- fha (27)

- fha credit scores (17)

- FHA Good Neighbor Next Door (2)

- fha income requirements (3)

- FHA Mortgage Insurance 2017 Kentucky FHA Changes Mortgage (1)

- FICO (7)

- fico scores first time home buyer (13)

- first time buyer (3)

- First Time Home Buyers (8)

- foreclosure (5)

- Gaps in Employment (2)

- gift funds (3)

- grants first time home buyer kentucky (2)

- home inspections (1)

- home insurance (1)

- homeready (1)

- income (6)

- inspections for home (1)

- job change (3)

- Job Changes (2)

- job gaps (4)

- job time (4)

- kentucky fha appraisal (3)

- kentucky fha loans (16)

- Kentucky First Time Home buyer zero down payment (21)

- Kentucky first Time Home Buyers (14)

- kentucky housing (1)

- Kentucky USDA Streamline Refinance Pilot (3)

- kentucky va loans (17)

- khc (4)

- khc credit scores (9)

Buying a Kentucky Home with a FHA Mortgage

Is an Kentucky FHA loan right for you?

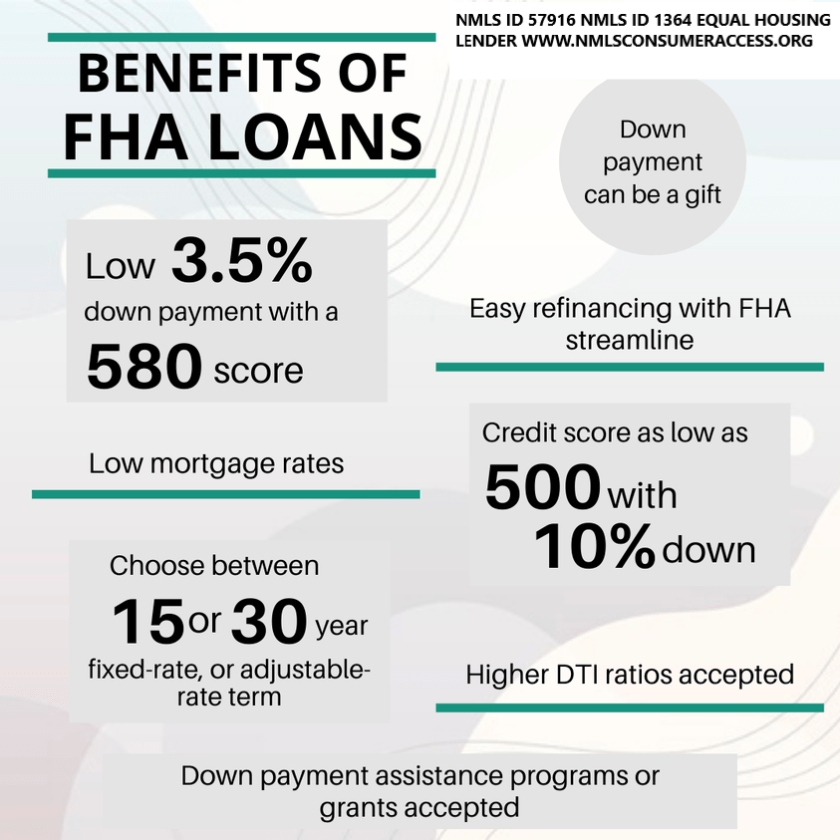

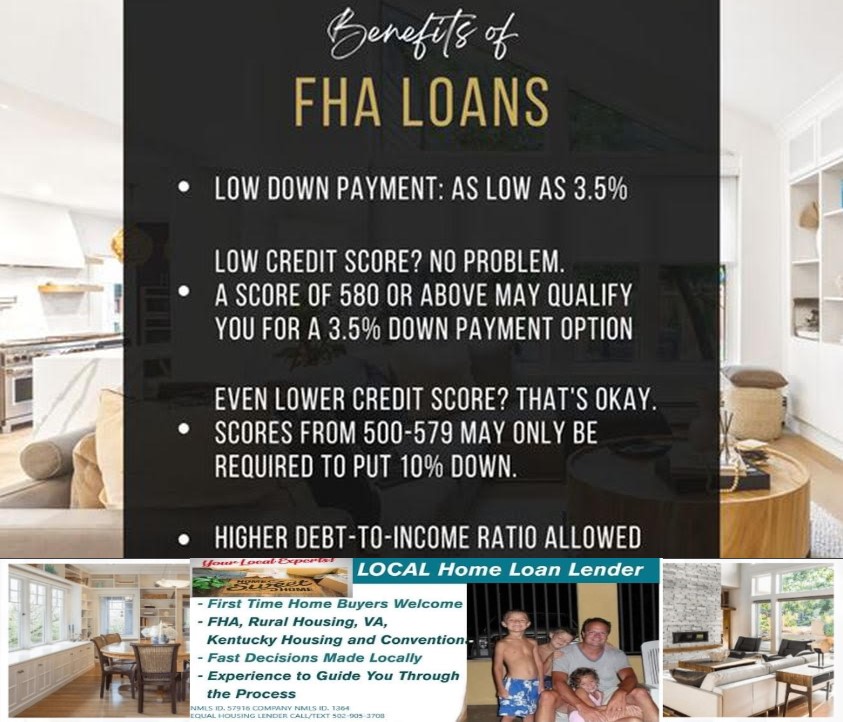

Here are some benefits of Kentucky FHA loans 🤩

✅ Low down payment options

✅ Down payment assistance programs available

✅ Higher DTI ratios acceptedFHA requires you to establish that the income is in fact stable. I am covering Time on Job, Part Time Income, Seasonal Income and Job Gaps below.Time on JobThere is not a minimum length of time a borrower must have held a position for the income to be eligible. However, the application must identify the most recent 2 years of employment.If the borrower’s employment history indicates that they were in school or in the military, then the borrower must provide evidence supporting this such as college transcripts or discharge papers.The current type of employment has to be supported by the college transcripts or discharge papers showing that he borrower’s training enabled them to gain employment in their field of training.Part Time Income

Part-time and second job income can be used to qualify if documentation is obtained to prove that the borrower has worked the part-time job uninterrupted for the past two years, and plans to continue.For Qualifying purposed, “part-time” income refers to jobs taken to supplement the borrower’s main income from regular employment, such as a second job that is less than 40 hours per week.Income: Is averaged over the previous 2 years. If there was a pay rate increase and we can document the increase in pay, you can average the new pay rate over 12 months.Seasonal IncomeSeasonal income may be acceptable for qualifying. It is not unusual to have out-of-season income from unemployment income. If the borrower has a 2 year history and continuance is probable, this type of income may be allowed to qualify the borrower.The key here is history and continuance.Job GapsThe borrower must provide a signed explanation for gaps in employment as follows:Income can be considered effective if the following can be verified:1. Borrower has been employed in the current job for at least six months at the time of the case number assignment AND2. A two year work history prior to the absence from employment.What does FHA stand for?

FHA stands for Federal Housing Administration, and the FHA is a government agency that insures mortgages. It was created just after the Great Depression, at a time when homeownership was prohibitively expensive and difficult to achieve because so many Americans lacked the savings and credit history to qualify for a loan. The government stepped in and began backing mortgages with more accessible terms. Approved lenders began funding FHA loans, which offered more reasonable down payment and credit score standards.

Today, government-backed mortgages still offer a safety net to lenders—because a federal entity (in this case, the FHA) is guaranteeing the loans, there’s less financial risk if a borrower defaults on their payments. Lenders are then able to loosen their qualifying guidelines, making mortgages available to middle and low income borrowers who might not otherwise be approved under conventional standards.

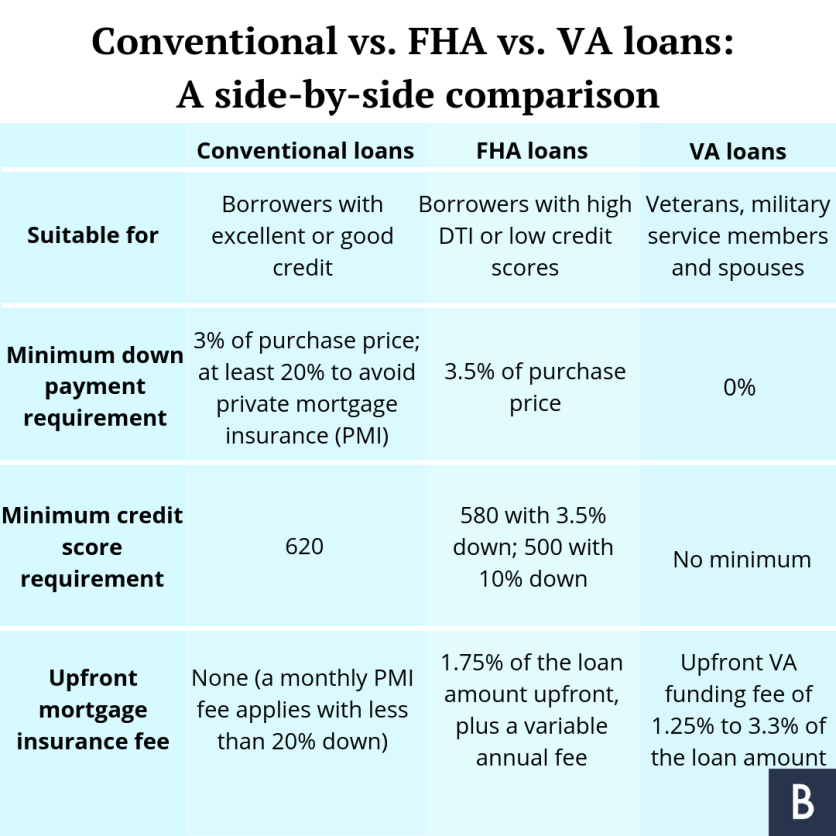

What’s the difference between FHA and conventional loans?

Home loans fall into two broad categories: government and conventional. A conventional loan is any mortgage that is not insured by a federal entity. Because private lenders assume all the risk in funding conventional loans, the requirements to qualify for these loans are more strict. Generally speaking, FHA loans might be a good fit if you have less money set aside to fund your down payment and/or you have a below-average credit score. While low down payment minimums and competitive interest rates are still possible with a conventional loan, you’ll need to show a strong credit score to qualify for those advantages.

Each loan type has advantages and disadvantages—including different mortgage insurance requirements, loan limits, and property appraisal guidelines—so choosing the one that works best for you really depends on your financial profile and your homebuying priorities.

FHA loans pros and cons

FHA loans are meant to make homeownership more accessible to people with fewer savings set aside and lower credit scores. They can be a great fit for some borrowers, particularly first time homebuyers who often need lower down payment options, but you should weigh the costs and benefits of any mortgage before committing. Here’s a breakdown of the key pros and cons when it comes to FHA loans:

Pros Cons Low down payment. Down payments make up the majority of cash to close in any purchase loan, and saving up for one can be a significant barrier for some borrowers. FHA loans make it possible to put down as little as 3.5% upfront and still get competitive rates. Mandatory MIP payments. FHA loans are more lenient, but they also come with insurance costs to mitigate risk to the lender. You’ll have to pay Mortgage Insurance Premiums (MIP) no matter what—either for 11 years or for the life of your loan, depending on your down payment. Lower credit score. Credit scores can be a major hurdle when it comes to conventional loans, but borrowers with credit scores starting at 500 can qualify for FHA loans. Less competitive. Sometimes sellers can be more hesitant to accept FHA loans. In a competitive market, you might not win out against conventional loan bids. Higher DTI accepted. Your debt-to-income (DTI) ratio gives lenders an understanding of other major financial obligations in your life. This ratio is a key factor in any loan application because it indicates your ability to afford a mortgage based on current household income and existing debt. Again, FHA loans offer more leniency here and borrowers at or below 43% DTI can qualify. Stricter property standards. To offset risk and further protect lenders, FHA loans have strict criteria when it comes to assessing the condition of any property being purchased with an FHA loan. The downside? The house you want to buy might not qualify for an FHA loan. The upside? You’re less likely to be financially burdened by a home that requires expensive repairs or updates. No income limitations. It’s a common misconception that FHA loans are only available to first-time homebuyers or borrowers with limited income—but they’re not. There’s no maximum income limit that would disqualify you from this type of loan. Loan limits: FHA loan limits are typically lower than conventional loan limits, which means you might not be able to get funding for more expensive houses. This isn’t necessarily a bad thing, since it helps ensure that borrowers get loans they can afford to repay. How to qualify for an FHA loan

Qualifying for an FHA loan is generally easier than qualifying for a conventional loan, but you’ll still need to meet some basic minimum standards set by the FHA. While the government insures these loans, the funding itself comes through FHA-approved lenders each lending institution may have slightly different qualifying guidelines for its borrowers. Keep in mind that, while these FHA standards offer a basic framework, you’ll need to confirm the individual qualifying rules with your specific lender.

Credit score minimum 500. Your exact credit score will play a big role in determining your down payment minimum; typically, the higher your credit score, the lower your down payment and the more favorable your interest rate.

Debt-to-income ratio at or below 56.9%. DTI is a standard way of comparing the amount of money you earn to the amount you spend paying off other debts, and FHA loans are more lax on this number.

Steady income and proof of employment. Being able to provide at least 2 years of income and employment records is a standard requirement for all loans.

Down payment between 3.5%-10%. The down payment minimum for an FHA loan is typically lower than conventional loan, and can be as little as 3.5% depending on your credit score and lender.

Property standards apply. You won’t qualify for an FHA loan if the house you want to buy doesn’t pass the appraisal process, which is more strict with this type of loan than conventional mortgages.

Maximum FHA loan amount. The amount of money you borrow cannot exceed the FHA loan limits; this number changes based on your county and is determined by how expensive the local market is; the maximum FHA loan limit in 2021 is $420,000 (check HUD resources to confirm the latest limits.)

Joel Lobb

Senior Loan Officer

(NMLS#57916)American Mortgage Solutions, Inc.

10602 Timberwood Circle, Suite 3

Louisville, KY 40223text or call my phone: (502) 905-3708

email me at kentuckyloan@gmail.comThe view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency.

The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people. NMLS ID# 57916, (http://www.nmlsconsumeraccess.org). Mortgage loans only offered in Kentucky.

All loans and lines are subject to credit approval, verification, and collateral evaluation and are originated by lender. Products and interest rates are subject to change without notice.Kentucky FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans.

Kentucky FHA Guidelines for 2024

FHA pros and cons

FHA loans are a good option, especially if you have low credit or a lot of debt. But they come with their own set of drawbacks too.

FHA pros

Some of the best reasons to apply for an FHA home loan include:

- Lenient credit requirements: You can generally qualify for maximum FHA financing with a credit score of 500 to 580 versus a 620 to 640 score for a USDA loan. You might also be eligible with a credit score between 500 and 579 if you can make a 10% down payment.

- Higher debt-to-income ratios: Your back-end DTI — that is, your total monthly debt obligations — can be as high as 56.9% for FHA loans, but only 45% for USDA loans.

- Potentially lower interest rates: FHA interest rates can be lower than rates for USDA loans because you have the option to choose shorter repayment terms, including a 15-year fixed interest rate. The USDA only offers 30-year fixed loans, which naturally have higher rates.

- Multi-family units can qualify: Properties with up to four units can qualify for financing with an FHA loan when one unit is your primary residence. For example, purchasing a duplex with an FHA loan is allowed as long as you live in one half of the property. Like USDA loans, however, second homes and investment properties are ineligible.

FHA cons

- Higher down payment requirements: Depending on your credit score, you’ll need to make a 3.5% or 10% down payment. USDA loans require no down payment.

- Higher mortgage insurance premiums: Your upfront and annual mortgage insurance premiums are higher than the USDA guarantee fee and annual fee.

- Difficult to cancel mortgage insurance: You’ll pay an annual mortgage insurance premium for the life of the loan unless your down payment is at least 10% — in which case, you’ll only pay mortgage insurance for the first 11 years.

Kentucky FHA Loans in the State of Kentucky for 2022

Advantages of Kentucky FHA Mortgage Loans

- You can often make a down payment as low as 3.5 percent down to a 580 credit score

- You can finance a home with a 500 credit score with 10% down payment.

- Kentucky FHA loans are assumable meaning that if you have a good rate on your current mortgage and the potential buyer of your home meets FHA guidelines, then he can assume your low rate mortgage

- Kentucky FHA loans offer streamline refinancing without credit score minimums, verification of income, and no appraisals to refinance to a lower rate making it easier to qualify.

- Kentucky FHA loans offer flexible terms when it comes to previous bankruptcy or foreclosures. 2 years removed from Chapter 7 with reestablished

- credit, or if a Chapter 13, one year in the payment plan is eligible for FHA financing.

- Foreclosures on a past home. FHA will finance a home 3 years removed from the sale date of your foreclosure property

- 30 year fixed rate mortgage with usually the best going rates on government insured loans like FHA, VA, USDA etc.

- No prepayment penalty on Kentucky FHA loans.

- Higher debt to income ratio requirements when compared to Conventional loans because most Fannie Mae Conventional loans cannot have a higher debt to income ratio than 45% on the back-end

- You can make an FHA loan anywhere in the state of Kentucky with no geographical restrictions.

- Will allow for down payment assistance and grants for borrowers minimum down payments in the State of Kentucky through the likes of KHC, Welcome Home Grant, and Kentucky Housing Down Payment Second Mortgage loans.

- Kentucky FHA loans allow for unoccupied cosigner. For example, lets say you have a daughter that is getting ready to graduate college and does not have the income or credit history established yet to buy a home. FHA allows a family-member to co-sign for them to buy a home and you don’t have to occupy as primary residence. Note, FHA co-singers are not allowed to makeup for some that has bad credit, because they will take the lowest credit scores of both applicants. FHA usually allows for co-singers lack of income purposes only.

- Can usually close within 30 days just like a regular conventional mortgage. No extra time to close an FHA loan in Kentucky versus other secondary market loans like VA, USDA, Fannie Mae.

- You can use the FHA loan over and over. You can actually have two FHA loans open at the same time, but it gets tricky on this. Call or text me with more info if you have an FHA loan currently and would like to use FHA Financing again.

- FHA loans aren’t just for first time home buyers in Kentucky.

Disadvantages of Kentucky FHA Mortgage Loans

- There are loan limits in the State of Kentucky on FHA Mortgage loans. The maximum FHA loan in the state of Kentucky is $$420,680 for 2022. So if you were needing to finance a loan over this amount, you would need to look at doing a Conventional loan with the updated 2021 Kentucky State Loan Limits for a Fannie Mae loan being $647,250

- If buying a condo in Kentucky, FHA requires the condo development be FHA approved. There is a >>>list here of Kentucky FHA approved condos here.

- Seller must have own the home for 90 days before you can make an offer on the home. This comes into play where the seller bought the home as an investor and rehabbed the property and wants to sell for a quick profit. FHA mandates seller must maintain for 90 days before you can write up an offer on it. Also called FHA Flipping Policy. Read more here

- There is mortgage insurance. This is one of the biggest disadvantages for FHA loans. But as I tell most people, nobody rarely has a loan for 30 years, so if it meets your payment and your cash to close requirement, I tell people to go with it because it can be refinanced down the road and you are getting one of the lowers 30 year fixed rates out there. Both upfront and monthly mortgage insurance premiums you have to pay HUD/FHA. These premiums change whenever FHA/HUD replenish their insurance pool to pay claims from defaults, but currently the FHA upfront mortgage insurance premium is 1.75% and monthly is .85% and .80% of the loan amount. If you happen do a 15 year term or shorter, the mortgage insurance is cheaper monthly with .45 and .70 respectively each month. The upfront mortgage insurance is the same for a 30 year and 15 year at 1.75%

- FHA Mortgage insurance can be on the loan for life of loan. This is a recent change made in 2016 when FHA lowered there premiums for upfront and monthly mi premiums, but made the mortgage insurance for life of loan for some FHA loans.

- If you put down more than 10% on the loan, or have at least 10% equity in the home for a refinance, you only have to pay mortgage insurance for 11 years before it automatically falls off.

- Obviously you can refinance out of an FHA loan at anytime, since it does not a prepayment penalty, and you can potentially get a refund of your upfront mortgage insurance if paid off within 3 years on sliding scale.

-

I have incorporated some charts below to illustrate the different Kentucky FHA Mortgage Insurance premiums to explain it better.

-

The upfront mortgage insurance is usually financed into the loan, so it will look like you are borrowing more than the standard 3.5% down payment because this is financed into the loan. Some borrowers elect to pay it out of pocket upfront, but I have never seen this done in my 20 years of doing FHA loans in the State of Kentucky

- Kentucky FHA Loans Greater Than 15 Years MIP Chart

- 👇

Base Loan Amt. LTV Annual MIP ≤$625,500 ≤95.00% 80 bps (0.80%) ≤$625,500 >95.00% 85 bps (0.85%) >$625,500 ≤95.00% 100 bps (1.00%) >$625,500 >95.00% 105 bps (1.05%)

Kentucky FHA Loans Less Than or Equal to 15 Years MIP Chart👇

Base Loan Amt. LTV Annual MIP ≤$625,500 ≤90.00% 45 bps (0.45%) ≤$625,500 >90.00% 70 bps (0.70%) >$625,500 ≤78.00% 45 bps (0.45%) >$625,500 78.01% – 90.00% 70 bps (0.70%) >$625,500 >90.00% 95 bps (0.95%) When can I get the FHA mortgage insurance off my Mortgage Loan? See chart below 👇👇

- Appraisals. On an FHA appraisal, the FHA appraiser has to turn on the utilities to make sure they are in worked order when he gets there. This is different that Conventional loan appraisals. A lot of realtors or buyers think that FHA loans are harder due to appraisals, but honestly, they’re really not. FHA puts these minimum HUD standards in place to make sure the home is in good working order and SAFE to live in. I.e.is there any lead based paint or chipping paint that could lead to poisoning It is all about Safety with FHA and HUD on these appraisals. The value is determined just like a regular Conventional, USDA, VA appraisals whereas they compare the house to 3 recent homes sold in the area to get a value.

- Some lenders don’t offer FHA loans due to their complexity and sale on the secondary market, so if you call a local lender in Kentucky and they don’t offer FHA loans, the reason is usually they don’t have the team in place to do them or don’t want to do them due to lack of experience on the secondary government market.

- Government Liens. FHA will not be an option for you usually if you have unpaid federal tax liens, delinquency on federal backed-government loans, or a claim with social security etc. FHA loans are ran through aCAVIRS alert system to check to see if you are delinquent on any federal oblation. If so, this swill stop you until you can clear the CAVIRS alert system. For example, I did a loan for a buyer that had a delinquent federal debt with his student loan that happened over 14 years old. It was off the credit report and title search, so I had to switch to a conventional loan to make the home loan work.

- FHA loans are not good for second homes or investment properties. FHA loans are mainly for single family residence 1-4 unit, that are going to occupied primarily as main home.

In summary, FHA loans have few drawbacks other than the mortgage insurance in my opinion. It is a great first time home buyer program or borrowers with past credit problems to get into a house of their own with very little out of pocket, at a low 30 year fixed rate, and no prepayment penalty

Questions about qualifying for a FHA loan in Kentucky . Give me text, call or email below. Love to help you out on your next home or refinance in Kentucky

Senior Loan Officer

If you are an individual with disabilities who needs accommodation, or you are having difficulty using our website to apply for a loan, please contact us at 502-905-3708.

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant’s eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916http://www.nmlsconsumeraccess.org/

— Some products and services may not be available in all states. Credit and collateral are subject to approval. Terms and conditions apply. This is not a commitment to lend. Programs, rates, terms and conditions are subject to change without notice. The content in this marketing advertisement has not been approved, reviewed, sponsored or endorsed by any department or government agency. Rates are subject to change and are subject to borrower(s) qualification.

Louisville Kentucky Mortgage Broker Offering FHA, VA, USDA, Conventional, and KHC Zero Down Payment Home Loans | October 17, 2018 at 3:54 pm | Tags: fha gift funds, fha loan kentucky, FHA Loans Kentucky Housing First time home buyer, fha mortgage, fha mortgage loan, gift funds for fha mortgage, kentucky fha loans |

KENTUCKY FHA MORTGAGE GUIDELINES FOR 2020

- FHA – 620+ Min Fico Approve Eligible / NO OVERLAYS-NONE!

- FHA – 620+ FICO for PURCH, RT, C/O including Flips & High Balance

- FHA – 640+ REFERS OK!—no overlays -u/w directly to 4000.1

- FHA – 640+ MANUALS up to 50% DTI (with 2 comp factors)

- FHA – 620+ No DTI CAP – Follow AUS Findings!!! (with approved eligible)

- FHA – 620+ NO Minimum Credit History or Trades with AUS Approval!

- FHA – 620+ – No VOR Unless Required by DU Findings!

- FHA – Transfer appraisals from ANY lender/AMC OK!

- FHA – ORDER YOUR APPRAISAL FROM 20+ AMCs YOU CHOOSE!

- FHA – Collections – HUD Guides Apply –

- FHA – Mortgage Lates OK if AUS Approved!!!

- FHA – ESCROW STATE – Non Purchasing Spouse derogs ignored – only affects DTI

- FHA – Borrower w/ Work Permits, Non-Resident Alien OK!

- FHA – 1 Day off Market for Cashout Refi! – Must be off market before date of loan application!

- FHA – Rental Income on 2-4 units ok FTHB

- FHA – STREAMLINE – 620 Minimum

- FHA – Streamline – 620 Score – No Appraisal, No Income, No AVM, No Credit Qualifying!!!

- FHA – Streamline -Investment and 2nd Homes OK!

- FHA – Streamline – Mtg only on subject property only!

What is an FHA Loan and Is It Right for You?

Source: What is an FHA Loan and Is It Right for You?

What Is An FHA Loan And Is It Right For You?

The Federal Housing Administration insures what are called FHA loans. These mortgage loans provide opportunities for buyers with less-than-perfect credit or limited down payments to purchase homes, but they aren’t without potential pitfalls.

FHA loans are available to borrowers with a credit score of at least 580, and you have to make a minimum 3.5% down payment. They’re a popular option for first-time home buyers.

Lenders such as banks and credit unions issue the mortgages, which are insured by the FHA. That protects the lender if the borrower defaults, which is why the terms are more favorable than a traditional mortgage.

Around eight million single-family homes have loans insured by the FHA.

What Can an FHA Loan be Used For?

You can use an FHA loan to refinance single-family houses, to buy a single-family home, to buy some multifamily homes and condos and certain mobile and manufactured homes. There are particular types of FHA loans that can be used to renovate an existing property or for new construction.

How is an FHA Loan Different from a Conventional Mortgage Loan?

The biggest differentiator between an FHA loan and a conventional mortgage is that it’s easier to qualify for an FHA loan. You may get a loan with a lower credit score than you would otherwise, and your mortgage insurance payments may be lower too.

There are also fewer restrictions as far as using gifts from family or donations for your down payment.

If you have a FICO score of at least 580, you have to make a 3.5% down payment. With a FICO score between 500 and 579, you’re required to make a 10% down payment, and mortgage insurance is required. Your debt-to-income ratio needs to be less than 43% whereas with a conventional loan it’s usually 36%. You do need to have proof of income and steady employment, as you would need with a conventional loan.

Are There FHA Loan Limits?

There are limits on the mortgage amount you can get with an FHA-guaranteed loan. The limits vary based on your county, and in 2020 these ranged from $331,760 to $765,600. The limit amounts are updated by the FHA each year based on fluctuations in home prices.

The Benefits of the FHA Loan

The primary benefits of an FHA loan are that buyers who wouldn’t otherwise qualify may be able to own a home and for a lower down payment. Sometimes the FHA will help facilitate coverage of closing costs. If you have problems making payments on an FHA loan you may be eligible for a forbearance period if you qualify.

What Are the Downsides of an FHA Loan?

You will have to pay an upfront mortgage insurance premium with an FHA loan to protect the lender. The fee is due when you close and it’s 1.75% of your loan. You will also have to pay an annual mortgage insurance premium for the life of your loan. The amount can range between 0.45% and 1.05%.

When you buy a home with an FHA loan, it has to meet strict standards in terms of health and safety.

Also, while there are set standards from the FHA, approved lenders can create their own requirements.

Applying for an FHA Loan

You’ll have to first find an FHA-approved lender to get one of these home loans. You’ll need some documents, including proof of U.S. citizenship, legal permanent residency, or eligibility to work in America. You’ll need bank statements for at least the past 30 days, and you’ll probably need to show pay stubs.

Some of the information your lender may be able to obtain on your behalf, such as your credit reports, tax returns and employment records.

There are advantages to an FHA loan because it expands homeownership to more people than conventional loans. It’s just important that if you’re considering this loan you understand the costs and that you’re not taking on more than you’re financially prepared for because of the less stringent approval requirements.

Written by Ashley Sutphin for http://www.RealtyTimes.com Copyright © 2020 Realty Times All Rights Reserved.

How does Kentucky FHA Mortgage Rates work?

Kentucky FHA mortgage loans are backed by the Federal Housing Administration under the umbrella of HUD. FHA loans were developed to help borrowers that don’t have a large down payment and a weaker credit profile to buy and refinance their home mortgage loan.

Kentucky FHA rates are backed by the government, so they are typically lower than other mortgage rates in the secondary market like Conventional loans and portfolio loans at banks, but fall in line compatible to other backed government loans in the secondary market likeUSDA, VA, mortgage loans. Most people seeking FHA mortgages will get a 30 year, 20 year of 15 year fixed rate loan with the security of the house payment not changing.

Lower Credit Standards and Credit Scores for FHA loans

FHA mortgages will go down to a 500 credit score with at least 10% down payment, and if your credit score is higher than 580, you can put the minimum of 3.5% down payment. Additionally, you need to be only 2 years removed from a Chapter 7 bankruptcy, or 1 year from a Chapter 13 bankruptcy.

Mortgage Insurance on FHA loans

Mortgage insurance is required on most FHA loans and is usually for life of loan with everyone paying the same. If you have a higher credit score and a larger down payment, it would make sense to look at doing a conventional mortgage loan because they are based on your credit score, money down, and debt to income ratio and not for life of loan.

You can get a lower FHA mortgage insurance premium and not have to finance the premiums for life of the loan if you put more than 10% down payment and finance on a 15 year term.

Why would you consider a FHA mortgage?

My best opinion is this. If you have a bankruptcy that is less than 4 years, have a credit score lower than 660, and very little money down, I would recommend at looking to do a FHA mortgage Loan. Your chances of getting approved with likely result in a loan approval as opposed to doing a conventional loan backed by Fannie Mae.

Why would you consider a Conventional Loan?

My best opinion is this. If you have a bankruptcy over 4 years or longer, at least 5% down payment, a credit score of 680 or higher, I would look doing a conventional mortgage loan.

I can help you understand what mortgage is correct for you. Please contact me below and I will be happy to answer any questions.

Senior Loan Officer

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant’s eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916http://www.nmlsconsumeraccess.org/

FHA to make financing easier for condo owners in Kentucky

FHA Condo Approval Kentucky

The Federal Housing Administration has finally issued a long-awaited update to its condominium rules, announcing Wednesday that it will now allow individual unit approval and is taking other steps to loosen requirements that make these properties eligible for FHA financing. The agency said it expects the updated guidelines to qualify up to 60,000 more condo units a year for financing.

Under the revised guidelines – which take effect Oct. 15, 2019 – an individual condo unit in a building of 10 units or more may be eligible for spot approval if no more than 10% of the units are FHA-insured. For units in buildings with fewer than 10 units, no more than two units can have FHA insurance.

The FHA is also extending the recertification deadline for approved condo projects from two to three years, and it will insure more mixed-use projects, or those with more commercial space, to be eligible, stating that approved projects can now have up to 35% of their square footage dedicated to non-residential use.

The agency also loosened restrictions on owner-occupancy rules, stating that eligible condo projects can now be just 50% owner-occupied.

It also said it will insure up to 50% of units in any given project.

The FHA said it expects the updated guidelines to qualify an estimated 20,000 to 60,000 more condo units per year for financing.

Currently, of the more than 150,000 condo projects across the country, only 6.5% are approved for FHA financing.

This is something the FHA is aiming to change with the updated guidelines, Department of Housing and Urban Development Secretary Ben Carson said on a call with reporters Wednesday.

Kentucky FHA loans

Kentucky FHA loans have always been a great alternative for people who don’t quite qualify for Conventional financing. The guidelines are more forgiving allowing for smaller down payments, higher debt to income ratios, some credit issues, and more sources for the down payment.

The great thing is that the interest rate is only slightly higher than a conventional loan. Sometimes the interest rate is actually lower. Remember this! IF you go to a Kentucky Mortgage Broker or a Bank and the rate quoted is exceptionally higher, they are charging you too much. Call around for quotes. You will usually get a better rate from a Kentucky Mortgage broker.

Advantages:

- Kentucky FHA loans are not as strict on credit scoring. We can go down to a 580 credit score with compensating factors and if it makes sense.

- High debt to income ratios: 31% / 55%

- 100% of down payment can be a gift from: relative, close friend, or employer. Currently Kentucky Housing will give you up to $6,000 for down payment assistance with Kentucky FHA mortgage loans

- Seller, builder, or realtor can pay up to 6% of the sales price towards the buyers closing costs, discount points, prepaids, and up front mortgage insurance premium.

- Buyer can finance closing costs into the loan, except for prepaids and discount points.

- Credit criteria is not as strict as a Conventional loan. In fact, you might qualify if you have filed a chapter 13 bankruptcy and have been in it for at least one year.

Disadvantages:

- Kentucky FHA mortgage insurance may be more expensive than Conventional mortgage insurance.

- Maximum loan amounts are lower than conventional loans and they are determined by area.