Blogger

Oct 2to me

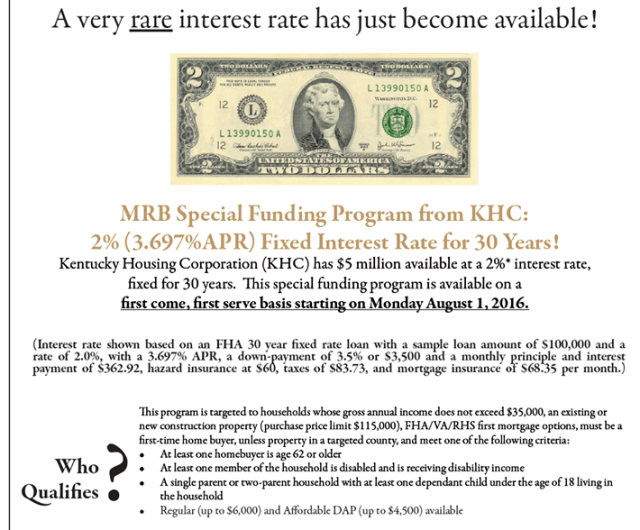

KHC has $5 million available at a 2 percent interest rate, fixed for 30 years. This special funding program is available on a first-come, first-served basis starting Monday, August 1, 2016, with NEW reservations.

The program is targeted to:

Households whose gross annual income does not exceed $35,000.

An existing or new construction property (purchase price limit $115,000).

640 minimum credit score.

FHA, VA or RHS first mortgage options.

Households who meet one of the following criteria:

At least one of the home buyers is age 62 or older.

At least one member of the household is disabled and is receiving disability income.

A single- or two-parent household with at least one dependent child under the age of 18 living in the household.

Borrowers with properties located in Non-targeted counties must be a first time homebuyer — no ownership interest in the last 3 years.

Borrowers with properties located in Targeted counties can be a repeat home buyer.Loan Type

Rate without Down Payment Assistance

Rate with Down Payment Assistance

FHA, VA & RHS

2.00%

2.00%RHS Streamlined-Assist Refinance Program

3.50%.

RHS USDA Recent News

Good news! Kentucky Mortgage holders of USDA Mortgage loans can get new drastically lower fees starts with commitments starting tomorrow October 1. If you have an USDA eligible Loan up to $417,000 with no money down in most Kentucky Counties.If you have questions about qualifying as first time home buyer in Kentucky, please call, text, email or fill out free prequalification below for your next mortgage loan pre-approval.

Joel Lobb

Senior Loan Officer

(NMLS#57916)Text or call phone: (502) 905-3708

email me at kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the views of my employer. Not all products or services mentioned on this site may fit all people

Louisville Kentucky Mortgage Loans

The Greater Louisville Association of Realtors® (GLAR) reported year-to-date (YTD) sales up 6.6% compared the same time last year. Sales in September 2016 were up 7.7%, vs September 2015, with 1,60…

Source: Tight Inventory Translates to Quick Home Sales

The Greater Louisville Association of Realtors® (GLAR) reported year-to-date (YTD) sales up 6.6% compared the same time last year. Sales in September 2016 were up 7.7%, vs September 2015, with 1,600 homes and condos sold. The median price was up 4.8% YTD and the average was 3.0% higher YTD.

In Jefferson County, the average price in September 2016 was $205,975 and the median was $167,000. For all MLS areas, the inventory of available properties was 22.5% lower than at the same time last year. In Jefferson County the inventory of homes and condos for sale was 23.7% lower than September 2015.

View original post 343 more words

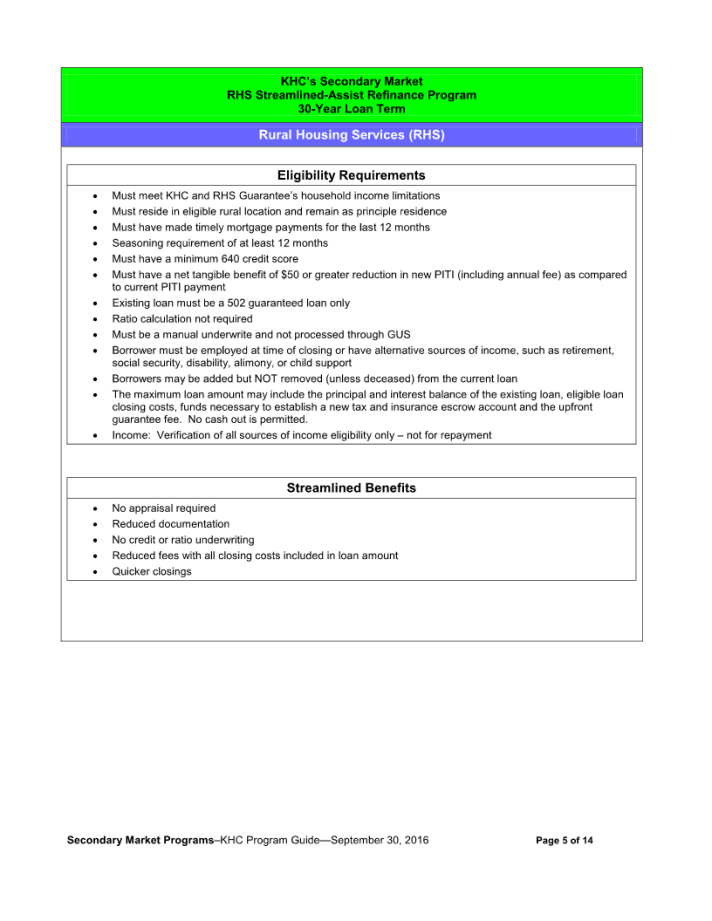

Can you refinance a Rural Housing Loan? The short answer is yes. See below for qualifying criteria

Can you refinance a Rural Housing Loan? The short answer is yes. See below for qualifying criteria