Kentucky FHA Loan Requirements – Updated for 2026

Kentucky FHA loan guidelines are established by the U.S. Department of Housing and Urban Development (HUD). FHA loans remain one of the most flexible mortgage options available to Kentucky homebuyers, particularly first-time buyers, borrowers rebuilding credit, and households using down payment assistance.

Employment and Income Requirements

Borrowers must demonstrate a stable employment history covering the most recent two years. This does not require the same employer, but the work history must show consistency in the same industry or line of work.

Recent college graduates may satisfy the two-year work history requirement by providing college transcripts, provided the current employment aligns logically with the education received.

Self-employed borrowers must document a minimum two-year history of self-employment and provide the most recent two years of federal tax returns filed with the IRS. FHA underwriting uses a two-year average of qualifying income, adjusted for business stability and trends.

All income must be verifiable through acceptable documentation such as pay stubs, W-2s, or tax returns. Cash income, undocumented deposits, or bank-statement-only income is not permitted for FHA qualifying purposes.

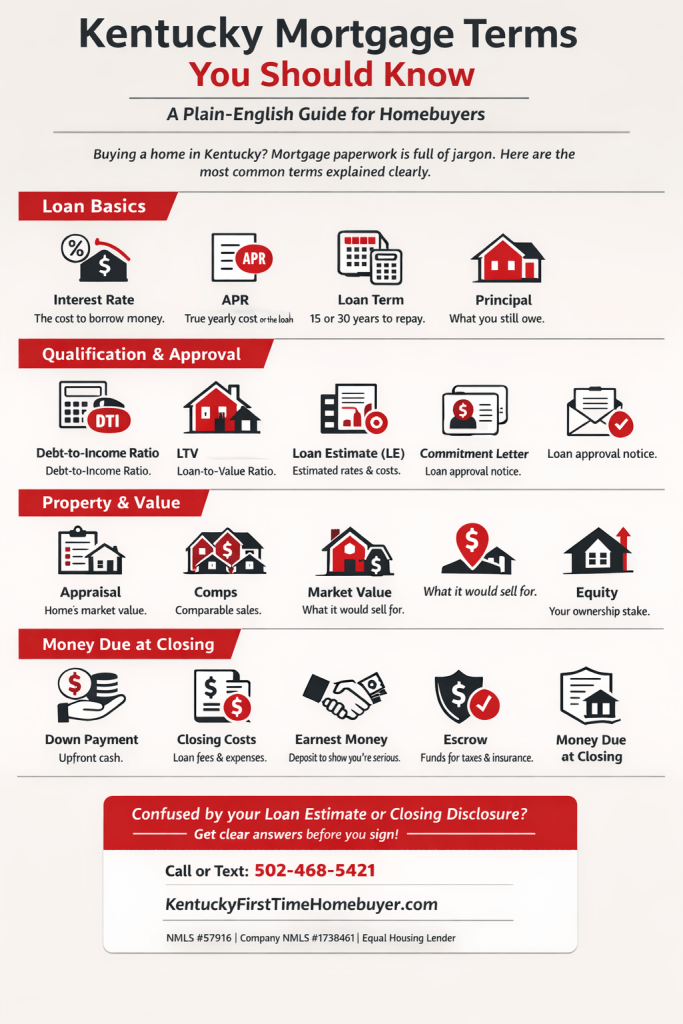

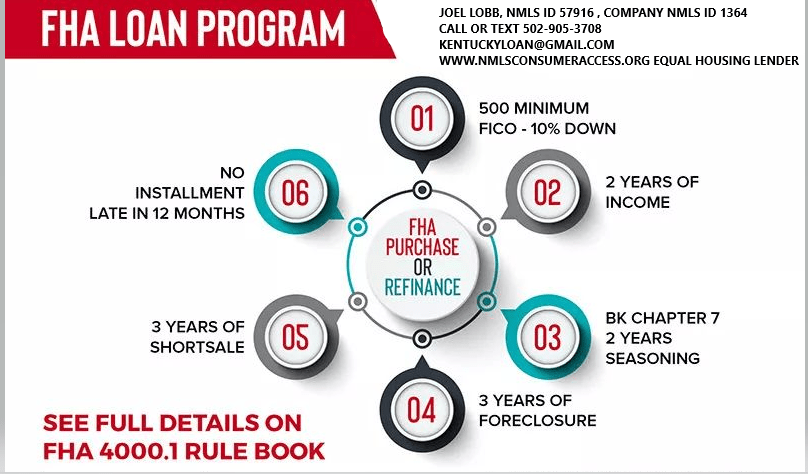

Down Payment Requirements

FHA loans require a minimum down payment of 3.5 percent for borrowers with credit scores of 580 or higher.

Borrowers with credit scores between 500 and 579 are limited to a maximum loan-to-value of 90 percent, requiring a minimum 10 percent down payment. In practice, most lenders apply overlays requiring higher credit scores, typically between 580 and 620, even though HUD technically allows lower scores.

Down payment funds must come from an approved source. Acceptable sources include personal savings, retirement account loans or withdrawals, and properly documented gift funds. Large or undocumented cash deposits are not allowed and remain one of the most common reasons for FHA loan delays or denials in underwriting.

Occupancy and Property Use

FHA loans are for primary residences only. The borrower must occupy the property as their primary home and move in within 60 days of closing. FHA financing may not be used for rental properties or investment homes.

Appraisal and Property Standards

The property must be appraised by a Kentucky-licensed, FHA-approved appraiser. The home must meet HUD’s minimum property standards, meaning it must be safe, sound, and secure.

Common appraisal concerns include peeling paint, exposed wiring, missing handrails, roof condition, and health or safety hazards. Most FHA appraisal issues are correctable prior to closing.

Debt-to-Income Ratio Guidelines

FHA evaluates two debt ratios:

The housing ratio (front-end), which includes principal, interest, property taxes, homeowners insurance, mortgage insurance, and HOA dues, is typically capped at 31 percent of gross monthly income.

The total debt ratio (back-end), which includes the housing payment plus all other monthly obligations reported on credit, is typically capped at 43 percent.

However, borrowers receiving an “Approve/Eligible” finding through FHA’s automated underwriting system may qualify with higher ratios, depending on credit scores, cash reserves, and other compensating factors.

Credit Score and Credit History Requirements

The minimum FHA credit score for maximum financing remains 580 in 2026. This does not guarantee approval, as lenders apply additional underwriting standards and overlays.

Borrowers must demonstrate acceptable recent payment history. FHA places significant weight on the most recent 12 months of credit performance.

Bankruptcy and Foreclosure Guidelines

Chapter 7 bankruptcy requires a minimum waiting period of two years from discharge, with re-established good credit and on-time payments afterward.

Chapter 13 bankruptcy may be eligible after at least 12 months of on-time plan payments, with trustee approval, and the borrower must qualify including the Chapter 13 payment.

Foreclosure generally requires a three-year waiting period from the date of foreclosure completion. Exceptions may be considered only for documented extenuating circumstances beyond the borrower’s control. Job relocation alone does not qualify as an extenuating circumstance.

Federal Debt and CAIVRS Requirements

Borrowers may not have delinquent federal debt, defaulted federal student loans, unpaid federal judgments, or unresolved FHA claims.

Lenders are required to check the CAIVRS (Credit Alert Interactive Voice Response System) database for all federally backed loans, including FHA, VA, USDA, and SBA loans. Title 31 of the U.S. Code prohibits delinquent federal debtors from receiving federal loan insurance or guarantees.

If a CAIVRS alert appears, the debt must be resolved or paid in full before closing.

FHA Gift Fund Rules for Down Payments

FHA permits gift funds for down payments and closing costs, provided there is no expectation of repayment.

Acceptable gift sources include relatives, employers, labor unions, close friends with a documented relationship, charitable organizations, and government or public entities.

Unacceptable gift sources include the seller, real estate agents, brokers, builders, or any party with a financial interest in the transaction.

A proper gift letter is required, stating that repayment is not expected. The donor must provide identifying information and documentation showing the transfer of funds from their account to the borrower.

Government and Employer Assistance Programs

Borrowers without access to family gift funds may qualify for state, local, or employer-assisted housing programs that provide down payment or closing cost assistance. In Kentucky, FHA loans can often be paired with Kentucky Housing Corporation (KHC) down payment assistance programs, subject to income limits and program availability.

How FHA Loans Are Used in Kentucky

FHA does not directly lend money. Instead, it insures loans made by FHA-approved lenders. These loans are designed for borrowers with limited down payment funds, past credit challenges, or non-traditional credit profiles.

Many Kentucky borrowers who do not qualify for conventional financing are still able to achieve homeownership through FHA-insured loans at competitive interest rates.

Pros and Cons of FHA Loans

Advantages include low down payment requirements, flexible credit standards, and the ability to combine FHA loans with down payment assistance programs.

Disadvantages include mandatory mortgage insurance. FHA charges an upfront mortgage insurance premium of 1.75 percent of the loan amount, which can be financed, and an annual mortgage insurance premium that ranges from approximately 0.45 percent to 1.05 percent depending on loan term, loan-to-value, and origination date. This annual premium is paid monthly and, in most cases, remains for the life of the loan unless refinanced.

Final Thoughts for Kentucky Homebuyers in 2026

FHA loans continue to be a practical, reliable option for Kentucky homebuyers who need flexibility without sacrificing long-term stability. While FHA guidelines are forgiving compared to conventional loans, preparation matters. Clean documentation, stable income, responsible credit behavior, and proper sourcing of funds are essential to a smooth approval.

Working with an experienced Kentucky FHA lender can help you navigate overlays, improve credit positioning, and pair FHA financing with available assistance programs.

Joel Lobb

NMLS #57916

Text or Call 502-905-3708

kentuckyloan@gmail.com

www.mylouisvillekentuckymortgage.com

Company NMLS #1738461

Equal Housing Lender

Information is provided for educational purposes only and does not guarantee loan approval. All loans are subject to underwriting guidelines, program availability, and lender approval.

Louisville Kentucky Mortgage Loans

Call/Text:

Call/Text:  Email:

Email:  Website:

Website:  Address: 911 Barret Ave, Louisville, KY 40204

Address: 911 Barret Ave, Louisville, KY 40204 Click here to apply for Free Info & Homebuyer Advice →

Click here to apply for Free Info & Homebuyer Advice →

Email –

Email – Address:

Address:  First-Time Home Buyers Welcome

First-Time Home Buyers Welcome