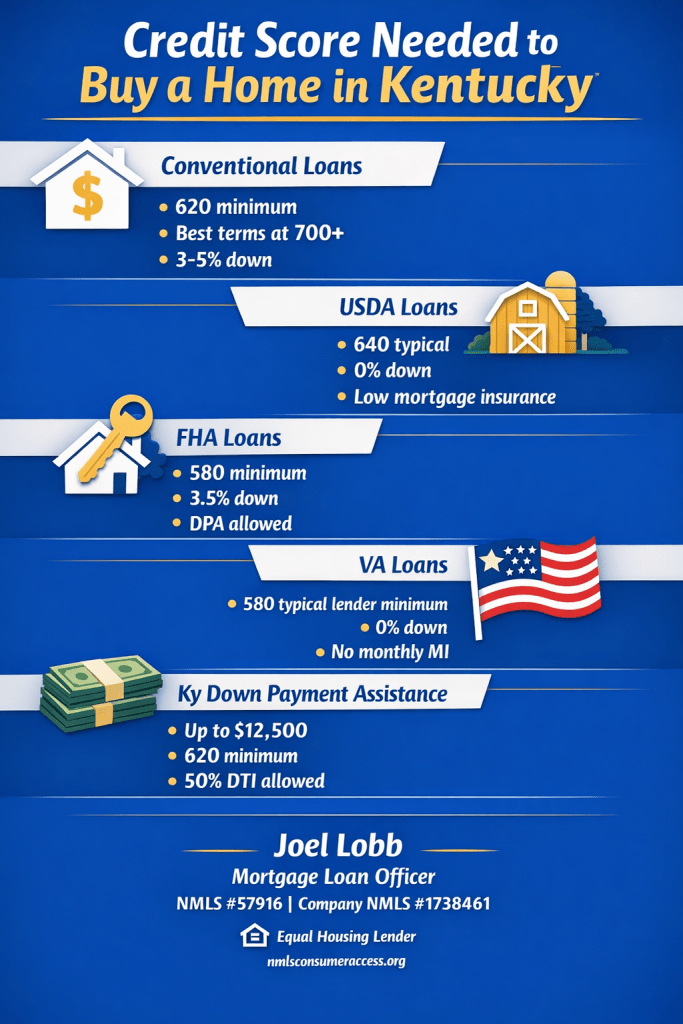

The main options for Kentucky homebuyers in 2026 include Conventional Loans, FHA Loans, VA Loans, USDA Loans, and Kentucky Housing Corporation (KHC) Down Payment Assistance programs. Each offers distinct advantages depending on your credit score, down payment savings, income level, and location.

This comprehensive guide breaks down every program, updated with 2026 loan limits, credit requirements, and qualification guidelines to help you make informed decisions about your home purchase.

Conventional Mortgage Loans in Kentucky (2026)

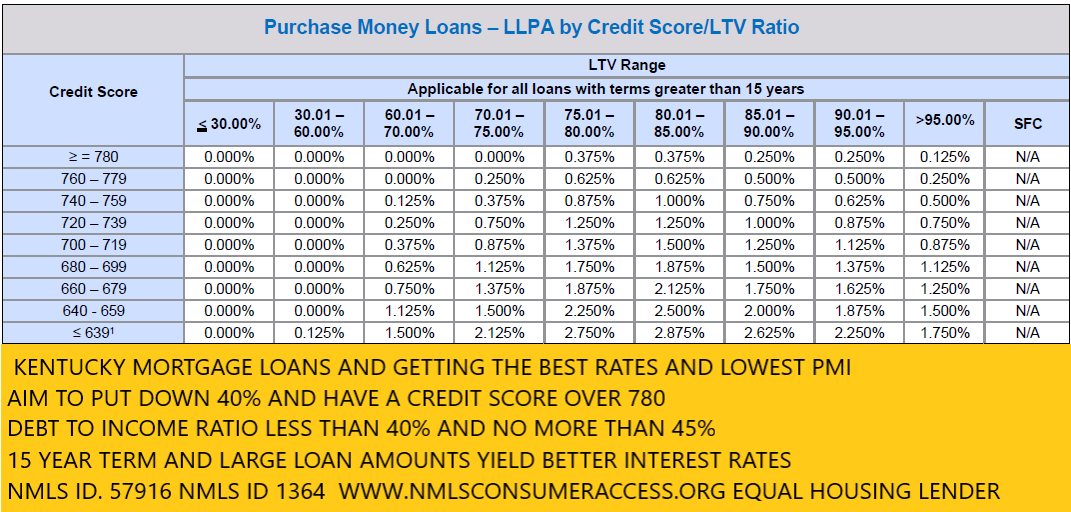

Conventional loans remain the most popular choice for Kentucky homebuyers with good credit and stable income. These loans are not government-backed, which means they follow stricter underwriting standards but offer significant benefits for qualified borrowers.

2026 Conventional Loan Requirements:

- Credit Score: Minimum 620 (preferred 740+ for best rates)

- Down Payment: As low as 3% for qualified first-time buyers; 5% for repeat buyers

- Debt-to-Income Ratio (DTI): Maximum 43-50% (varies by lender and compensating factors)

- 2026 Loan Limits for Kentucky:

- Single-Family Home: $832,750

- Two-Unit Property: $1,066,000

- Three-Unit Property: $1,288,750

- Four-Unit Property: $1,601,750

Additional Requirements:

- Work History: Two years of consistent employment in the same field or industry

- Bankruptcy & Foreclosure Waiting Periods:

- No foreclosure in the past 7 years

- No Chapter 7 bankruptcy in the past 4 years

- Chapter 13 bankruptcy allowed after 2 years of discharge with court approval

- Loan-to-Value (LTV): Up to 97% for qualified first-time buyers

- Private Mortgage Insurance (PMI): Required for down payments under 20%; can be canceled once you reach 20% equity

Required Documentation:

- Last two years of W-2 forms

- Last 30 days of pay stubs

- Two years of federal tax returns (self-employed or commissioned income)

- Last two months of bank statements

- Tri-merge credit report from lender

Why Choose Conventional? Borrowers with credit scores of 740+ and 20% down payments often prefer conventional loans because they can avoid mortgage insurance entirely and typically secure the lowest interest rates available.

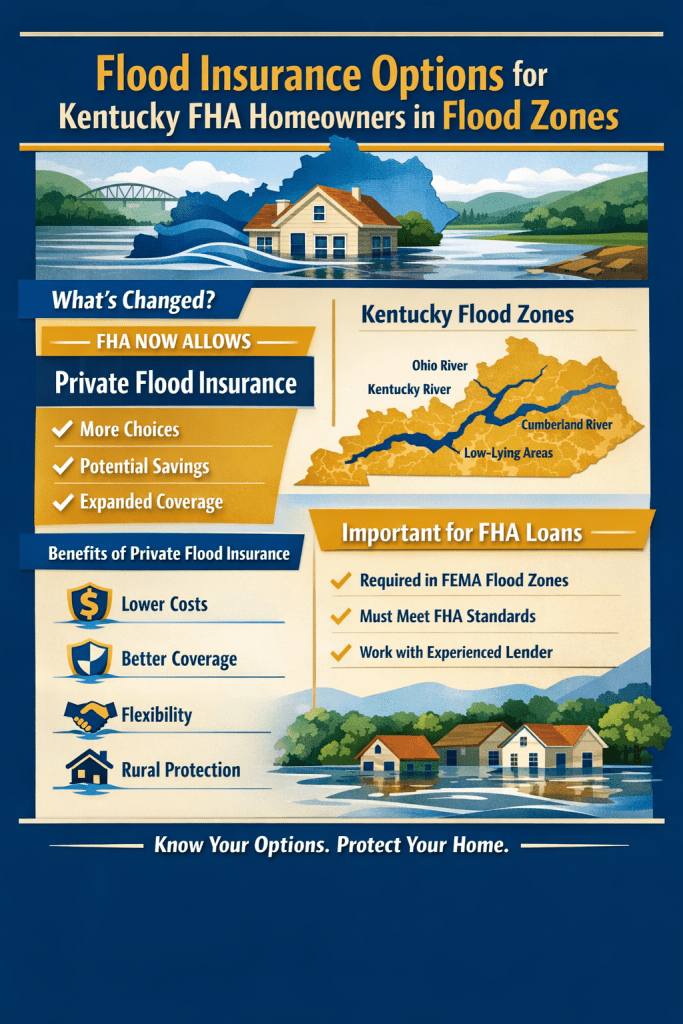

Kentucky FHA Loans (2026)

FHA loans are designed specifically for first-time homebuyers and those with lower credit scores or limited savings. Backed by the Federal Housing Administration, these loans offer the most flexible qualification guidelines of any mortgage program.

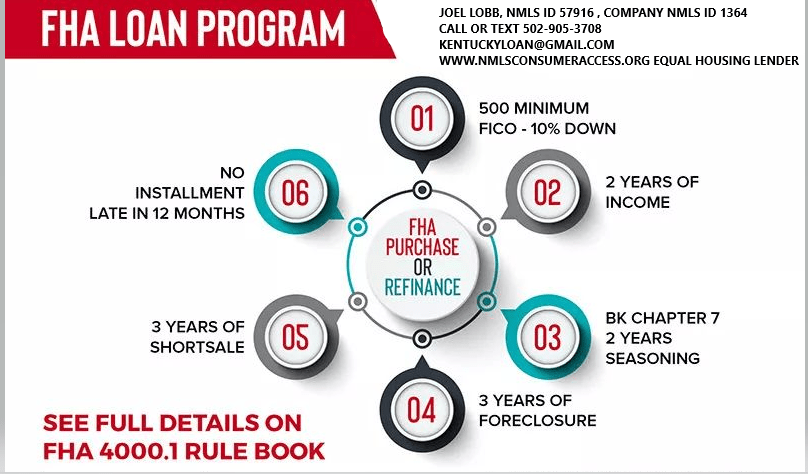

2026 FHA Loan Requirements:

- Credit Score:

- 580+ for 3.5% down payment

- 500-579 for 10% down payment

- Down Payment: As low as 3.5%

- Debt-to-Income Ratio:

- Front-End Ratio: Maximum 31% (housing costs only)

- Back-End Ratio: Maximum 43-57% with compensating factors

- 2026 FHA Loan Limits for All Kentucky Counties:

- Single-Family Home: $541,287

- Two-Unit Property: $693,050

- Three-Unit Property: $837,700

- Four-Unit Property: $1,041,125

FHA Waiting Periods:

- Foreclosure: 3 years minimum

- Chapter 7 Bankruptcy: 2 years minimum

- Chapter 13 Bankruptcy: 12 months of on-time payments with trustee approval

Work History Requirements:

- Two years of steady employment in the same industry

- Gaps exceeding 6 months in the past 2 years must be explained

- Multiple job changes (3+ in 12 months) may require additional documentation

- Recent college graduates can substitute education for work history

FHA Mortgage Insurance:

- Upfront Premium: 1.75% of loan amount (can be financed into loan)

- Annual Premium: 0.45% to 1.05% (paid monthly), based on loan amount and down payment

Required Documentation:

Same as conventional loans, plus:

- 12-24 months of rental payment history (if manually underwritten)

- Verification of non-traditional credit (if applicable)

Why Choose FHA? Perfect for first-time buyers rebuilding credit, those with limited savings, or anyone who has experienced past financial challenges. FHA loans are more forgiving and accessible than conventional financing.

Kentucky VA Home Loans (2026)

VA loans provide unmatched benefits for eligible veterans, active-duty service members, National Guard members, Reservists, and qualifying surviving spouses. These loans eliminate major barriers to homeownership.

2026 VA Loan Benefits:

- Down Payment: Zero down payment required

- Mortgage Insurance: No monthly PMI required (major savings)

- Credit Score: Minimum 580-620 (varies by lender)

- Debt-to-Income Ratio: No maximum DTI with sufficient residual income

- 2026 VA Loan Limits for Kentucky:

- Veterans with full entitlement have no loan limit

- Partial entitlement follows conforming limits: $832,750 for single-family homes

VA Loan Requirements:

- Certificate of Eligibility (COE): Required; obtain through VA website or your lender

- Work History: Two years of consistent employment

- Waiting Periods:

- No foreclosure in the past 2 years

- No Chapter 7 bankruptcy in the past 2 years

- Chapter 13 bankruptcy allowed after 12 months with trustee approval

- Loan-to-Value (LTV): Up to 100% for purchases; 100% for cash-out refinances

- VA Funding Fee: 1.25% to 3.3% of loan amount (waived for disabled veterans)

Required Documentation:

- Certificate of Eligibility (COE)

- DD-214 (for veterans)

- Statement of Service (for active duty)

- Standard income/asset documentation

Why Choose VA? The combination of no down payment, no monthly mortgage insurance, and competitive interest rates makes VA loans the most powerful financing option available for eligible borrowers.

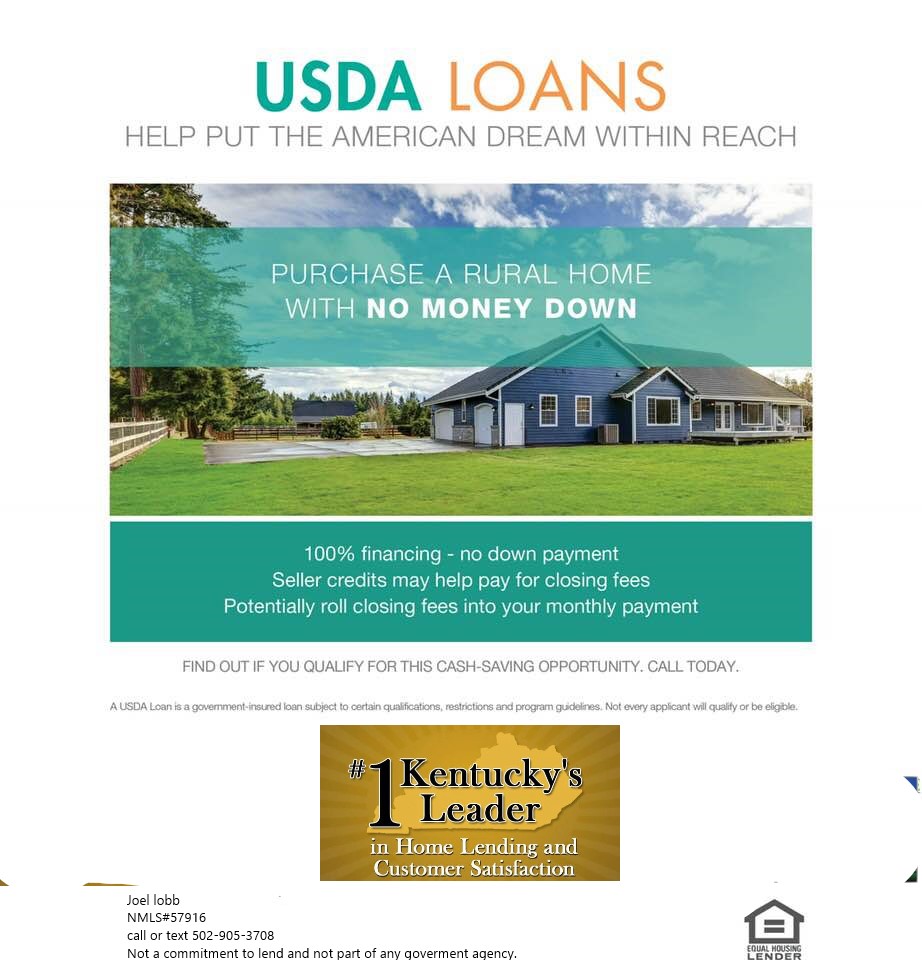

USDA Loans in Kentucky (2026)

USDA loans offer 100% financing for eligible rural and suburban properties throughout Kentucky. Despite the “rural” designation, many suburban areas qualify, including parts of major metro areas.

2026 USDA Loan Requirements:

- Credit Score: Minimum 620 (preferred 640+ for automated approval)

- Down Payment: Zero down payment required

- Debt-to-Income Ratio:

- Front-End: Maximum 29-32%

- Back-End: Maximum 41-45% (higher with compensating factors through GUS system)

- Income Limits: Must not exceed 115% of area median income (varies by county and household size)

- Property Eligibility: Home must be in USDA-designated eligible area

USDA Waiting Periods:

- Foreclosure: 3 years minimum

- Chapter 7 Bankruptcy: 3 years minimum

- Chapter 13 Bankruptcy: 12 months of on-time payments with trustee approval

USDA Guarantee Fee:

- Upfront Fee: 1% of loan amount (can be financed)

- Annual Fee: 0.35% (paid monthly)

Work History Requirements:

- Two years of steady employment

- Seasonal or temporary work may qualify with sufficient documentation

Why Choose USDA? Perfect for buyers purchasing in eligible rural or suburban areas who want 100% financing. Many Kentucky locations qualify, including areas near Louisville, Lexington, and other cities.

Kentucky Housing Corporation (KHC) Loan Programs (2026)

The Kentucky Housing Corporation offers the most comprehensive suite of programs for first-time homebuyers in the state, combining competitive interest rates with substantial down payment assistance.

KHC Down Payment Assistance Program (2026):

- Assistance Amount: Up to $12,500

- Structure: Second mortgage at 3.75% interest rate for 10 years

- Usage: Can be used for down payment, closing costs, and prepaid expenses

- Repayment: Monthly payments required; not forgivable

2026 KHC Program Options:

1. Conventional Preferred Program

- Down payment as low as 3%

- Available to low- to moderate-income borrowers

- Private mortgage insurance required

- Income limits apply (varies by county)

2. Conventional Preferred Plus 80 Program

- Down payment as low as 3%

- Available to higher-income borrowers (up to $181,300+ depending on county)

- First-time and repeat buyers eligible

- PMI required

3. Mortgage Revenue Bond (MRB) Program

- Below-market interest rates

- Available with FHA, VA, USDA, or Conventional loans

- First-time buyer requirement (waived in targeted areas)

- Maximum purchase price: $544,232

2026 KHC Income Limits (Examples):

Income limits vary by county and household size. Here are representative examples:

- Jefferson County (Louisville): $95,000-$181,300 (depending on program and household size)

- Fayette County (Lexington): $92,000-$176,000

- Rural Counties: Generally lower limits; check with KHC-approved lender

KHC Purchase Price Limits (2026):

- Maximum Purchase Price: $544,232 for most programs

- Some programs have lower limits; verify with your lender

KHC Eligibility Requirements:

- Must purchase primary residence in Kentucky

- Property must meet KHC appraisal standards

- Income and purchase price limits apply

- First-time homebuyer requirement for most programs (waived in targeted areas)

- Must complete homebuyer education course

Why Choose KHC? The combination of below-market interest rates and up to $12,500 in down payment assistance can save Kentucky homebuyers thousands of dollars over the life of their loan.

2026 Kentucky Welcome Home Grant

The Kentucky Welcome Home Grant is expected to return in March 2026, offering additional down payment assistance to eligible Kentucky homebuyers.

2026 Welcome Home Grant Details:

- Grant Amount: To be announced (historically $7,500-$20,000)

- Availability: First-come, first-served basis; funds typically depleted within weeks

- Structure: Forgivable grant (not a loan)

- Eligibility: Income limits and first-time buyer requirements apply

- Launch Date: Expected March 2026

Important: The Welcome Home Grant consistently sells out within days of opening. Get pre-approved now and be ready to act immediately when the program launches.

Comparison: Kentucky Mortgage Loan Program Requirements (2026)

| Program | Min. Credit Score | Down Payment | Max DTI | 2026 Loan Limit (1-Unit) |

|---|---|---|---|---|

| Conventional | 620 | 3-5% | 43-50% | $832,750 |

| FHA | 580 | 3.5% | 31/43-57% | $541,287 |

| VA | 580-620 | 0% | No max* | $832,750 (or unlimited) |

| USDA | 620 | 0% | 29/41-45% | Based on income limits |

| KHC Programs | Varies | 3-3.5% | Varies by loan type | $544,232 |

*VA loans evaluate residual income rather than strict DTI limits

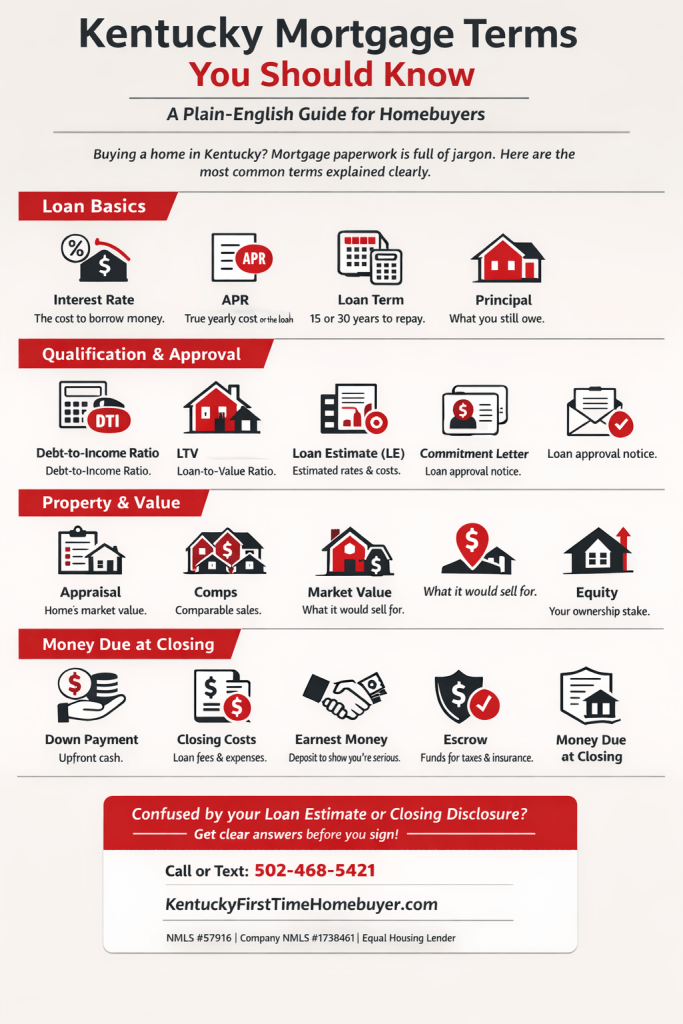

Step-by-Step: How to Apply for a Kentucky Home Loan in 2026

Step 1: Check Your Credit Score

- Obtain free credit reports from all three bureaus

- Review for errors and dispute inaccuracies

- Work on improving your score if below 620

Step 2: Calculate Your Budget

- Determine how much you can afford monthly

- Factor in property taxes, insurance, HOA fees

- Use online mortgage calculators for estimates

Step 3: Get Pre-Approved

- Contact a Kentucky-licensed mortgage professional

- Submit required documentation

- Receive pre-approval letter (typically same-day)

Step 4: Choose Your Loan Program

- Compare options based on your situation

- Consider credit score, down payment, income, and location

- Ask about combining KHC assistance with other programs

Step 5: Find Your Home

- Work with a licensed Kentucky real estate agent

- Stay within your pre-approved amount

- Ensure property meets program requirements

Step 6: Submit Full Application

- Complete formal loan application

- Provide any additional documentation requested

- Coordinate home inspection and appraisal

Step 7: Close on Your Home

- Review closing disclosure carefully

- Bring required funds to closing

- Sign documents and receive keys

Frequently Asked Questions

Q: Can I combine KHC down payment assistance with FHA or VA loans?

A: Yes! KHC assistance can be layered with FHA, VA, USDA, or Conventional loans, making it possible to buy with minimal out-of-pocket costs.

Q: What’s the difference between the Welcome Home Grant and KHC down payment assistance?

A: The Welcome Home Grant is a forgivable grant (not repaid), while KHC down payment assistance is a second mortgage with monthly payments at 3.75% interest.

Q: Do all Kentucky counties have the same FHA loan limits?

A: Yes. For 2026, all 120 Kentucky counties use the same FHA floor limit of $541,287 for single-family homes.

Q: Can I buy a multi-unit property with these programs?

A: Yes! FHA, VA, and Conventional loans all allow 2-4 unit purchases, with the requirement that you occupy one unit as your primary residence.

Q: How long does the mortgage approval process take?

A: Pre-approval typically happens within 24 hours. Full approval to closing typically takes 30-45 days depending on the loan type and your responsiveness.

Q: What if I have student loan debt?

A: All programs allow student loan debt. Lenders will calculate either 0.5-1% of the balance or use your actual payment amount in DTI calculations.

Why Work With a Kentucky Mortgage Specialist?

Navigating multiple loan programs, down payment assistance options, and changing requirements requires expertise and local knowledge. Working with a Kentucky-licensed mortgage professional who specializes in first-time homebuyer programs ensures:

- ✓ Accurate Pre-Approval: Same-day approvals with correct numbers

- ✓ Program Expertise: Knowledge of all available KHC and state programs

- ✓ Competitive Rates: Access to wholesale pricing and special programs

- ✓ Local Market Knowledge: Understanding of Kentucky’s 120 counties

- ✓ Personalized Service: One-on-one guidance throughout the entire process

Get Started Today

Ready to explore your Kentucky home buying options? The 2026 loan limits and programs provide more opportunities than ever for Kentucky families to achieve homeownership.

Contact Information:

📧 Email: kentuckyloan@gmail.com

📞 Call/Text: 502-905-3708

🌐 Website: www.mylouisvillekentuckymortgage.com

Joel Lobb

Mortgage Loan Officer – Kentucky Mortgage Loan Specialist

20+ Years Experience | 1,300+ Families Helped

NMLS Personal ID: 57916

Company NMLS ID: 1738461

Services Available:

- ✓ Free mortgage applications with same-day approval

- ✓ All 120 Kentucky counties served

- ✓ FHA, VA, USDA, Conventional, and KHC programs

- ✓ Down payment assistance guidance

- ✓ First-time homebuyer counseling

Equal Housing Lender | Licensed for Kentucky Mortgage Loans Only

Disclaimer: This website is not endorsed by or affiliated with the FHA, VA, USDA, or any government agency. Information provided is for educational purposes. Loan programs, rates, and requirements subject to change. All borrowers must meet program eligibility requirements.

2026 Kentucky Housing Market Outlook

Kentucky’s housing market continues to show strength in 2026, with steady home price appreciation and competitive interest rates creating favorable conditions for buyers. The increased loan limits provide greater purchasing power, while expanded down payment assistance programs make homeownership more accessible.

Whether you’re a first-time buyer, a veteran, or someone looking to purchase in a rural area, Kentucky’s diverse loan programs offer a pathway to homeownership that fits your unique financial situation.

Start your journey today by

Call/Text:

Call/Text:  Email:

Email:  Website:

Website:  Address: 911 Barret Ave, Louisville, KY 40204

Address: 911 Barret Ave, Louisville, KY 40204 Click here to apply for Free Info & Homebuyer Advice →

Click here to apply for Free Info & Homebuyer Advice →

Email –

Email – Address:

Address:  First-Time Home Buyers Welcome

First-Time Home Buyers Welcome