Advantages of Kentucky FHA Mortgage Loans

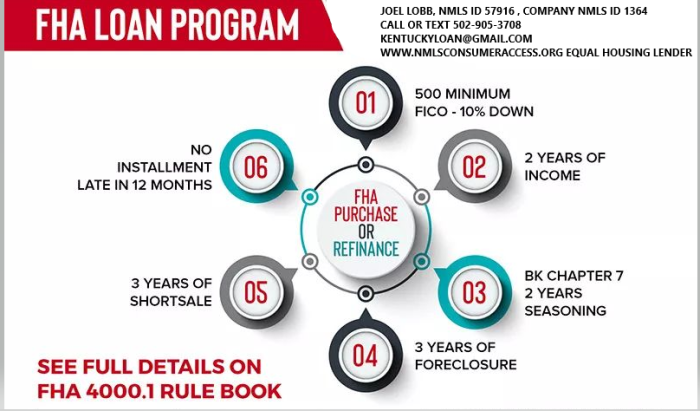

- You can often make a down payment as low as 3.5 percent down to a 580 credit score

- You can finance a home with a 500 credit score with 10% down payment.

- Kentucky FHA loans are assumable meaning that if you have a good rate on your current mortgage and the potential buyer of your home meets FHA guidelines, then he can assume your low rate mortgage

- Kentucky FHA loans offer streamline refinancing without credit score minimums, verification of income, and no appraisals to refinance to a lower rate making it easier to qualify.

- Kentucky FHA loans offer flexible terms when it comes to previous bankruptcy or foreclosures. 2 years removed from Chapter 7 with reestablished

- credit, or if a Chapter 13, one year in the payment plan is eligible for FHA financing.

- Foreclosures on a past home. FHA will finance a home 3 years removed from the sale date of your foreclosure property

- 30 year fixed rate mortgage with usually the best going rates on government insured loans like FHA, VA, USDA etc.

- No prepayment penalty on Kentucky FHA loans.

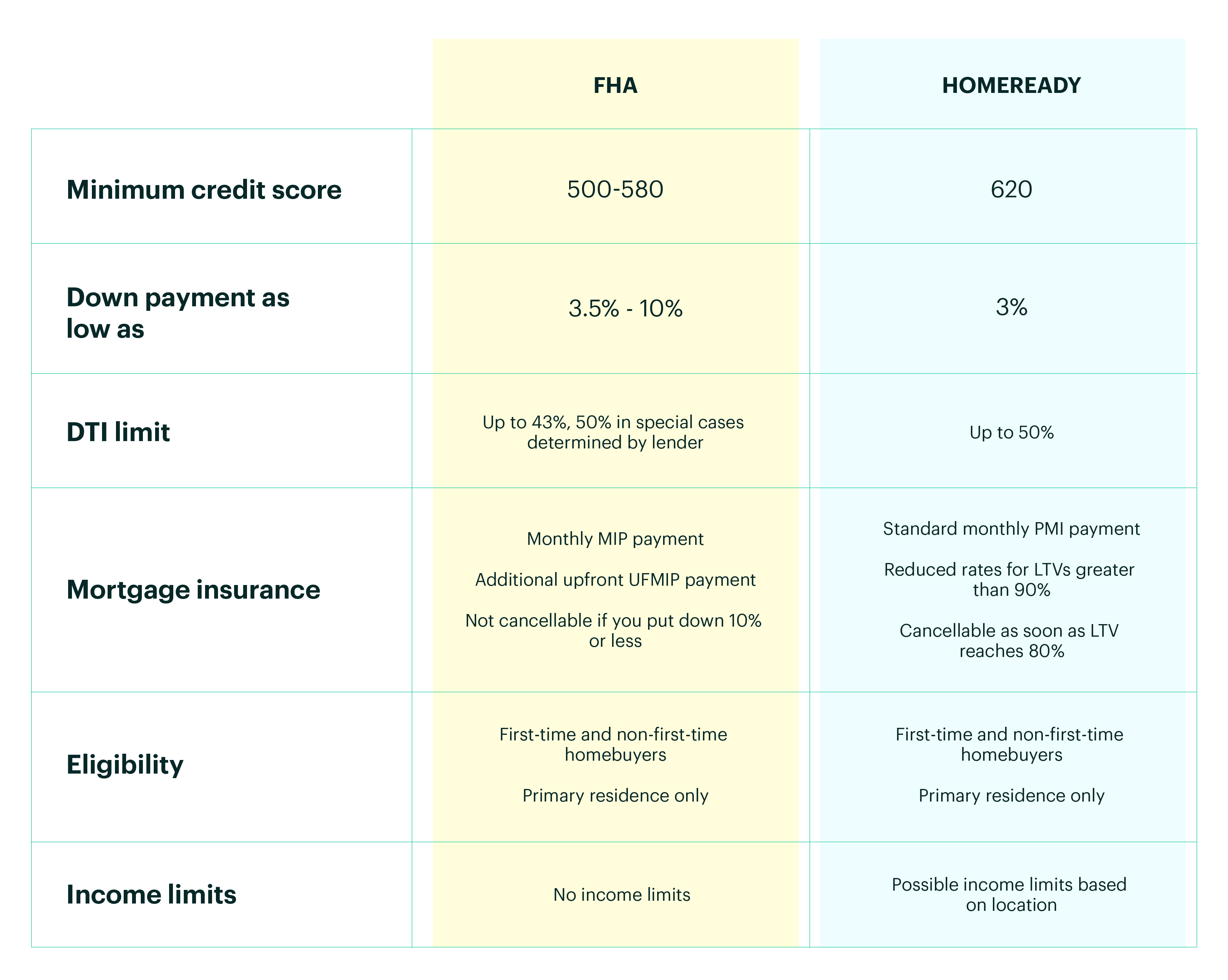

- Higher debt to income ratio requirements when compared to Conventional loans because most Fannie Mae Conventional loans cannot have a higher debt to income ratio than 45% on the back-end

- You can make an FHA loan anywhere in the state of Kentucky with no geographical restrictions.

- Will allow for down payment assistance and grants for borrowers minimum down payments in the State of Kentucky through the likes of KHC, Welcome Home Grant, and Kentucky Housing Down Payment Second Mortgage loans.

- Kentucky FHA loans allow for unoccupied cosigner. For example, lets say you have a daughter that is getting ready to graduate college and does not have the income or credit history established yet to buy a home. FHA allows a family-member to co-sign for them to buy a home and you don’t have to occupy as primary residence. Note, FHA co-singers are not allowed to makeup for some that has bad credit, because they will take the lowest credit scores of both applicants. FHA usually allows for co-singers lack of income purposes only.

- Can usually close within 30 days just like a regular conventional mortgage. No extra time to close an FHA loan in Kentucky versus other secondary market loans like VA, USDA, Fannie Mae.

- You can use the FHA loan over and over. You can actually have two FHA loans open at the same time, but it gets tricky on this. Call or text me with more info if you have an FHA loan currently and would like to use FHA Financing again.

- FHA loans aren’t just for first time home buyers in Kentucky.

Disadvantages of Kentucky FHA Mortgage Loans

- There are loan limits in the State of Kentucky on FHA Mortgage loans. The maximum FHA loan in the state of Kentucky is $$420,680 for 2022. So if you were needing to finance a loan over this amount, you would need to look at doing a Conventional loan with the updated 2021 Kentucky State Loan Limits for a Fannie Mae loan being $647,250

- If buying a condo in Kentucky, FHA requires the condo development be FHA approved. There is a >>>list here of Kentucky FHA approved condos here.

- Seller must have own the home for 90 days before you can make an offer on the home. This comes into play where the seller bought the home as an investor and rehabbed the property and wants to sell for a quick profit. FHA mandates seller must maintain for 90 days before you can write up an offer on it. Also called FHA Flipping Policy. Read more here

- There is mortgage insurance. This is one of the biggest disadvantages for FHA loans. But as I tell most people, nobody rarely has a loan for 30 years, so if it meets your payment and your cash to close requirement, I tell people to go with it because it can be refinanced down the road and you are getting one of the lowers 30 year fixed rates out there. Both upfront and monthly mortgage insurance premiums you have to pay HUD/FHA. These premiums change whenever FHA/HUD replenish their insurance pool to pay claims from defaults, but currently the FHA upfront mortgage insurance premium is 1.75% and monthly is .85% and .80% of the loan amount. If you happen do a 15 year term or shorter, the mortgage insurance is cheaper monthly with .45 and .70 respectively each month. The upfront mortgage insurance is the same for a 30 year and 15 year at 1.75%

- FHA Mortgage insurance can be on the loan for life of loan. This is a recent change made in 2016 when FHA lowered there premiums for upfront and monthly mi premiums, but made the mortgage insurance for life of loan for some FHA loans.

- If you put down more than 10% on the loan, or have at least 10% equity in the home for a refinance, you only have to pay mortgage insurance for 11 years before it automatically falls off.

- Obviously you can refinance out of an FHA loan at anytime, since it does not a prepayment penalty, and you can potentially get a refund of your upfront mortgage insurance if paid off within 3 years on sliding scale.

-

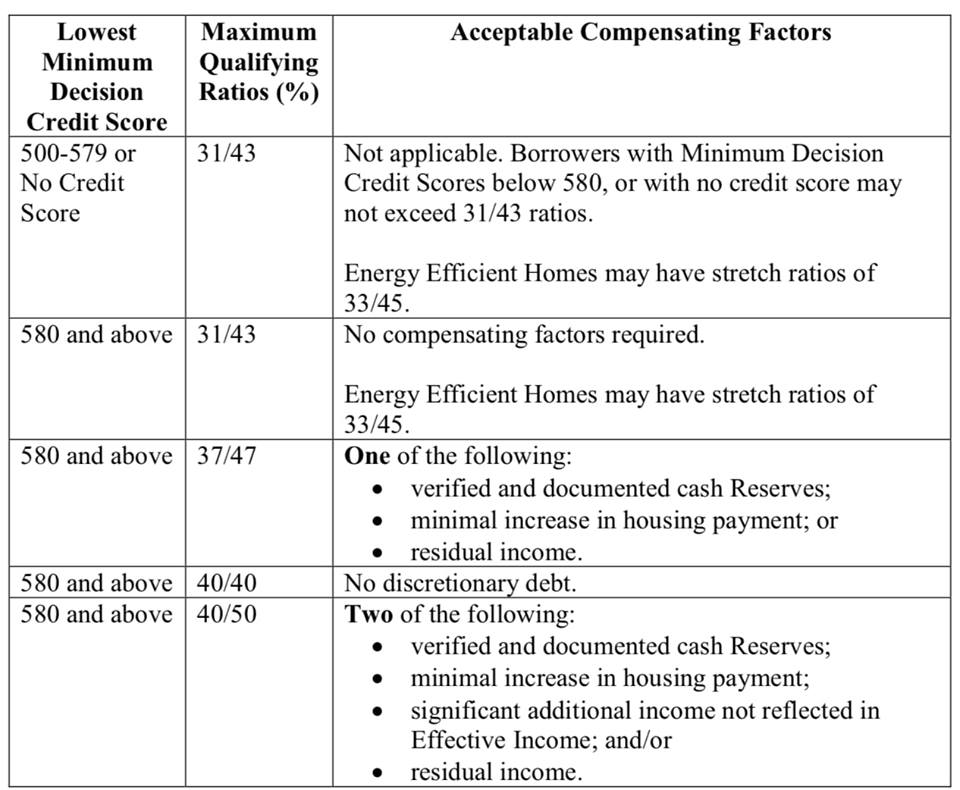

I have incorporated some charts below to illustrate the different Kentucky FHA Mortgage Insurance premiums to explain it better.

-

The upfront mortgage insurance is usually financed into the loan, so it will look like you are borrowing more than the standard 3.5% down payment because this is financed into the loan. Some borrowers elect to pay it out of pocket upfront, but I have never seen this done in my 20 years of doing FHA loans in the State of Kentucky

- Kentucky FHA Loans Greater Than 15 Years MIP Chart

- 👇

Base Loan Amt. LTV Annual MIP ≤$625,500 ≤95.00% 80 bps (0.80%) ≤$625,500 >95.00% 85 bps (0.85%) >$625,500 ≤95.00% 100 bps (1.00%) >$625,500 >95.00% 105 bps (1.05%)

Kentucky FHA Loans Less Than or Equal to 15 Years MIP Chart👇

Base Loan Amt. LTV Annual MIP ≤$625,500 ≤90.00% 45 bps (0.45%) ≤$625,500 >90.00% 70 bps (0.70%) >$625,500 ≤78.00% 45 bps (0.45%) >$625,500 78.01% – 90.00% 70 bps (0.70%) >$625,500 >90.00% 95 bps (0.95%) When can I get the FHA mortgage insurance off my Mortgage Loan? See chart below 👇👇

- Appraisals. On an FHA appraisal, the FHA appraiser has to turn on the utilities to make sure they are in worked order when he gets there. This is different that Conventional loan appraisals. A lot of realtors or buyers think that FHA loans are harder due to appraisals, but honestly, they’re really not. FHA puts these minimum HUD standards in place to make sure the home is in good working order and SAFE to live in. I.e.is there any lead based paint or chipping paint that could lead to poisoning It is all about Safety with FHA and HUD on these appraisals. The value is determined just like a regular Conventional, USDA, VA appraisals whereas they compare the house to 3 recent homes sold in the area to get a value.

- Some lenders don’t offer FHA loans due to their complexity and sale on the secondary market, so if you call a local lender in Kentucky and they don’t offer FHA loans, the reason is usually they don’t have the team in place to do them or don’t want to do them due to lack of experience on the secondary government market.

- Government Liens. FHA will not be an option for you usually if you have unpaid federal tax liens, delinquency on federal backed-government loans, or a claim with social security etc. FHA loans are ran through aCAVIRS alert system to check to see if you are delinquent on any federal oblation. If so, this swill stop you until you can clear the CAVIRS alert system. For example, I did a loan for a buyer that had a delinquent federal debt with his student loan that happened over 14 years old. It was off the credit report and title search, so I had to switch to a conventional loan to make the home loan work.

- FHA loans are not good for second homes or investment properties. FHA loans are mainly for single family residence 1-4 unit, that are going to occupied primarily as main home.

In summary, FHA loans have few drawbacks other than the mortgage insurance in my opinion. It is a great first time home buyer program or borrowers with past credit problems to get into a house of their own with very little out of pocket, at a low 30 year fixed rate, and no prepayment penalty

Questions about qualifying for a FHA loan in Kentucky . Give me text, call or email below. Love to help you out on your next home or refinance in Kentucky

Senior Loan Officer

If you are an individual with disabilities who needs accommodation, or you are having difficulty using our website to apply for a loan, please contact us at 502-905-3708.

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant’s eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916http://www.nmlsconsumeraccess.org/

— Some products and services may not be available in all states. Credit and collateral are subject to approval. Terms and conditions apply. This is not a commitment to lend. Programs, rates, terms and conditions are subject to change without notice. The content in this marketing advertisement has not been approved, reviewed, sponsored or endorsed by any department or government agency. Rates are subject to change and are subject to borrower(s) qualification.

Louisville Kentucky Mortgage Broker Offering FHA, VA, USDA, Conventional, and KHC Zero Down Payment Home Loans | October 17, 2018 at 3:54 pm | Tags: fha gift funds, fha loan kentucky, FHA Loans Kentucky Housing First time home buyer, fha mortgage, fha mortgage loan, gift funds for fha mortgage, kentucky fha loans |