Credit score, Down payment, Fannie Mae, Federal Housing Administration, FHA, First-time buyer, Kentucky, Kentucky Housing Corporation, Kentucky-Louisville, louisville, Mortgage, Refinancing, USDA, VA loan

Student Loans In Collections, What Can I Do to get Approved For A Kentucky Mortgage ?

|

|

Credit Scores on your mind ?

Here are tips for improving your credit score

Pay your bills on time. Late payments can hurt your score significantly. If you have missed payments, get current and stay current. The more you pay your bills on time, the better your score.

Open a secured credit card ( 2 of them) for the both of you.Keep credit card balances low relative to credit limits (30 percent or lower is recommended). “Maxing out” your credit cards means you have a very high utilization rate, which significantly lowers your credit score.

Here are NerdWallet’s picks for the best secured credit cards.

Lowest deposit for people with no credit: Capital One® Secured MasterCard®

For a deposit of $49, $99 or $200, depending on your credit history, you’ll get a limit of $200;

the annual fee is $0.Capital One Secured MasterCard Credit Card

(86)

Apply Now

on Capital One’s

secure websiteBenefits of the Capital One® Secured MasterCard®:

Unlike most secured cards, it’s possible to get a credit limit on this card that’s higher than the security deposit you put down. You can get a limit of $200 for a $49, $99 or $200 deposit.

You can make partial payments on your deposit, as long as you provide the full amount within 80 days of being approved. You’ll get access to your full credit line before that time.

There’s no penalty APR.

This card reports to the three major consumer credit bureaus, which is somewhat rare among secured cards.

You can track your credit-building with Capital One’s Credit Tracker.Best for bad credit or no checking account: OpenSky® Secured Visa® Credit Card

Capital Bank Open Sky Secured Credit Card

(3)

Apply Now

on Capital Bank’s

secure websiteBenefits of the OpenSky® Secured Visa® Credit Card:

You can qualify for this card within minutes. The bank doesn’t run a credit check and doesn’t require a checking account, unlike other major issuers.

Since the annual fee is $35, this card is a relatively affordable way to improve a severely damaged credit score.

The card reports to the three major consumer credit bureaus.Credit Score

While the items on your credit report matter, you’ll also need to watch your FICO score. There are many different types of credit scores out there. You have the individual credit bureaus scores (Experian, Trans Union, and Equifax), FICO scores, Vantage Scores, and industry specific scores. However when looking to purchase a home you will want to watch your FICO as it is used in an overwhelming majority of mortgage related credit evaluations.

Also it’s important to note that FICO changes the way they evaluate creditworthiness based on new information and changes in the market. They have recently release FICO version 9. Since the majority of mortgage lenders still use an older FICO scoring model, when evaluating and monitoring your score, FICO recommends you use one calculated from a scoring model previous to Version 8.

When evaluating your FICO score it’s good to know that a score above 700 is considered excellent while a score under 620 is considered poor. You may secure a mortgage with a low FICO score but your interest rates will be subprime. In the case of a mortgage, it may be beneficial to wait until you’ve raised your credit score.

FICO has a great calculator on their web site to help you plan on when is a good time to get a mortgage loan depending on your credit score. It will help you determine if the savings you will receive with a higher score are worth the wait and energy required to increase your credit score.

Here are six tips for improving your credit score for a fresh financial start in 2017.

1. Pay Your Monthly Bills on Time

Paying monthly bills is a necessary chore that has a definite effect on your credit score. According to the FICO scoring model, your payments account for as much as 35 percent of your total score. Create reminders for due dates or establish a calendar for yourself to ensure you get everything paid on time.2. Reduce Your Debts

Got credit card debt? Start paying it off now. Part of your credit score is based on the amount of available credit you have, known as your credit utilization ratio. So if you’re carrying high balances, you’ll want to lower them as soon as possible. Create a personal budget with a goal of reducing your spending so that it’s lower than your income. Then, use any monthly surplus for your credit card debts until they’re gone for good.3. Limit Credit Inquiries

Looking for a new apartment? What about a mortgage? In either situation, try and group your applications together as much as possible. Applications for new lines of credit will generate a “hard pull” on your credit, and having too many of them in a short period of time can lower your score. However, credit reporting agencies usually consider a group of applications within a short period of time as one pull, as long as they’re in the same category.Similarly, limit yourself to opening up no more than one or two credit cards per year, which also generate hard pulls. Even if you get a ton of offers in the mail for stellar sign-up bonuses, they’re likely to be offset by the damage to your credit. FICO reports that new credit and credit inquiries account for 10 percent of your total score.

4. Don’t Cancel Old Cards

Have a card you don’t use anymore? Don’t close it. This can negatively affect your score as it lowers your amount of available credit. Instead, use it about once per month and don’t forget to pay the bills in full, and on time.5. Request Credit Limit Increase

If you only have one card and you’re constantly approaching your spending limit, call the bank and ask for an increase in your credit line. This will raise the amount of available credit, which will eventually improve your score.6. Take Care of Late Payments Before They Hit Your Score

If you do happen to miss a payment, contact the card issuer immediately. If you have good history built up, the company may agree to not report your late payment. Even if you can’t avoid a late-payment fee, be sure to get your account up to date as soon as possible so you can limit the damage.

Your credit score is yours to own. It reflects your financial history and helps lenders predict how you will manage your finances in the future. Due to the lingering effects of credit, you don’t want to waste any time to improve your credit.Joel Lobb

Senior Loan Officer

(NMLS#57916)American Mortgage Solutions, Inc.

10602 Timberwood Circle, Suite 3

Louisville, KY 40223phone: (502) 905-3708

Fax: (502) 327-9119

kentuckyloan@gmail.comhttp://www.mylouisvillekentuckymortgage.com/

CONFIDENTIALITY NOTICE: This message is covered by the Electronic Communications Privacy Act, Title 18, United States Code, §§ 2510-2521. This e-mail and any attached files are deemed privileged and confidential, and are intended solely for the use of the individual(s) or entity to whom this e-mail is addressed. If you are not one of the named recipient(s) or believe that you have received this message in error, please delete this e-mail and any attached files from all locations in your computer, server, network, etc., and notify the sender IMMEDIATELY at 502-327-9770. Any other use, re-creation, dissemination, forwarding, or copying of this e-mail and any attached files is strictly prohibited and may be unlawful. Receipt by anyone other than the named recipient(s) is not a waiver of any attorney-client, work product, or other applicable privilege. E-mail is an informal method of communication and is subject to possible data corruption, either accidentally or intentionally. Therefore, it is normally inappropriate to rely on legal advice contained in an e-mail without obtaining further confirmation of said advice.

Kerry Vasquez on Oregon Home Loans

While it is an American dream to be debt free- we always wonder how does it affect my credit score?

This may weigh on your mind so take a quick read…

Believe it or not, being completely debt free can actually hurt your credit scores.

It may feel wonderful to be debt free, you could be damaging your credit score. The credit bureaus’ scoring models like to see some balances. A good mix would be: one mortgage, one auto loan and at least one revolving debt with a balance, even if that balance is only $10.

The scoring models also favor consumers that have several open revolving debts with no balances. Closing accounts can actually hurt your credit scores. This is especially true of accounts with long

histories.

Note- when you close accounts, the history also goes away, the good history will no longer be there!

Pairing down to only…

View original post 257 more words

HUD down payment assistance on Kentucky FHA mortgages

The Department of Housing and Urban Development announced this week that it is issuing new rules for down payment assistance on mortgages insured by the Federal Housing Administration. Click the headline for a full breakdown of which rules are changing and why.

Source: HUD announces new rules for down payment assistance on FHA mortgages

The new rules are laid out in an FHA mortgagee letter titled “Downpayment Assistance and Operating in a Governmental Capacity.”

According to HUD, this “clarification” of the current documentation rules “should assist mortgagees in determining whether governmental entities providing gifts or secondary financing, or both, towards borrowers’ MRI are doing so consistent with FHA requirements.”

As the FHA states in its mortgagee letter, the current FHA handbook requires mortgagees to confirm that a “governmental entity is operating in its governmental capacity but, except for requiring a source of funds letter, does not specify the necessary documentation that demonstrates support for such a conclusion.”

According to HUD, that lack of “necessary documentation” is leading to some unnamed “entities” skirting the rules.

“It has come to FHA’s attention that certain Governmental Entities may be acting beyond the scope of any inherent or granted governmental authority in providing funds towards the Borrower’s MRI in circumstances that would violate Handbook 4000.1, the National Housing Act, and is contrary to established law,” the FHA said in the mortgagee letter.

In order to remedy this situation, the FHA is now stating that its current documentation requirements need to be “clarified to provide Mortgagees with specific guidance regarding documentation that will give greater assurances that the standards for providing the MRI have been satisfied by the Governmental Entity.”

According to HUD and the FHA, the new rules took effect on April 18, 2019.

To read HUD’s announcement of the rule change, click here.

And for a full look at how the rules are actually changing and what documentation will now be required, click here.

Joel Lobb

Mortgage Loan Officer

Individual NMLS ID #57916

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

https://www.mylouisvillekentuckymortgage.com/

Four Things Not to do When Getting a Mortgage

We discuss various things such as credit, income, assets, family, and future plans. During these discussions, I have discovered that not only must I tell the borrowers what to do, I need to place a lot of emphasis on what not to do.

1) Do not apply for credit cards while waiting to be approved for a mortgage. Most lenders will “monitor” your credit profile during the process or recheck your credit report before closing. More available credit can mean a lower credit score and a higher DTI (debt to income ratio used to determine if you qualify to buy – money coming in verses money going out). This can also delay a closing because the future homeowner may have to provide a statement from the account to the underwriter.

2) Do not be late on any payment. If you are late on a payment prior to closing, your score will drop. I saw one this morning drop from 679 to 582. Crazy! An underwriter will not approve your home loan if you cannot show the ability to pay a bill on time.

3) Do not quit your job. If anything changes regarding your employment, tell your loan officer. One of the last things a lender does prior to closing is verify employment. No job. No loan. This has actually happened.

4) Do not accept cash gifts and deposit them into your bank account. Cash gifts are very difficult,if not impossible to prove. If you are receiving a gift in order to make the down payment at closing, talk to your loan officer first. He or she can make your life a lot easier with just a little guidance and direction.

I know that the four items above may seem simple, but what if the buyer does not know and goes down that path? It is painful to have worked so hard to buy the home of your dreams only to have it taken away due to one bad decision. I work for one of the best mortgage companies in the country and I help people get a home loan every day. But it is also my job to inform inform inform.

I spend a lot of time advising potential home buyers regarding homes in Georgia. We discuss various things such as credit, income, assets, family, and future plans. During these discussions, I have discovered that not only must I tell the borrowers what to do, I need to place a lot of emphasis on what not to do.

1) Do not apply for credit cards while waiting to be approved for a mortgage. Most lenders will “monitor” your credit profile during the process or recheck your credit report before closing. More available credit can mean a lower credit score and a higher DTI (debt to income ratio used to determine if you qualify to buy – money coming in verses money going out). This can also delay a closing because the future homeowner may have to provide a statement from the account to the underwriter.

2) Do not be late on…

View original post 277 more words

FHA says as many as 50,000 mortgages will be affected by new lending rules

Two weeks ago, the FHA took steps to limit risk to its single-family portfolio, announcing that it will flag some loans for manual underwriting. FHA’s Chief Risk Officer Keith Becker told the WSJ just how many loans the agency thinks will be affected, adding that the FHA felt that it was appropriate to take some steps to mitigate the risks we’re seeing.

Two weeks ago, the Federal Housing Administration took steps to mitigate risks to its single-family portfolio, announcing updates to its TOTAL Mortgage Scorecard that will flag some loans for manual underwriting.

The move upset a number of lenders who feared that some of their borrowers would be shut out of FHA financing and that borrowers who began the process but no longer qualified under new guidelines would be angry.

Turns out, their fears have some merit.

An FHA official told The Wall Street Journal that approximately 40,000 to 50,000 loans a year will likely be affected, which amounts to about 4-5% to all the mortgages the FHA insures on an annual basis.

“We have continued to endorse loans with more and more credit risk,” said FHA’s Chief Risk Officer Keith Becker. “We felt that it was appropriate to take some steps to mitigate the risks we’re seeing.”

The WSJ points out that the move is a complete reversal of the agency’s 2016 decision to loosen underwriting standards, nixing an old rule that required manual underwriting for loans with credit scores below 620 and a debt-to-income ratio above 43%.

But the agency’s annual report to Congress released in November revealed risk trends that threatened to drain the program, among them a significant increase in cash-out refinances, a drop in average borrower credit score, and a jump in borrowers with high DTIs.

Requiring manual underwriting for riskier loans is intended to curb these risks, and there’s a good chance a number of borrowers will no longer qualify.

According to Becker, it’s likely that many of the loans flagged for manual underwriting won’t end up passing muster.

Source: FHA says as many as 50,000 mortgages will be affected by new lending rules

Latest FHA shift to mitigate risks may shut out some Kentucky home buyers wanting FHA Loans in 2019

Latest FHA shift to mitigate risks may shut out some homebuyers:

Kentucky FHA Loan Changes for FICO Scores and Credit Scores for 2019

Call or Text me at 502-905-3708 with your mortgage questions.

Email Kentuckyloan@gmail.com

—

Mortgage Loan Officer

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

Source: Latest FHA shift to mitigate risks may shut out some homebuyers

FHA eliminates two unnecessary and outdated lending roadblocks

The Federal Housing Administration has taken steps to reduce some of the regulatory burdens that belabor the lending process, releasing two mortgagee letters Tuesday with updated guidelines on home warranty and inspection requirements for single-family FHA loans. FHA Commissioner Brian Montgomery said the moves align with the administration’s goal streamline and update guidelines in an effort to reduce regulatory barriers.

Source: FHA eliminates two unnecessary and outdated lending roadblocks

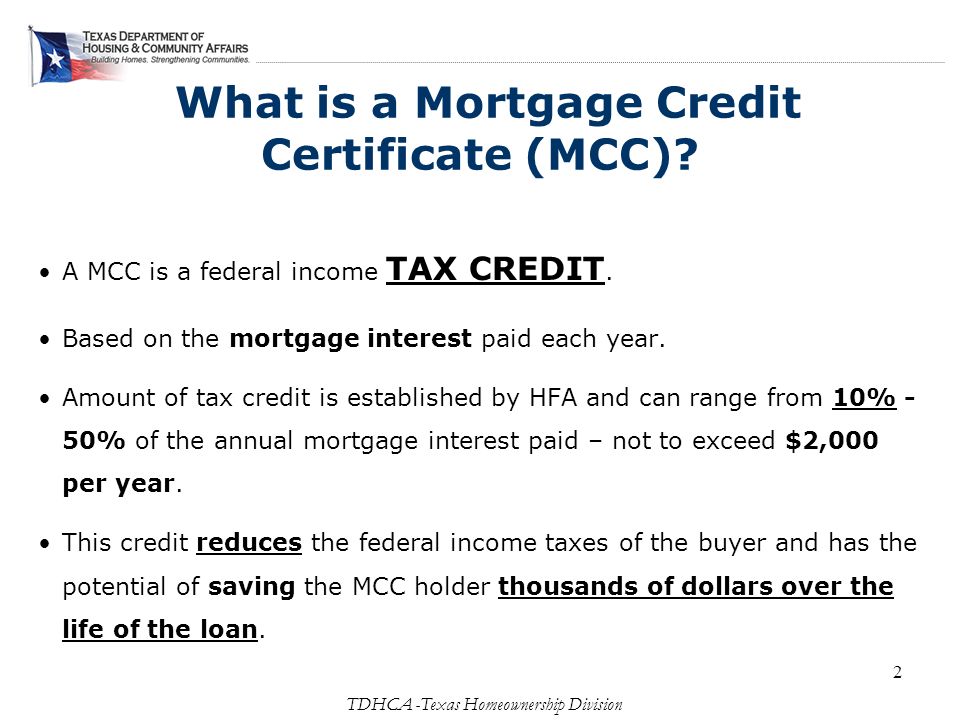

>The Kentucky MCC Program

The MCC (Mortgage Credit Certificate) program is a state tax credit program currently available to qualified buyers. It allows a tax credit of up to 25% of the mortgage interest paid each year, not to exceed $2000, for qualified buyers, for each year of ownership during the term of the mortgage. The MCC is available to qualified first-time home buyers in all Kentucky counties and to all qualified homebuyers in certain areas, including Jefferson, Oldham, Bullitt, Nelson, Meade, Hardin and Spencer County

Louisville Kentucky Mortgage Loans

The Kentucky MCC Program!!

The MCC (Mortgage Credit Certificate) program is a state tax credit program currently available to qualified buyers. It allows a tax credit of up to 25% of the mortgage interest paid each year, not to exceed $2000, for qualified buyers, for each year of ownership during the term of the mortgage. The MCC is available to qualified first-time home buyers in all Kentucky counties and to all qualified homebuyers in certain areas, including Jefferson, Oldham, Bullitt, Nelson, Meade, Hardin and Spencer County

2019 Kentucky FHA Mortgage Loan Limits

2019 Kentucky FHA Mortgage Loan Limits