FHA loans are a popular choice for many first-time homebuyers in Kentucky. This is due to their flexible qualifying criteria. If you’re considering an FHA loan in the Bluegrass State, understanding the key qualifying factors is crucial. Here’s a comprehensive guide to the criteria you need to know:

- Credit Score Requirements:

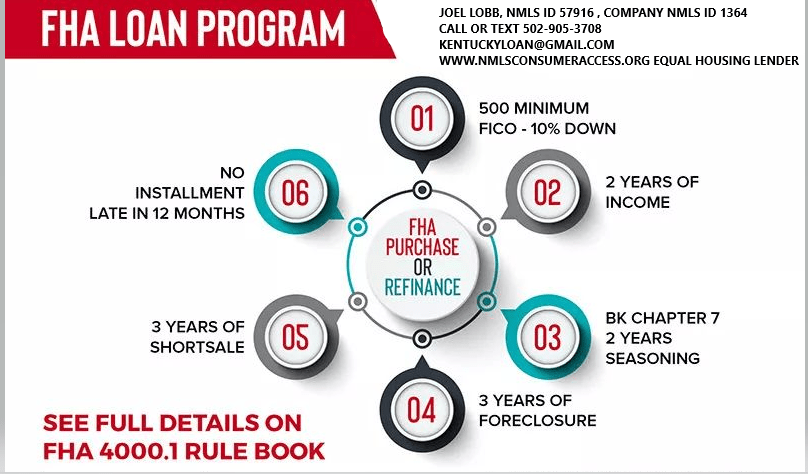

- FHA loans are known for accommodating borrowers with lower credit scores. The minimum required credit score can vary. Typically, a credit score of 580 or higher is needed to qualify for the minimum down payment of 3.5%. Borrowers with credit scores between 500 and 579 might still qualify. They will need a higher down payment, usually around 10%.

- Down Payment:

- The minimum down payment for an FHA loan in Kentucky is 3.5% of the home’s purchase price. This is advantageous for buyers who may not have substantial savings for a larger down payment, making homeownership more accessible.

- Work History:

- Lenders typically look for a steady 2 year employment history when considering FHA loan applications. A consistent work history is beneficial. It is preferable to have worked with the same employer or within the same field. This helps demonstrate financial stability and the ability to repay the loan.

- Debt-to-Income Ratio (DTI):

- The debt-to-income ratio is a crucial factor in mortgage approval. For FHA loans, the maximum allowable DTI ratio is typically around 40% to 45% of your gross monthly income. It can go higher up to 56% with good credit scores, a large down payment, or a shorter-term loan. Lenders may also consider higher ratios in certain cases if compensating factors are present.

- Bankruptcy and Foreclosure:

- FHA loans have lenient guidelines regarding bankruptcy and foreclosure. Generally, borrowers with a past bankruptcy may qualify for an FHA loan after two years. This is possible if they have re-established good credit and demonstrated responsible financial behavior. For foreclosures, the waiting period is usually three years.

- Mortgage Term:

- FHA loans offer various mortgage term options, including 15-year, 20 year, 25 year and 30-year fixed-rate loans. The choice of term depends on your financial goals and ability to manage monthly payments.

- Occupancy: Primary residences with 1-4 units. Not for investment properties or second homes.

- Mortgage Insurance on the loan for life of loan. Larger down payments and shorter terms will reduce the upfront mi and monthly mi premiums

- can be used for refinances, not only for purchases.

- No income limits nor property restrictions on where home is located

- Can close within 30 days typically with good appraisal and title work

FHA Loan Requirements in Kentucky for Credit scores, Down payment, Debt Ratio and work history below

| Requirement | Details |

|---|---|

| Credit Score | – 580+: Eligible for a 3.5% down payment. – 500-579: Requires a 10% down payment. |

| Down Payment | Minimum of 3.5% for qualified buyers; 10% for lower credit scores below 580 to 500 score range |

| Debt-to-Income Ratio (DTI) | – Ideal: 45% or lower on front end ratio or housing ratio. – Acceptable: Up to 57% with compensating factors. There are two ratios. Front end and back end with front end being maxed at 45% and the backed end ratio being 56.99% with an AUS approval. If manually underwritten, see guidelines here |

| Employment History | Must provide at least **2 years of consistent employment—College transcripts can supplement with a less than 2 year work history |

Key Benefits of FHA Loans in Kentucky

- Low Credit Score Requirements

- FHA loans accept borrowers with credit scores as low as 500. However, a score of 580+ qualifies you for the lowest down payment option.

- Low Down Payment Options

- You can purchase a home with as little as 3.5% down if you meet credit requirements, making FHA loans more accessible than conventional loans.

- Competitive Interest Rates

- FHA loans typically offer rates comparable to conventional mortgages. They may even offer lower rates. This could save you money over the life of the loan.

- Flexible Loan Uses

- With an FHA 203(k) loan, you can bundle home purchase and renovation costs into a single mortgage.

- Assumable Loans

- FHA loans can be transferred to a new buyer. This feature is especially valuable if you sell your home when interest rates are higher.

Understanding these qualifying criteria can help you navigate the FHA loan application process in Kentucky more effectively. Working with an experienced mortgage professional can provide valuable guidance. They offer assistance tailored to your specific financial situation and homeownership goals.

Joel Lobb Mortgage Loan Officer

Email – kentuckyloan@gmail.com

Email – kentuckyloan@gmail.com  Call/Text – 502-905-3708

Call/Text – 502-905-3708Joel Lobb

Mortgage Loan Officer – Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

Kentucky Local Home Loan Lender Services

First-Time Home Buyers Welcome

First-Time Home Buyers Welcome FHA, Rural Housing (USDA), VA, and Kentucky Housing Corporation (KHC) Loans

FHA, Rural Housing (USDA), VA, and Kentucky Housing Corporation (KHC) Loans Conventional Loan Options Available

Conventional Loan Options Available Fast Local Decision-Making

Fast Local Decision-Making Experienced Guidance Through the Home Buying Process

Experienced Guidance Through the Home Buying Process

(www.nmlsconsumeraccess.org).