Income limits apply, and the property must be in an eligible rural area.

The good news? USDA loans are currently open — no shutdown.

Getting pre-approved is free and there’s no obligation.

If you want to see if you qualify, let’s get started.

Buying your first home in Kentucky in 2026? You’re entering a market with more options than ever before. Updated loan limits, competitive interest rates, and powerful down payment assistance programs are making homeownership more accessible for Kentucky families across all 120 counties.

The main options for Kentucky homebuyers in 2026 include Conventional Loans, FHA Loans, VA Loans, USDA Loans, and Kentucky Housing Corporation (KHC) Down Payment Assistance programs. Each offers distinct advantages depending on your credit score, down payment savings, income level, and location.

This comprehensive guide breaks down every program, updated with 2026 loan limits, credit requirements, and qualification guidelines to help you make informed decisions about your home purchase.

Conventional loans remain the most popular choice for Kentucky homebuyers with good credit and stable income. These loans are not government-backed, which means they follow stricter underwriting standards but offer significant benefits for qualified borrowers.

Why Choose Conventional? Borrowers with credit scores of 740+ and 20% down payments often prefer conventional loans because they can avoid mortgage insurance entirely and typically secure the lowest interest rates available.

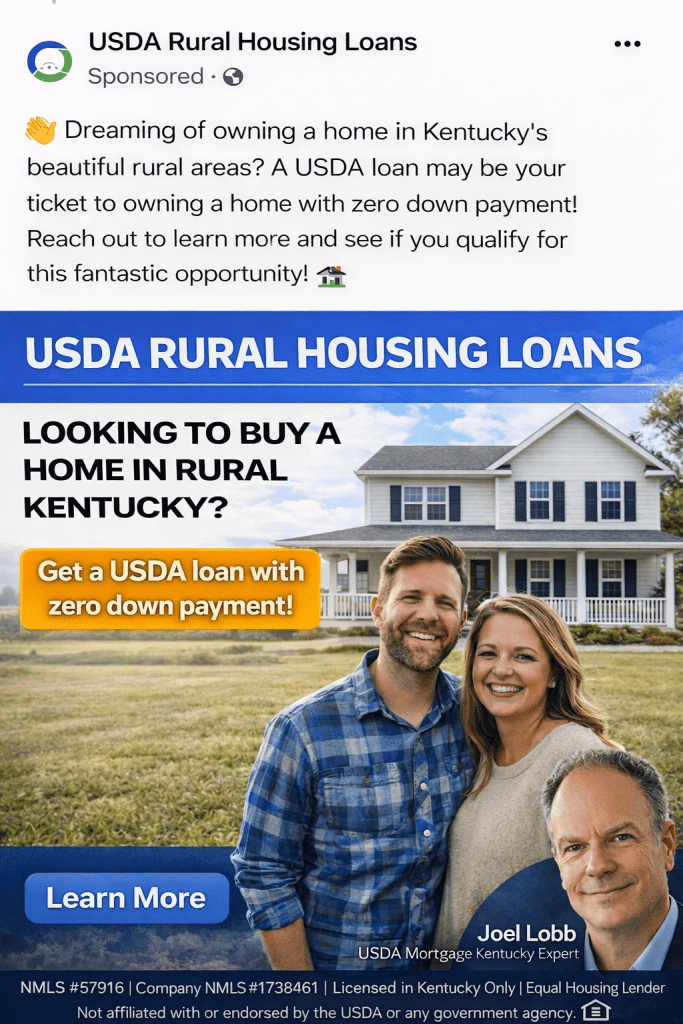

FHA loans are designed specifically for first-time homebuyers and those with lower credit scores or limited savings. Backed by the Federal Housing Administration, these loans offer the most flexible qualification guidelines of any mortgage program.

Same as conventional loans, plus:

Why Choose FHA? Perfect for first-time buyers rebuilding credit, those with limited savings, or anyone who has experienced past financial challenges. FHA loans are more forgiving and accessible than conventional financing.

VA loans provide unmatched benefits for eligible veterans, active-duty service members, National Guard members, Reservists, and qualifying surviving spouses. These loans eliminate major barriers to homeownership.

Why Choose VA? The combination of no down payment, no monthly mortgage insurance, and competitive interest rates makes VA loans the most powerful financing option available for eligible borrowers.

USDA loans offer 100% financing for eligible rural and suburban properties throughout Kentucky. Despite the “rural” designation, many suburban areas qualify, including parts of major metro areas.

Why Choose USDA? Perfect for buyers purchasing in eligible rural or suburban areas who want 100% financing. Many Kentucky locations qualify, including areas near Louisville, Lexington, and other cities.

The Kentucky Housing Corporation offers the most comprehensive suite of programs for first-time homebuyers in the state, combining competitive interest rates with substantial down payment assistance.

1. Conventional Preferred Program

2. Conventional Preferred Plus 80 Program

3. Mortgage Revenue Bond (MRB) Program

Income limits vary by county and household size. Here are representative examples:

Why Choose KHC? The combination of below-market interest rates and up to $12,500 in down payment assistance can save Kentucky homebuyers thousands of dollars over the life of their loan.

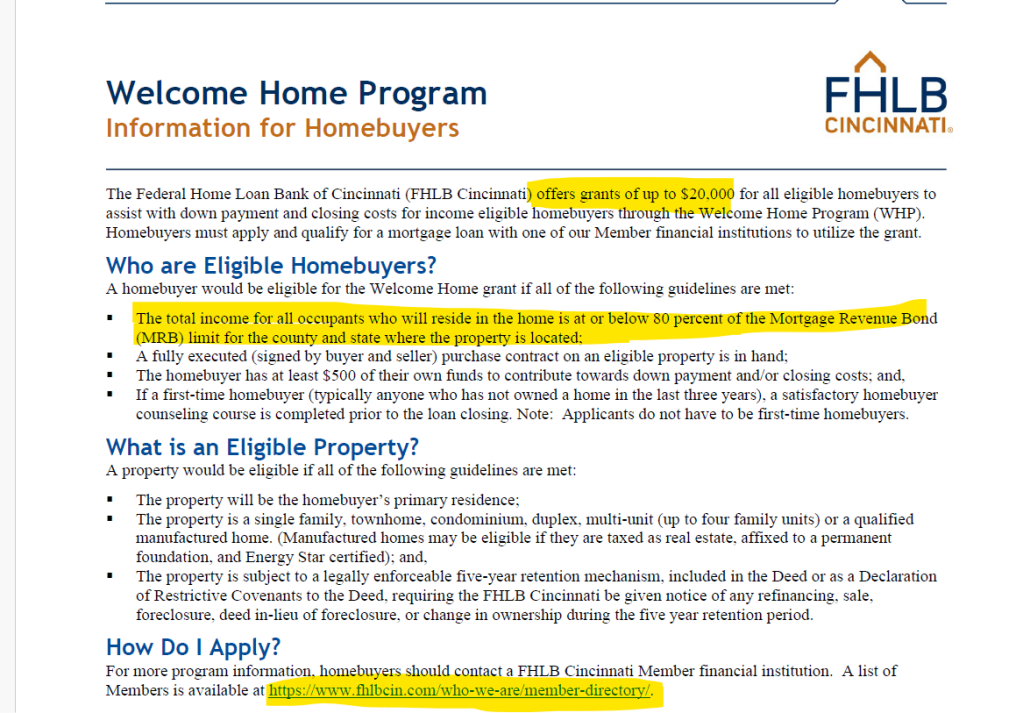

The Kentucky Welcome Home Grant is expected to return in March 2026, offering additional down payment assistance to eligible Kentucky homebuyers.

Important: The Welcome Home Grant consistently sells out within days of opening. Get pre-approved now and be ready to act immediately when the program launches.

| Program | Min. Credit Score | Down Payment | Max DTI | 2026 Loan Limit (1-Unit) |

|---|---|---|---|---|

| Conventional | 620 | 3-5% | 43-50% | $832,750 |

| FHA | 580 | 3.5% | 31/43-57% | $541,287 |

| VA | 580-620 | 0% | No max* | $832,750 (or unlimited) |

| USDA | 620 | 0% | 29/41-45% | Based on income limits |

| KHC Programs | Varies | 3-3.5% | Varies by loan type | $544,232 |

*VA loans evaluate residual income rather than strict DTI limits

Q: Can I combine KHC down payment assistance with FHA or VA loans?

A: Yes! KHC assistance can be layered with FHA, VA, USDA, or Conventional loans, making it possible to buy with minimal out-of-pocket costs.

Q: What’s the difference between the Welcome Home Grant and KHC down payment assistance?

A: The Welcome Home Grant is a forgivable grant (not repaid), while KHC down payment assistance is a second mortgage with monthly payments at 3.75% interest.

Q: Do all Kentucky counties have the same FHA loan limits?

A: Yes. For 2026, all 120 Kentucky counties use the same FHA floor limit of $541,287 for single-family homes.

Q: Can I buy a multi-unit property with these programs?

A: Yes! FHA, VA, and Conventional loans all allow 2-4 unit purchases, with the requirement that you occupy one unit as your primary residence.

Q: How long does the mortgage approval process take?

A: Pre-approval typically happens within 24 hours. Full approval to closing typically takes 30-45 days depending on the loan type and your responsiveness.

Q: What if I have student loan debt?

A: All programs allow student loan debt. Lenders will calculate either 0.5-1% of the balance or use your actual payment amount in DTI calculations.

Navigating multiple loan programs, down payment assistance options, and changing requirements requires expertise and local knowledge. Working with a Kentucky-licensed mortgage professional who specializes in first-time homebuyer programs ensures:

Ready to explore your Kentucky home buying options? The 2026 loan limits and programs provide more opportunities than ever for Kentucky families to achieve homeownership.

📧 Email: kentuckyloan@gmail.com

📞 Call/Text: 502-905-3708

🌐 Website: www.mylouisvillekentuckymortgage.com

Joel Lobb

Mortgage Loan Officer – Kentucky Mortgage Loan Specialist

20+ Years Experience | 1,300+ Families Helped

NMLS Personal ID: 57916

Company NMLS ID: 1738461

Equal Housing Lender | Licensed for Kentucky Mortgage Loans Only

Disclaimer: This website is not endorsed by or affiliated with the FHA, VA, USDA, or any government agency. Information provided is for educational purposes. Loan programs, rates, and requirements subject to change. All borrowers must meet program eligibility requirements.

Kentucky’s housing market continues to show strength in 2026, with steady home price appreciation and competitive interest rates creating favorable conditions for buyers. The increased loan limits provide greater purchasing power, while expanded down payment assistance programs make homeownership more accessible.

Whether you’re a first-time buyer, a veteran, or someone looking to purchase in a rural area, Kentucky’s diverse loan programs offer a pathway to homeownership that fits your unique financial situation.

Start your journey today by

FHA loans are a popular choice for many first-time homebuyers in Kentucky. This is due to their flexible qualifying criteria. If you’re considering an FHA loan in the Bluegrass State, understanding the key qualifying factors is crucial. Here’s a comprehensive guide to the criteria you need to know:

| Requirement | Details |

|---|---|

| Credit Score | – 580+: Eligible for a 3.5% down payment. – 500-579: Requires a 10% down payment. |

| Down Payment | Minimum of 3.5% for qualified buyers; 10% for lower credit scores below 580 to 500 score range |

| Debt-to-Income Ratio (DTI) | – Ideal: 45% or lower on front end ratio or housing ratio. – Acceptable: Up to 57% with compensating factors. There are two ratios. Front end and back end with front end being maxed at 45% and the backed end ratio being 56.99% with an AUS approval. If manually underwritten, see guidelines here |

| Employment History | Must provide at least **2 years of consistent employment—College transcripts can supplement with a less than 2 year work history |

Understanding these qualifying criteria can help you navigate the FHA loan application process in Kentucky more effectively. Working with an experienced mortgage professional can provide valuable guidance. They offer assistance tailored to your specific financial situation and homeownership goals.

Email – kentuckyloan@gmail.com

Email – kentuckyloan@gmail.com  Call/Text – 502-905-3708

Call/Text – 502-905-3708Joel Lobb

Mortgage Loan Officer – Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

First-Time Home Buyers Welcome

First-Time Home Buyers Welcome FHA, Rural Housing (USDA), VA, and Kentucky Housing Corporation (KHC) Loans

FHA, Rural Housing (USDA), VA, and Kentucky Housing Corporation (KHC) Loans Conventional Loan Options Available

Conventional Loan Options Available Fast Local Decision-Making

Fast Local Decision-Making Experienced Guidance Through the Home Buying Process

Experienced Guidance Through the Home Buying Process

1 – Email – kentuckyloan@gmail.com 2. Call/Text – 502-905-3708

Joel Lobb

Mortgage Loan Officer – Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.