Kentucky Mortgage Requirements for FHA, VA, USDA and Fannie Mae

FHA loan in Kentucky you will be confronted with minimum credit score requirements set forth by FHA and the lender. Even though FHA will insure the mortgage loan at a certain credit score, you will see that lenders will create “credit-overlays” to protect their risk and ask for a higher credit score.

So keep in mind when you are getting an FHA lenders will have higher credit score minimums in addition to the FHA Mortgage Insurance program.

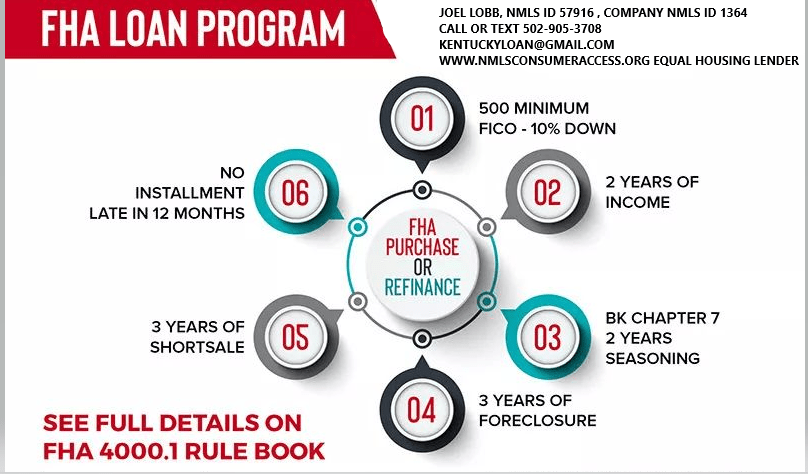

For a Kentucky Homebuyer wanting to purchase a home or refinance their existing FHA loan, FHA requires a 3.5% down payment and the borrower must have a 580 FICO Credit Score. If the score is below 580, then you would need 10% down and still qualify on a manual underwrite.

You must have a FICO score of at least 500 to be eligible for a Kentucky FHA loan. If your FICO score is from 500 to 579, your down payment on the loan is 10 percent of the loan.

If your FICO score is 580 or higher, your down payment is only 3.5 percent. If your credit score is less than 580, it may be more cost-effective to take the necessary steps to improve your score before taking out the loan, rather than putting the money into a larger down payment.

How do they get the credit score: There are three main credit bureaus in the US. Equifax, Experian, and Transunion. The three scores vary but should be relatively close as long as the same creditors are reporting to the same bureaus.

You will get a variation in the scores due to all creditors or collection companies don’t report to all three bureaus. This is why they take the mid score. So if you have a 590 Experian, 680 Equifax, and 620 TransUnion, your qualifying credit score would be 620

Based on my experience with lenders that I deal with in Kentucky on FHA loans, most lenders require 620 middle credit score for consideration for loan approval.

How do they get the score: They take the mid score, so if you have a 590 Experian, 680 Equifax, and 620 TransUnion, your qualifying score would be 620.

Kentucky FHA Loans with less than 620 Score

If your score is below 620, a manual underwrite is where the AUS (Automated Underwriting System) refers your loan to a human being, and they look at the entire file to see if they can overturn and approve the mortgage loan because the Desktop Underwriting Automated Software could not approve you.

With scores below 620, they typically will want to verify your rent history, have no bankruptcies in the last two years, and no foreclosures in the last 3 years.

If you have had any lates since the bankruptcy this will probably result in a denial on a refer manual underwrite file.

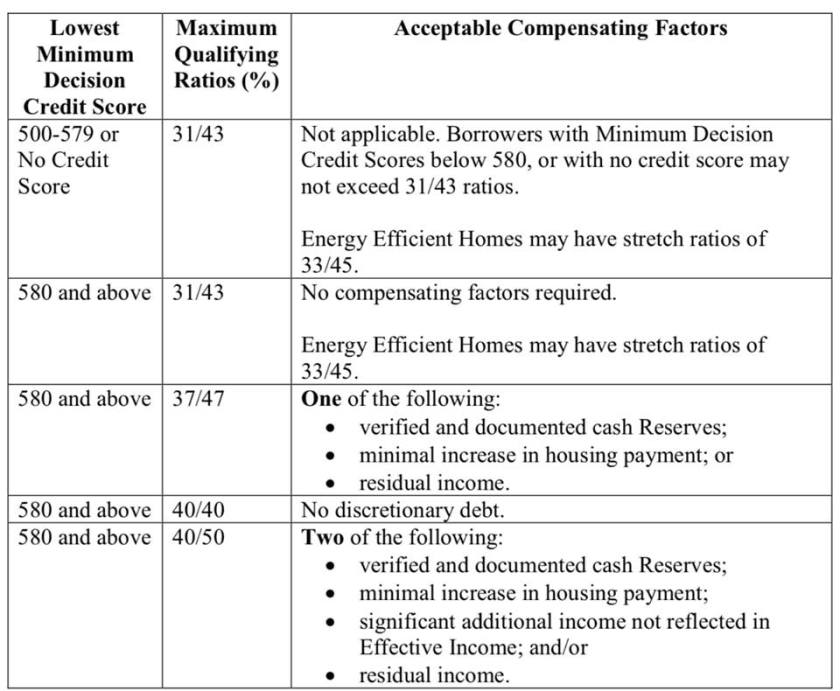

Your max house payment will be set at 31% of your gross monthly income, and your new house payment plus the bills you are paying on the credit report cannot be more than 43%.

Typically, on scores below 620 for FHA loans, they will also look at reserves or money you have saved up after the loan is made to try and qualify you. For example, if you have a 401k or savings account that has at least 4 months reserves (take your mortgage payment x 4) and this would equal your reserves. They look at this as a rainy day fund and could help you keep up on your bills if you were unemployed or could not work.

What credit score do you need to qualify for a Kentucky mortgage loan?

The first thing to keep in mind is that qualifying for a mortgage involves a lot more than just a credit score. While your FICO score is a very important ingredient, it is just one factor. Lenders also look at your income and level of debt, among other things.

As a rule of thumb, however, a credit score below 620 will make buying a home very difficult. A FICO score below 620 is considered sub-prime. In the past, there were mortgage companies that specialized in sub-prime mortgages. Because of the challenges in the credit market over the last year or so, however, sub-prime loans have become difficult if not impossible to obtain.

A FICO score between 600 and 640 is considered fair to good credit. But keep in mind, this range of credit scores does not guarantee you will qualify for a mortgage, and if you do qualify, it won’t get you the lowest interest rate possible. Still, to buy a home aim for a score of at least 620, recognizing that other factors weigh in the decision and that some banks may require a higher score.

What credit score do you need to get a low rate mortgage?

It uses to be that a score of about 720 would yield the lowest mortgage rates available. Today, the best rates kick in with a FICO score of 760. And interest rates go up significantly as your credit score drops. To give you an idea, the following table shows current rates by credit score and calculates a monthly principal and interest payment based on a $300,000 loan:

By paying down your credit card balances (credit utilization) and having a good pay history (payment history) ,this is the best way to raise your score.

The credit bureaus don’t update immediately, so I would not add to the balance or open any new bills or have any other lender do an inquiry on your credit report while we wait for the scores to hopefully go up in the next 30 days. Try to keep everything status quo and make your payments on time and keep your balances low or lower than what is now reporting on the credit report.

How to improve your credit score!

Pay Every Single Bill on Time, or Early, Every Month

Please understand one thing; paying your bills on time each month is the single most important thing you can do to increase your credit scores.

Depending on the credit bureau, there are 4 or 5 main items that determine everyone’s credit score. Of those items, your history of paying bills makes up about 35% of the score. THIS IS HUGE!

Paying your bills on time shows lenders that you are responsible. It will also spare you from paying late fees whether it is a charge from a credit card or an added fee from your landlord.

Use a calendar, or a phone app, or some other organized system to make sure that you pay your bills on time every single month.

MAIN TIP: Do not pay ANY bill late!

Credit Cards: Lower Balances Are Always Better

( If you don’t have a credit card, I suggest getting a secured credit card through Capital one Secured Card Or Open Sky Credit card...click this link here

Another big factor in calculating a credit score is the amount of credit card debt. Credit bureaus look at two things when analyzing your credit cards.

First, they look at your available credit limit. Second, they look at the existing balance on each card. From these two figures an available ratio is developed. As the ratio goes higher, so too will your credit score increase.

Here is one simple example. Suppose a person has the following credit cards, corresponding balances, and credit limits

| Credit Card | Current Balance | Credit Limit |

| Chase Visa | $105 | $1,000 |

| MarterCard from local bank | $236 | $1,500 |

| BP MasterCard | $87 | $500 |

| Totals | $428 | $3,000 |

From these numbers, we get the following calculation

$428/$3,000 = 14%

In other words, the person is using 14% of their available credit and they have 86% available credit. The closer that ratio is to 100%, the better the credit score will be.

MAIN TIP: Keep all credit card balances as low as possible.In this particular example, if they had a problem with their car, or needed medical attention or some other emergency, the person would have the money necessary to handle the situation without incurring new debt. This is wise on the consumer’s part and lenders like to see this kind of money management.

Credit Cards Part 2: 1 or 2 is Better Than a Wallet Full

The previous example showed a person that utilized just three credit cards. This is much better than someone who has 5+ credit cards, all with available balances. Why? Lenders do not like to see someone that has the potential to get too far in debt in a short amount of time.

Some people have 5, 10 or more credit cards and they use many of them. This shows a lack of restraint and control. It is much better, and neater, to have only 2 or 3 cards with low rates that handle all of your transactions. A lower number of cards are easier to manage and it does not give a person the temptation to go on a huge shopping spree that could take years to payoff.

MAIN TIP: Try to limit yourself to no more than 2-3 credit cards.

Keep the Good Stuff Right Where it is

Too many people make the mistake of paying off old debts, such as old credit cards, and then closing the account. This is actually a bad idea.

A small part of the credit score is based on the length of time a person has had credit. If you have a couple of credit cards with a long track history of making payments on time and keeping the balance at a manageable level, it is a bad idea to close out the card.

Similarly, if you have been paying on a car or motorcycle for a long time, do not be in a hurry to pay off the balance. Continue to make the payments like clockwork each month.

An account that has a good record will help your scores. An account that has a good record and multiple years of use will have an even better impact on your score.

MAIN TIP: Keep old accounts open if you have a good payment history with them.

Stop Filling Out Credit Applications

Multiple credit inquiries in a short amount of time can really hurt your credit scores. Lenders view the various inquiries as someone that is desperate and possibly on the verge of making a bad financial choice.Too many people make the mistake of getting more credit after they are approved for a loan. For example, if someone is approved for a new credit card, they feel good about their finances and decide to apply for credit with a local furniture store. If they get approved for the new furniture, they may decide to upgrade their car. This requires yet another loan. They are surprised to learn that their credit score has dropped and the interest rate on the new car loan will be much higher. What happened?

If you currently have 2 or 3 credit cards along with either a car loan or a student loan, don’t apply for any more debt. Make sure the payments on your current debt are all up to date and focus on paying them all down.

In a few months of making timely payments your scores should noticeably go up.

MAIN TIP: Limit your new loans as much as possible

Which credit scores do mortgage lenders use to qualify people for a mortgage?

While it’s common knowledge that mortgage lenders use FICO scores, most people with a credit history have three FICO scores, one from each of the three national credit bureaus (Experian, Equifax, and TransUnion).

- Which FICO Score is Used for Mortgages

Most lenders determine a borrower’s creditworthiness based on FICO® scores, a Credit Score developed by Fair Isaac Corporation (FICO™). This score tells the lender what type of credit risk you are and what your interest rate should be to reflect that risk. FICO scores have different names at each of the three major United States credit reporting companies. And there are different versions of the FICO formula. Here are the specific versions of the FICO formula used by mortgage lenders:

- Equifax Beacon 5.0

- Experian/Fair Isaac Risk Model v2

- TransUnion FICO Risk Score 04

Lenders have identified a strong correlation between Mortgage performance and FICO Bureau scores (FICO score). FICO scores range from 300 to 850. The lower the FICO score, the greater the risk of default.

Which Score Gets Used?

Since most people have three FICO scores, one from each credit bureau, how do lenders choose which one to use?

For a FICO score to be considered “usable”, it must be based on adequate, concrete information. If there is too little information, or if the information is inaccurate, the FICO score may be deemed unusable for the mortgage underwriting process. Once the underwriter has determined if a score is usable or not, here’s how they decide which score(s) to use for an individual borrower:

- If all three scores are different, they use the middle score

- If two of the scores are the same, they use that score, regardless of whether the two repeated scores are higher or lower than the third score

Lenders have identified a strong correlation between Mortgage performance and FICO Bureau scores (FICO score). FICO scores range from 300 to 850. The lower the FICO score, the greater the risk of default.

If it helps to visualize this information:

| Identifying the Underwriting Score | ||||

|---|---|---|---|---|

| Example | Score 1 | Score 2 | Score 3 | Underwriting Score |

| Borrower 1 | 680 | 700 | 720 | 700 |

Joel Lobb

Mortgage Loan Officer

Individual NMLS ID #57916

email: kentuckyloan@gmail.com

email me at kentuckyloan@gmail.com

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people. NMLS ID# 57916, (www.nmlsconsumeraccess.org). USDA Mortgage loans only offered in Kentucky.

All loans and lines are subject to credit approval, verification, and collateral evaluation

Email –

Email – Call/Text –

Call/Text –  Website:

Website:  Address:

Address:  First-Time Home Buyers Welcome

First-Time Home Buyers Welcome Email:

Email:  Address: 911 Barret Ave, Louisville, KY 40204

Address: 911 Barret Ave, Louisville, KY 40204

Debt-to-Income Ratio Requirements –Depending on the automated underwriting system from Desktop Originator, your Debt-to-income ratio is the percentage of your income before taxes that you spend on monthly debt.Taking into account the proposed mortgage payment as well as the other debts, the FHA requires that these debts all total less than 43 percent of your pretax income in order to qualify for the loan.If your debt load is too high, you will struggle to pay all of your bills and mortgage expenses and care for yourself and your family.

Debt-to-Income Ratio Requirements –Depending on the automated underwriting system from Desktop Originator, your Debt-to-income ratio is the percentage of your income before taxes that you spend on monthly debt.Taking into account the proposed mortgage payment as well as the other debts, the FHA requires that these debts all total less than 43 percent of your pretax income in order to qualify for the loan.If your debt load is too high, you will struggle to pay all of your bills and mortgage expenses and care for yourself and your family. Property Requirements for a Kentucky FHA LoanIt must be the place where you intend to reside. You must move into the home within 60 days of closing the loan. The home cannot be an investment. There will be an inspection to ensure that the home is safe and habitable.It is really not too hard to pass FHA loans and the appraisal process.

Property Requirements for a Kentucky FHA LoanIt must be the place where you intend to reside. You must move into the home within 60 days of closing the loan. The home cannot be an investment. There will be an inspection to ensure that the home is safe and habitable.It is really not too hard to pass FHA loans and the appraisal process. Pros of FHA Loans –

Pros of FHA Loans –