2023 WELCOME HOME PROGRAM FOR KENTUCKY HOME BUYERS, FHA, FHA APPRAISAL REQUIREMENTS, FHA APPROVED CONDO, FHA EXTENDS “ANTI-FLIPPING WAIVER”, FHA LOANS, FHA MORTGAGE GUIDE, FHA PROPERTY REQUIREMENTS, FHA STUDENT LOANS, FICO CREDIT SCORE, FICO CREDIT SCORES

Top 4 reasons why mortgage applications are denied

Kentucky First-Time Home Buyer Programs | USDA, FHA, VA & KHC Loans

Top 4 reasons why mortgage applications are denied

1. Debt-to-income ratio

Whether you go through a traditional bank or a mortgage lender, your debt-to-income ratio is one of the most important elements of your mortgage application. This ratio is a simple measure of how much debt you carry expressed as a percentage of the amount of money you earn before taxes and deductions each month.

To figure out your debt-to-income ratio, add up all of your monthly debts (including student loans, car payments, credit card bills, and other loans with fixed payments, but not including utilities bills and other variable monthly expenses) and divide it by your gross—or pre-tax—monthly earnings. Most mortgage lenders are looking for a debt-to-income ratio that doesn’t exceed 45 to 50 %, and that includes the mortgage payment you are applying to take on.

If your debt-to-income ratio is too high to consider taking out a…

View original post 966 more words

First-Time Homebuyer Louisville Kentucky Mortgage Programs

Accessibility Statement

100% Financing

100% financing Kentucky Home Loan

Down Payment Assistance Programs in Kentucky

First-Time HomeBuyer Louisville Kentucky Mortgage Programs

4 things needed for Mortgage Approval

VA loan

Kentucky VA Mortgage Frequently Asked Questions

Rural Housing Loans No Money Down Program

Kentucky Rural Housing USDA Loans

FHA

FHA Loans Kentucky Housing First time home buyer

Kentucky HUD Homes for $100 Down

welcome home funds ky

Grants

Credit Scores

Credit Scoresrequired for KHC

Credit Reports

Refinance of Mortgage

manufactured homes

Foreclosure

USDA Rural Development

Rural housing

USDA

Kentucky Housing Corporation (KHC)

Customer Testimonials From Real Kentucky Home Buyers😍😍

Refinancing

Documents Needed for a Mortgage Loan Approval

Debt-to-Income Ratio for Kentucky Mortgage Loans:

STUDENT LOANS

Louisville Kentucky Mortgage Loans

Kentucky First-Time Homebuyer Loan Programs for FHA, VA, KHC and USDA Mortgage Loans in Kentucky

- Accessibility Statement

- 100% Financing

- First-Time HomeBuyer Louisville Kentucky Mortgage Programs

- 4 things needed for Mortgage Approval

- VA loan

- Rural Housing Loans No Money Down Program

- FHA

- Kentucky HUD Homes for $100 Down

- welcome home funds ky

- Grants

- Credit Scores

- Refinance of Mortgage

- manufactured homes

- Foreclosure

- USDA Rural Development

- Kentucky Housing Corporation (KHC)

- Customer Testimonials From Real Kentucky Home Buyers

- Documents Needed for a Mortgage Loan Approval

- Debt-to-Income Ratio for Kentucky Mortgage Loans:

- STUDENT LOANS

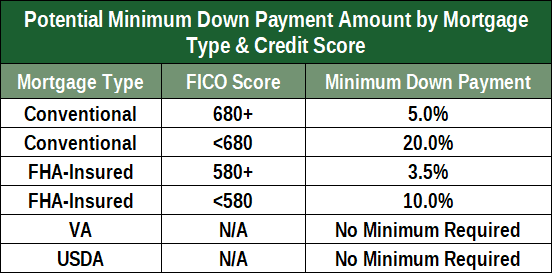

What credit score do you need for a mortgage?

What credit score do you need for a mortgage?

What credit score do you need for a mortgage in Kentucky for FHA, VA, USDA and Fannie Mae Home Loans?

Kentucky First-Time Home Buyer Programs | USDA, FHA, VA & KHC Loans

There’s no universal minimum credit score needed for a mortgage, but a better credit score will give you more options.

If you’re trying to get a mortgage, your credit score matters. Mortgage lenders use credit scores — as well as other information — to assess your likelihood of repaying a loan on time.

Because credit scores are so important, lenders set minimum scores you must have in order to qualify for a mortgage with them. Minimum credit score varies by lender and mortgage type, but generally, a higher score means better loan terms for you.

Let’s look at which loan types are best for different credit scores.

Credit score needed to buy a house

Mortgage lending is risky, and lenders want a way to quantify that risk. They use your three-digit credit score to gauge the risk of loaning you money since your credit score helps predict your likelihood of…

View original post 1,372 more words

FHA Announces Consideration of Positive Rental Payment History for First Time Homebuyers

The Federal Housing Administration (FHA) Mortgagee Letter (ML) 22-17 announced that FHA’s Technology Open To Approved Lenders (TOTAL) Mortgage Scorecard will begin scoring a borrower’s positive rental payment history as part of the credit risk analysis when they are applying for FHA-insured financing.

TOTAL will begin scoring on or after October 30, 2022, as well as for case numbers assigned on or after September 20, 2021, allowing lenders to implement the guidance on existing pipeline cases without the need to obtain a new case number.

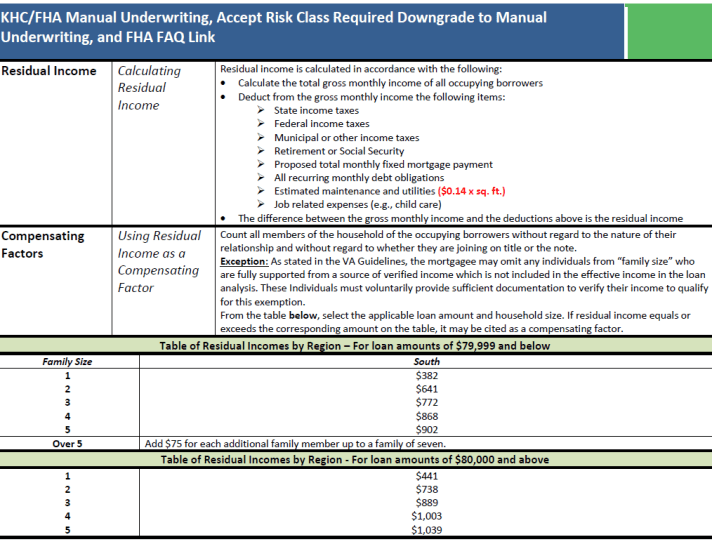

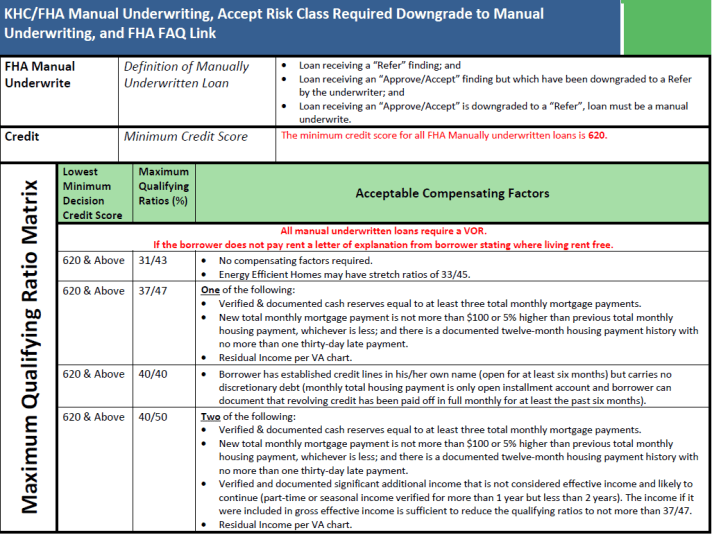

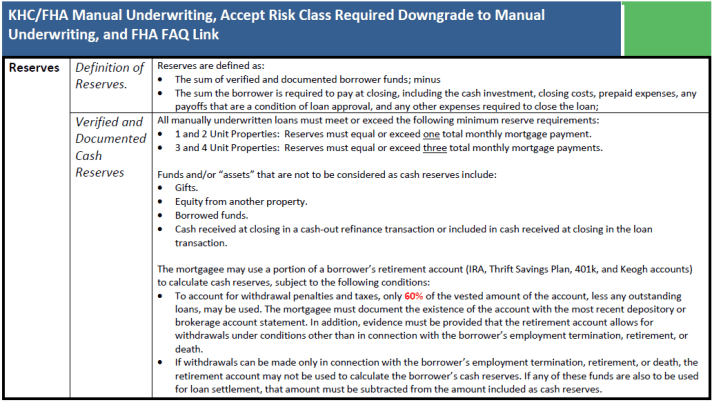

Kentucky FHA Manual Underwriting Guidelines for Approval

Kentucky FHA loans are manual underwrites #fhaloans #fha #fha2022 #fhaloan #mortgage

#homeloan #khcloan #kentuckyhousing #downpaymentassistance #kentuckymortgage #kentuckyrealestate #louisvillerealestate

Louisville Kentucky Mortgage Loans

Kentucky FHA loans are manual underwrites #fhaloans #fha #fha2022 #fhaloan #mortgage

#homeloan #khcloan #kentuckyhousing #downpaymentassistance #kentuckymortgage #kentuckyrealestate #louisvillerealestate

#homeloan #khcloan #kentuckyhousing #downpaymentassistance #kentuckymortgage #kentuckyrealestate #louisvillerealestate

—

Mortgage Loan Officer

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

Kentucky FHA Appraisal Requirements for Validity Period

The following update aligns with FHA Mortgagee Letter 2022-11 and is effective for all FHA loans with case numbers assigned on and after June 1, 2022.

Appraisal Validity Period

Loans with case numbers assigned prior to June 1, 2022

Loans with case numbers assigned on and after June 1, 2022

• The initial appraisal validity period is 120 days from the effective date of the appraisal.

• The 120-day validity period may be extended for 30 days at the option of the underwriter if the conditional commitment is issued before the original appraisal expiration date.

• An appraisal update may be used to extend the validity period of the initial appraisal. The appraisal update must be performed before the initial appraisal with no extension has expired.

• When the initial appraisal is updated, the updated appraisal will be valid for 240 days after the initial appraisal effective date.

• The initial appraisal validity period is 180 days from the effective date of the appraisal.

• If the initial appraisal will be more than 180 days at the disbursement date, an appraisal update may be performed to extend the appraisal validity period.

• When the initial appraisal is updated, the updated appraisal will be valid for one year after the initial appraisal effective date.

With these updates, the optional 30-day extension is no longer necessary and has been eliminated. In addition, the requirement for the appraisal update to be performed before the initial appraisal has expired has been removed.

Mortgage Loan Officer

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

Quick Guide to Kentucky USDA Rural Development Loans Approval Requirements

close a Kentucky Rural Housing Loan in Kentucky?

June 10, 2022

In “2022 Kentucky USDA Income and Property Guidelines”

Kentucky Rural Housing Development Mortgage Guide for USDA Loans

close a Kentucky Rural Housing Loan in Kentucky? June 10, 2022 In “2022 Kentucky USDA Income and Property Guidelines” Kentucky Rural Housing Development Mortgage Guide for USDA Loans

Kentucky FHA Mortgage Loan Lender Guidelines

- fha (27)

- fha credit scores (17)

- FHA Good Neighbor Next Door (2)

- fha income requirements (3)

- FHA Mortgage Insurance 2017 Kentucky FHA Changes Mortgage (1)

- FICO (7)

- fico scores first time home buyer (13)

- first time buyer (3)

- First Time Home Buyers (8)

- foreclosure (5)

- Gaps in Employment (2)

- gift funds (3)

- grants first time home buyer kentucky (2)

- home inspections (1)

- home insurance (1)

- homeready (1)

- income (6)

- inspections for home (1)

- job change (3)

- Job Changes (2)

- job gaps (4)

- job time (4)

- kentucky fha appraisal (3)

- kentucky fha loans (16)

- Kentucky First Time Home buyer zero down payment (21)

- Kentucky first Time Home Buyers (14)

- kentucky housing (1)

- Kentucky USDA Streamline Refinance Pilot (3)

- kentucky va loans (17)

- khc (4)

- khc credit scores (9)

Kentucky FHA Loan Changes for 2022

Here’s what you need to know about Kentucky FHA Loans and the changes that have been made for 2022.

What is a Kentucky FHA loan?

It stands for a Federal Housing Administration loan, meaning it is backed by the U.S. government. It is not made by a government agency. You deal directly with a mortgage lender or broker to get the loan, but the FHA will typically buy the loan from the lender after it is made or guarantee the lender against loss. FHA loans typically require lower down payments and credit scores than most conventional loans, making them a clear favorite among first-time buyers.

What Are the Terms?

These loans can have terms of either 30 years or 15 years. The interest rate is fixed for the entire loan length.

FHA borrowers are required to pay mortgage insurance premiums, but after a borrower’s equity in their home increases they may be able to refinance into a conventional loan and eliminate the monthly mortgage insurance premiums.

What Are the Qualifications?

To qualify for an FHA mortgage, home buyers need a FICO credit score of 580 or higher and a down payment of 3.5% (or a minimum down payment of 10% with a 500 FICO score).

These loans also require a two-year employment and income verification and the property as must be used as a primary residence.

If a borrower has had a bankruptcy, they must wait one to two years depending on if Chapter 13 or Chapter 7 before applying and three years after a foreclosure.

Increased Loan Limits for 2022

In 2022, for most parts of the U.S., Kentucky FHA borrowers can take out a loan for up to $420,680, an increase from 2021’s limit of $356,362.