Originally Posted On: https://thelindleyteam.com/how-to-ditch-fha-mortgage-insurance-premiums/ When you get a mortgage, you’re signing a million sheets of paper and agreeing to pay a lot…

Source: How to Ditch FHA Mortgage Insurance Premiums

When you get a mortgage, you’re signing a million sheets of paper and agreeing to pay a lot of things that you may not understand at the time. Closing costs, down payments, inspections, real estate agent fees, home insurance, escrow, and so on and so forth. One of the numbers that may have gotten rolled into that list is mortgage insurance premiums.

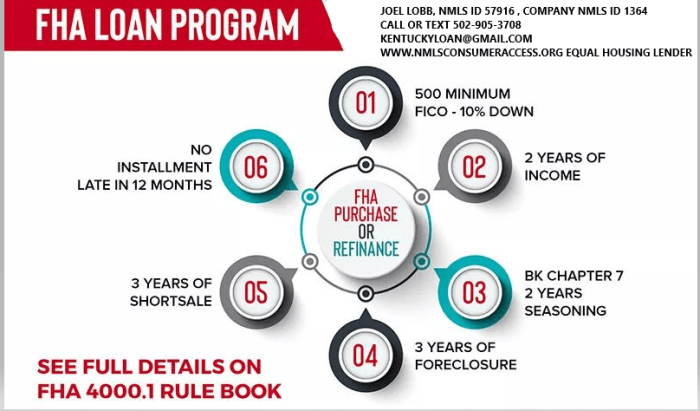

If you got an FHA loan, you’re almost certainly paying FHA mortgage insurance premiums. Read on to learn more about what these are, how much you might be paying each month, and how you can get out from under them.

What Are FHA Mortgage Insurance Premiums?

Before the Federal Housing Administration was founded, in order to qualify to buy a house, mortgage applicants had to have excellent credit and a large down payment. This made it harder for people to buy homes, so the FHA was established to make this process easier for first-time homebuyers. The FHA does not actually give loans they just insure them.

Mortgage insurance is a policy that protects your lender in case you default on your loan. It allows lenders to make higher-risk loans without worrying about losing money. You pay the premiums for that insurance policy as a part of your agreement with the loan.

Mortgage Insurance Rates

If your loan was $625,000 or less and you got a thirty-year fixed-rate mortgage and you paid less than 5 percent on a down payment, you’ll have an annual mortgage insurance premium of 0.85 percent of your loan. If you put down more than 5 but less than 10 percent, you’ll pay 0.8 percent for the life of the loan. If you put down more than 10 percent, you’ll pay 0.8 percent for the first eleven years of the loan

For loans less than $625,000 with a fifteen-year fixed-rate note where you paid less than 10 percent down, you’ll pay 0.7 percent of your loan amount every year for the life of the loan. If you paid more than 10 percent, you’ll pay 0.45 percent every year for the first eleven years.

If you have a mortgage greater than $625,000 with a thirty-year fixed-rate loan and you paid less than 10 percent down, you’ll pay 1 percent of your mortgage every year for the life of the loan. If you paid more than 10 percent down, you’ll pay a slightly higher 1.05 percent, but only for the first eleven years.

And finally, if your loan is greater than $625,000, you have a 15-year fixed-rate mortgage, and you paid less than ten percent down, you’ll pay 0.95 percent of your loan every year for the life of the loan. If you paid more than 10 percent but less than 22 percent, you’ll pay 0.7 percent for the first eleven years of the loan. And if you paid more than 22 percent, you’ll pay 0.45 percent every year for the first eleven years.

How to Get Out of Mortgage Insurance

The good news is that you aren’t stuck forever. Once you get about 20 percent equity in your house, either through improvements or paying down the loan, you can refinance your mortgage. With that 20 percent, you should be able to get a mortgage that doesn’t require FHA protection.

Even if you don’t yet have 20 percent equity in the house, you may be able to refinance into a lower mortgage insurance premium bracket. If you can get 10 percent to put down on your new mortgage, for instance, you may be able to drop to a lower monthly percentage that you’re paying.

Reappraise

Depending on where you live and what work you’ve done on the house, you may be able to get 20 percent equity without having to pay all that money in. If property values in your area are on the rise, your home may be worth more now than when you bought it. The same goes for home improvements, and that total may leave you with more than 20 percent equity in your home so you can refinance out of your mortgage insurance.

A great way to determine if this is the case for you is to have your home appraised again. A home appraisal will cost somewhere between $300 and $400. If you’re paying $520 a month for mortgage insurance premiums (1 percent on a $625,000 loan), this will pay for itself immediately.

How to Refinance

Once you get 20 percent equity in your house, no matter how you do it, you can refinance into a new mortgage. Start by shopping around and applying for a new mortgage with three or four lenders. This will give you an idea of what sort of interest rates you’re looking at and what your new monthly payment should be.

Once you find a lender you like, lock in your interest rate and start on the process of getting the loan closed. You’ll need a fair amount of paperwork for both the application and closing processes. Your last several pay stubs, tax returns, credit reports, and statements of your assets and outstanding debts are a good place to start.