What You Need To Know About A Mortgage… BEFORE You Get One!!!

Qualifying for a Mortgage

Mortgage companies are in business to make money by lending money that is secured by an asset large enough to sell and recover their capital if the borrower is no longer able or willing to pay the payments. They are not in the business of owning property and would rather not have to foreclose on a loan, repossess the property and sell it to recapture their capital. This does happen but it is not their primary business. They would rather have their borrowers make their payments so that they could collect the interest and move on down the road. To increase their odds of that happening, mortgage companies look at several areas of your financial history to determine if you will meet their standards. This is called Qualifying for a Mortgage.

Mortgage companies are in business to make money by lending money that is secured by an asset large enough to sell and recover their capital if the borrower is no longer able or willing to pay the payments. They are not in the business of owning property and would rather not have to foreclose on a loan, repossess the property and sell it to recapture their capital. This does happen but it is not their primary business. They would rather have their borrowers make their payments so that they could collect the interest and move on down the road. To increase their odds of that happening, mortgage companies look at several areas of your financial history to determine if you will meet their standards. This is called Qualifying for a Mortgage.

What the mortgage company finds when they look at these areas will help determine the type of mortgage that is available to you and the interest rate you will pay on the money that you borrow.

The areas that they are interested in looking at are:

Job History

Lenders want to know if you have been in your current job and/or profession for at least two years. They also want to know if you are retired or self-employed.

Income

Mortgage lenders want to know how much your monthly income is before taxes are taken out (Gross Monthly Income). Typically you will be asked to provide check stubs for the last 30 days and Federal Tax Returns or W-2’s for the last two years to prove your income.

Mortgage lenders want to know how much your monthly income is before taxes are taken out (Gross Monthly Income). Typically you will be asked to provide check stubs for the last 30 days and Federal Tax Returns or W-2’s for the last two years to prove your income.

If you are self-employed and it is difficult for you to prove your gross income to the lender you may be able to get a “stated income” loan. If that is the route that you take, your income must be “reasonable” for your profession. Since stated income loans are riskier for the lender you will generally have a higher interest rate.

Credit History

Mortgage lenders really like it if you have a history of paying your bills on time. This is reflected in your credit report and FICO score. If you have “bad credit”, you are NOT automatically disqualified from getting a mortgage. Lower credit scores will increase the interest rate that you will be required to pay and sometimes that increase will be quite significant.

Debt Load

You can have an awesome job with an income to make Bill Gates jealous and a great credit score but if you have already acquired too much long term debt you may not qualify for the loan you want.

Assets

Mortgage lenders will want to check your bank accounts to make sure that you have the cash necessary to pay the down payment and closing costs and that you have “reserves” available to make the loan payment. Often, the lender will require 3-6 months reserves. (Reserves can be in a 401K or other retirement account that you can pull the money out of)

Requested Loan Amount

The loan you are requesting will need to be proportional to your ability to make the payments. Be reasonable with your house buying expectations – don’t expect to buy a lot more house than you can afford. The recent housing bust defined the term “house poor” and got a lot of people into financial trouble. Again, mortgage lenders would much rather you make your monthly house payments because everyone loses if they have to foreclose.

Determining YOUR Mortgage Interest Rate

The market place determines the range of interest rates available for any mortgage and the lending rates change daily. The specific interest rate you will pay is based on how well qualified you are and the type of loan you want.

Interest rates are typically based on the answers to these questions:

How Good Is Your Credit Score?

The most widely used score is the FICO score, the credit score created by Fair Isaac Corporation. Lenders use the FICO Score to help them make billions of credit decisions every day. Fair Isaac calculates the FICO Score based solely on information in consumer credit reports maintained by the credit reporting agencies.

The most widely used score is the FICO score, the credit score created by Fair Isaac Corporation. Lenders use the FICO Score to help them make billions of credit decisions every day. Fair Isaac calculates the FICO Score based solely on information in consumer credit reports maintained by the credit reporting agencies.

FICO credit scores range from 300 to 850. That FICO Score is calculated by a mathematical equation that evaluates many types of information from your credit report, at that agency. By comparing this information to the patterns in hundreds of thousands of past credit reports, the FICO Score estimates your level of future credit risk.

With the top end of the credit score being 850, anything above about 720 is considered excellent. Some local lenders set 740 as the benchmark for their preferred interest rates. Having a lower credit score DOES NOT mean you will not get a loan. You may qualify BUT your interest rate will be higher than someone with better credit.

How Big Is Your Down-Payment?

The Down-Payment is the amount of your own money you are going to put into buying the property. The more money you put into the property on the front end, the lower the risk of you not paying the payments. The amount of your down payment also directly affects the amount of your loan (purchase price – down payment = loan amount). This is called the Loan to Value Ratio (LTV).

The LTV is the percentage of the value of the house that the mortgage will cover (loan amount / purchase price x 100). For example, the property you are interested in buying is selling for $100,000. You have $20,000 for the down-payment and want a mortgage for the other $80,000. The LTV for this mortgage is 80%.

Similar to the LTV is the Combined Loan to Value Ratio (CLTV). The CLTV is used when 2 loans are used to finance the home purchase. You may see or hear terms like “80-20” or “80-15-5”. This refers to the 1st lien percentage (80), the 2nd lien percentage (20 or 15) and the down payment percentage (5).

How Much Debt Do You Currently Have?

It only makes sense that the more debt you have the riskier the loan is for the lender. There is a finite amount of income in all of our households and it all gets allocated every month. Lenders use a “debt-to-income” ratio to determine how qualified you are for the loan based on how much debt you already have.

Your Debt to Income Ratio (DTI) is the percentage of your income that you owe in debt on a monthly basis. For example, if you make $5,000 per month, and have debt payments (car loans, credit cards, student loans, etc.) of $2,000, your DTI ratio is 40%. The higher this ratio is, the less likely you will be to qualify for a low interest rate.

Conventional loans typically have a qualifying ratio of 28/36. FHA loans will sometimes allow for a higher debt load of 29/41 qualifying ratio.

The first number in a qualifying ratio is the maximum percentage of your gross monthly income that can be applied to your mortgage. That includes the loan principal and interest, private mortgage insurance, property taxes, homeowners insurance, and homeowner’s association dues.

The second number is the maximum percentage of your gross monthly income that can be applied to housing expenses and recurring debt. Recurring debt includes monthly payments for cars, boats, motorcycles, child support payments and monthly credit card payments.

Example: of a 28/36 qualifying ratio:

Gross monthly income of $5,000 x .28 = $1400 can be applied to housing.

Gross monthly income of $5,000 x .36 = $1,800 can be applied to recurring debt plus housing expenses

Example: of a 29/41 qualifying ratio:

Gross monthly income of $5,000 x .29 = $1,450 can be applied to housing.

Gross monthly income of $5,000 x .41 = $2,050 can be applied to recurring debt plus housing expenses

These are just general guidelines and everyone’s personal finances are unique.

Here is a KEY point to remember…

Your credit score is one of the most vital piece of information when qualifying for a loan and you can greatly affect it too.

Below are the important items I will discuss:

- What is a credit report?

- What do mortgage lenders use to determine my credit score?

- What does FICO stand for?

- What determines my FICO score?

- What’s a good FICO score?

- What if my FICO score is below 620?

- Can I get a copy of my credit report?

- Ah Ha! Now I understand all things credit and I’m this much closer to owning my home!

What is a credit report?

A credit report record’s your credit history including information about:

- Your identity: name, social security number, date of birth and possibly employment information.

- Your existing credit: credit card accounts, mortgages, car loans, students loans etc.including credit terms, how much you owe, and your payment history.

- Your public record: Judgments against you, tax liens or bankruptcies.

- Recent Credit Inquiries: Requests for your information from companies extending credit such as credit card companies, auto loans, etc.

Be aware, credit card companies, car companies and mortgage lenders use slightly different models to determine credit risk. Today we are focusing on Mortgage related credit.

How do lenders calculate my credit score?

Your credit score is the key to your castle. Your home is most likely the most expensive purchase you will ever make. Therefore, when buying a home, lenders use a different system for assessing risk than credit card companies or even auto loan companies use.

Mortgage lenders use a comprehensive system of checking credit called a Residential Mortgage Credit Report (RMCR), commonly called a “Tri-Merge” report. The RMCR report combines your three credit reports from the three national credit bureaus, Equifax, Experian, and TransUnion. Each credit reporting agency calculates your credit score or FICO Score differently. Therefore, pulling from all three bureaus gives lenders a more complete picture of your credit behavior.

Once pulled, lenders use the average of these three scores, usually the middle score, to determine loan qualification and interest rate. For example, if Equifax gives you a 720, Experian a 730 and TransUnion a 740, the lender will use the 730 FICO Score to help determine the terms of your mortgage. If you are applying for a loan jointly, your partner’s three reports will also be pulled.

What does FICO stand for?

FICO stands Fair, Isaac and Company. Over 25 years ago, lenders began using FICO’s scoring model, or algorithm, to fairly and more accurately determine a person’s credit risk. Since it’s inception, FICO’s continually updates its’ algorithms to reflect more current lending trends and consumer behaviors. Today, FICO Scores are used by over 90% of enders. Importantly, your FICO score can impact your loan interest rates, terms, approvals and more.

What determines my FICO score?

A Mortgage FICO score is determined by an algorithm that generally looks at five credit factors including payment history, current level of indebtedness, types of credit used, length of credit history and new credit accounts.

What’s a good FICO score?

To qualify for a conventional loan, most Mortgage lenders require a FICO score of 620+. The best interest rates go to borrowers with a 740+ FICO score. For each 40 point drop, borrowers can expect to see a slightly higher interest rates by about 0.2 percentage points. If a borrower drops below 660, the increase is likely to be twice as big, a 0.43 percentage point increase. If your credit score is below 620, it is very difficult to get a conventional loan in today’s marketplace. However, don’t be discouraged. You may still be able to buy a home.

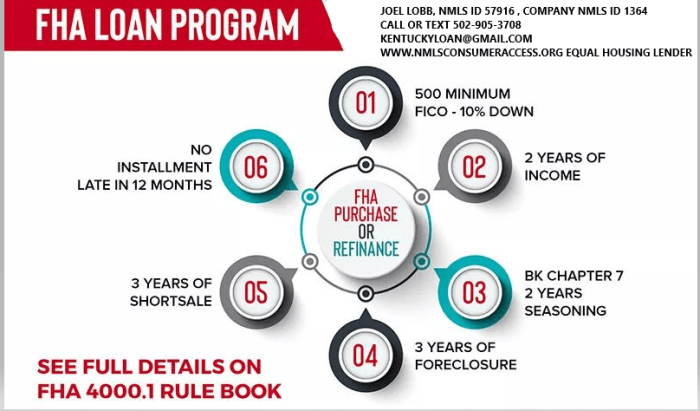

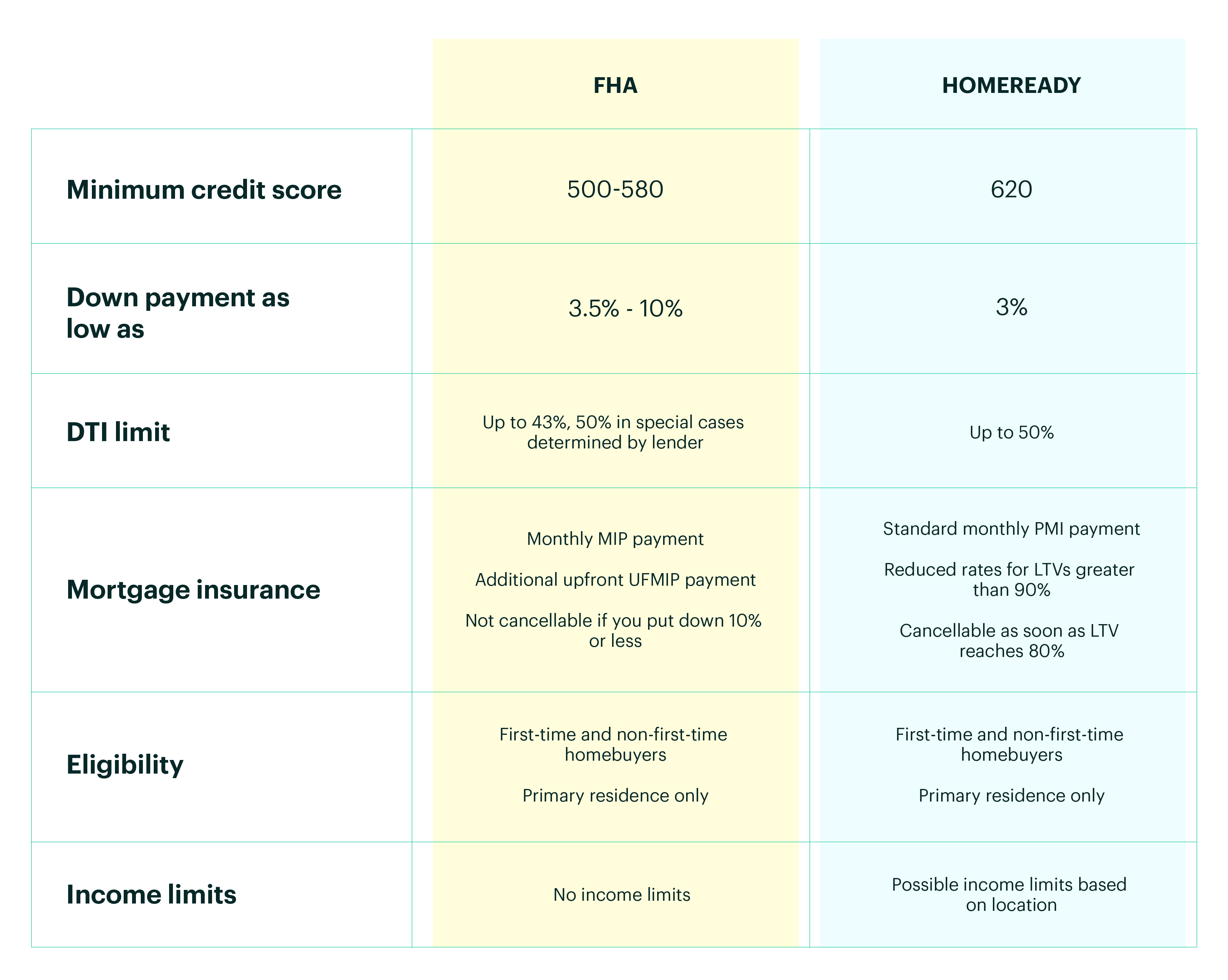

What if my FICO or credit score is below 620?

If your score is below 620, you may still be able to buy a home. There are several options:

Can I get a copy of my credit report after a lender has pulled it?

Yes! In fact, you can get one free credit report every twelve months from each of the nationwide credit bureaus—Equifax, Experian, and TransUnion. You may also purchase your credit score at any time from any of the credit bureaus. Some Mortgage lenders will tell you your score when you apply for a loan or even give you a copy of your report but they are not required to do so. However, if a lender denies you credit, under the Fair Credit Reporting Act (FCRA) you are entitled to a free copy of your personal credit report if you have received notice that in the past 60 days you have been declined credit.

You ALWAYS get a free copy of your credit report from me.

If you’re ready to buy a new home and want to shop around for the best deal on a mortgage…

Looking for a mortgage, auto or student loan may cause multiple lenders to request your credit report, even though you are only looking for one loan. To compensate for this, the score ignores mortgage, auto, and student loan inquiries made in the 30 days prior to scoring. So, if you find a loan within 30 days, the inquiries won’t affect your score while you’re rate shopping. In addition, the score looks on your credit report for mortgage, auto, and student loan inquiries older than 30 days. If it finds some, it counts those inquiries that fall in a typical shopping period as just one inquiry when determining your score. For FICO scores calculated from older versions of the scoring formula, this shopping period is any 14 day span. For FICO scores calculated from the newest versions of the scoring formula, this shopping period is any 45 day span. Each lender chooses which version of the FICO scoring formula it wants the credit reporting agency to use to calculate your FICO score.

What Type of Loan Are You Looking For?

40 year fixed, 30 year fixed, 20 year fixed, 15 year fixed, 10 Year Fixed, Adjustable Rate, etc. All of these loan types have different interest rate ranges.

Locking Your Interest Rate

Once you have completed a loan application, determined what type of loan you want and qualified for that loan you can “lock” the interest rate for that loan. Locking the Interest Rate means, for the period of the “lock” you are guaranteed that interest rate. Lock periods are typically 15, 30 or 60 days, although you may be able to get an extended lock period.

Once you lock your interest rate:

If you do not close on the loan before the lock period expires, you will NOT have a guaranteed interest rate anymore. And, the longer the lock period, the higher the rate will be. For example, a 15 day lock may be at 5.125%, a 30 day lock at 5.25%, and a 60 day lock at 5.375%. So, before locking your loan, be sure you are not locking for too long a time or for too short a time.

Interest rates fluctuate daily and may go up or down. By locking your rate, you are betting that rates will go up in the future.

What does “Buying Down” the Interest Rate Mean?

You can reduce the interest rate on your mortgage by paying “points” at closing. A point is 1% of the value of the loan, so a point on a $200,000 loan is $2,000. If you “buy down” you loan to a lower interest rate you will have lower monthly payments and pay less interest over the life of the loan. However, “buying down” you loan to a lower interest rate means more money out of your pocket on the front end when you close the loan. You should do the math and weigh each side of the equation before making a decision about buying down the interest rate or not.

What Are The Closing Costs and Fees?

There are four types of closing costs and fees…

Those charged by the mortgage company and/or mortgage broker, those charged by 3rd party vendors, those charged by the Title Company, Escrow Company or Escrow Attorney and Pre-Paid Charges.

Lender Fees

These can include loan origination fees and Broker fees which are usually a percentage of the loan amount; administrative fees and application fees, processing fees and underwriting fees. These last fees usually run from $100 to $500, and ALL of them are negotiable.

3rd Party Vendor charges

These are charges collected by the lender and paid to outside companies that provide a service. These are not usually negotiable and can include appraisal charges, flood certification fees, courier charges, document prep fees, mortgage lender attorney fees, etc.

Title Company charges

These are the fees charged by the Title Company, Escrow Company or Escrow Attorney. They are usually set by the state and are not negotiable. These charges include title insurance, attorney fees, state/county/city registration fees, etc.

Pre-Paid Charges

If the lender will be establishing an escrow account to pay taxes and insurance, the buyer will pre-pay taxes and insurance to establish an escrow account and will pre-pay the interest on the loan until the end of the month in which the loan closes.

Does The Closing Date Really Matter?

The day you choose to close determines the amount of pre-paid interest you will have to pay. Closing at the end of the month means that you will pay less pre-paid interest. For example, if you close on October 1st you will pay 31 days of pre-paid interest. If you close on October 31st you will pay 1 day of pre-paid interest.

When Is My First Payment Due?

It doesn’t matter what day of the month you close on, you will not have your first loan payment due until a month has passed. So, if you close in October, your first payment is due in December – you get November for free!

What Is PMI?

Private Mortgage Insurance (PMI) is required on all loans that have a LTV greater than 80%. PMI is an insurance premium that you pay every month as part of your monthly payment. However, PMI is not intended to protect you. PMI is insurance coverage that protects the mortgage lender against default on the loan. If you stop making your payments, the mortgage lender is paid a percentage of the loan amount (usually 25% to 35%) by the insurance company.

We suggest that our clients use a local mortgage lender and avoid the big banks. Local lenders provide excellent service, you talk to the same person throughout the loan process, if something is (or isn’t) happening with the loan they can easily check on it with someone right there in their office.

If you have mortgage questions, ask them in the comments section so others will get the answer too.

If you want a personalized answer for your unique situation call, text, or email me.

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people. NMLS ID# 57916, (www.nmlsconsumeraccess.org). Mortgage loans only offered in Kentucky.

Labels: 100% Financing, 2017 KY First Time Buyer Programs, conventional loans, down payment assistance, fha, First Time Home Buyers, grants first time home buyer kentucky, kentucky va mortgage, khc, rhs, usda

Fill out my form!

—

Posted By Blogger to Kentucky First Time Home Buyer Mortgage Loans

Kentucky FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans.

Kentucky FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans.