Interest Rate Decrease for SFH Direct Programs October 17, 2019 Programs Current Interest Rate Interest Rate Effective 11/1/19 Section 502 Direct – Program Loans 3.125% 3.000% Section 502 Direct – Non-Program Loans 3.625% 3.500% Section 524 Housing Site Development Loans – Non-Self-Help 3.125% 3.000% For Program Information Single Family Housing Direct Loans Single Family […]

What is a Kentucky Mortgage Rate Lock?

Locking in a Kentucky Mortgage Rate?

Louisville Kentucky Mortgage Loans

via What is a Kentucky Mortgage Rate Lock?

Senior Loan Officer

(NMLS#57916

text or call my phone: (502) 905-3708

email me at kentuckyloan@gmail.com

View original post 1 more word

How to Buy a Home with a Student Loan Debt

Buying a home can be a nerve-wracking experience, especially if it’s your first time. It may feel even more so if you’re still saddled with student loan debts.

Source: How to Buy a Home with a Student Loan Debt

Buying a home can be a nerve-wracking experience, especially if it’s your first time. It may feel even more so if you’re still saddled with student loan debts.

Does your income-driven repayment plan has Do you have Federal student loans in it? Do you know how your lender will handle your debt to income ratio?

These are just some of the factors that you need to put into consideration when planning to buy a house. It might just be not that easy since you also have to factor in your student loan debts.

To make the process less intimidating for you, here are the things you need to do.

Pay Attention to Your Credit Score

FICO credit scores are among one of the most commonly used scoring systems by lenders and creditors whose range plays in between 350 to 800. A consumer with a credit score below 620 is considered to have poor credit, while those with credit scores of 750 or higher is considered to have excellent credit.

Now, if you want to qualify for a home improvement financing or a mortgage and nail a low mortgage rate, make sure your credit score is in good shape. Whenever you apply for a mortgage, every credit bureau gathers information about your credit history and calculate your credit score that lenders will use to gauge your risk factor.

If you find an error or any inconsistencies in your credit report, report it immediately to the credit bureau and have it fixed.

Your DTI (debt-to-income ratio) is one of the major factors that lenders consider when you apply for a mortgage loan. It’s the ratio of the total amount of your recurring debt every month with your monthly gross income.

To calculate your DTI, add up all of your recurring monthly debt such as student loan payments, minimum credit card payments, or car loan payments, then divide it by your pre-tax (the amount you earn before taxes and other withholdings) income every month.

Since your debt-to-income contains two main components: debt and income, the efficient way to reduce it is to:

earn more income

repay existing debt

do both

Pay Attention to Your Payments

Case in point: Lenders will approve the application of those who are financially responsible.

Know it that your payment history takes up one of the biggest portions of your credit score. Thus, to make sure that you pay on time, set up an autopay system for all your accounts so that funds are automatically debited every month.

Moreover, your FICO is being weighed heavily by current payments, which means your future will matter more than your past. Make sure also to do the following:

Pay off the balance if you have a delinquent payment.

Do not skip payments.

Pay on time.

The common cycle for home buyers is to look for a property, then get a mortgage. You have to switch it.

It’s better if you get yourself pre-approved with a lender, so you will know how much you can afford for a home. To get pre-approved, lenders will look at your income, credit profile, employment, assets, to name a few.

Besides your credit score and DTI, your lenders also assess your credit card utilization score, or your credit card expenses as a percentage of your credit limit every month. The ideal credit utilization must be 30% or less. Even better, keep it less than 10% if possible.

For instance, if you have a $20,000 credit card limit and spent $6,000, your credit utilization is equivalent to 30%.

If you want to regulate your credit card utilization better, here are the things you can do:

Talk with your lender about increasing your credit limit. It may require a hard credit pull so better consult your lender first.

Pay off your balance at least twice a month to lessen your credit utilization.

To track credit utilization, set up alerts for automatic balance.

Even if you have outstanding student loan debts, you can still seek for different down payment assistance. You can start with the following:

USDA loans. These loans have zero-down mortgages for suburban and rural homeowners.

FHA loans. Acquire federal loan through the Federal Housing Authority.

VA loans. You can avail these loans if you’ve served in the military service.

There are local, state, and federal assistance programs as well that you can resort to.

If paying off your credit card balance is impossible before getting a mortgage, you can consolidate your credit card debt into one personal loan for a lower interest rate.

Taking a personal loan can help you save big on you on interest expenses over the repayment term, which usually lasts for three up to7 years, depending on the lender. It can also enhance your credit score since it’s an installment loan with a fixed repayment term.

On the flip side, credit cards have no fixed repayment terms because they are revolving loans. When such is the case, you can minimize your credit utilization and diversify your debt types whenever you trade your credit card debt for a personal loan.

Takeaway

Buying a home while grappling with student loan debts can be taxing. Your likelihood to get a mortgage for a property will depend on your loans. It can result in disappointment if your loans are in bad shape.

Now, if you don’t evaluate your student loan picture and ensure that you’re taking all the necessary steps to be successful, getting that mortgage will be impossible. It might not work all the time, but arming yourself with the right knowledge to get there is the beginning of your homeownership journey.

© 2017 University Herald, All rights reserved. Do not reproduce without permission.

Kentucky Manufactured Home Loans for Doublewide Mobile Homes for FHA, VA, USDA, KHC and Fannie Mae

Kentucky Manufactured Home Loans for Doublewide Mobile Homes for FHA, VA, USDA, KHC and Fannie Mae

Louisville Kentucky Mortgage Loans

via Kentucky Manufactured Home Loans for Doublewide Mobile Homes for FHA, VA, USDA, KHC and Fannie Mae

| Kentucky Manufactured Home Loans for Double wide Mobile Homes Now Available

|

Senior Loan Officer

View original post 116 more words

Kentucky HUD Homes for Sale with the FHA $100 Down Program

Kentucky HUD Homes for Sale with the FHA $100 Down Program

Kentucky FHA Property Flipping Guidelines

Sales by HUD of Real Estate-Owned (REO) properties under 24 CFR part 291 and of single family assets in revitalization areas pursuant to section 204 of the National Housing Act (12 U.S.C. 1710);

Sales by another agency of the United States Government of REO single family properties pursuant to programs operated by these agencies;

Senior Loan Officer

Text/call 502-905-3708

kentuckyloan@gmail.com

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant’s eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916http://www.nmlsconsumeraccess.org/

— Some products and services may not be available in all states. Credit and collateral are subject to approval. Terms and conditions apply. This is not a commitment to lend. Programs, rates, terms and conditions are subject to change without notice. The content in this marketing advertisement has not been approved, reviewed, sponsored or endorsed by any department or government agency. Rates are subject to change and are subject to borrower(s) qualification.

3 Reasons Your Credit Scores Are Low

Card Payments To Maximize Your Credit Scores

In “Credit Card Utilization”

Why Credit Cards Are Good For Your Credit Score

View original post 190 more words

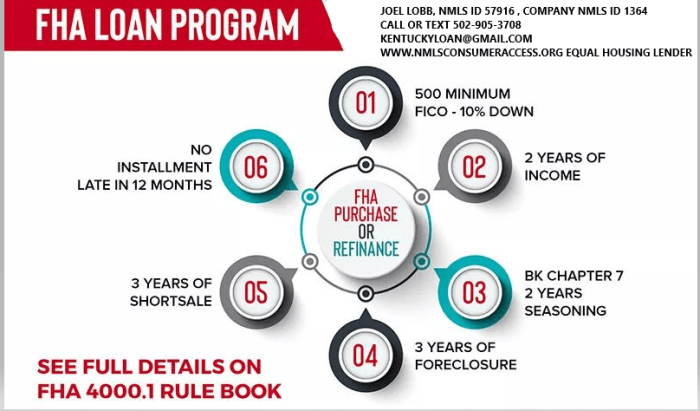

What are the requirements to qualify for a Kentucky FHA Mortgage?

What are the requirements to qualify for a Kentucky FHA Mortgage in 2020?

Kentucky FHA loan is a mortgage that is insured by the Government agency under Housing and Urban Development that is called FHA or short for Federal Housing Administration. The loan was established for Kentucky Home buyers will very little or no money down home loans with more lenient credit score and income requirements and tends to be more forgiving about credit history with regard to bankruptcy and foreclosures, higher debt to income ratios and job history with limited work history for home buyers will only 2 years work history or less.

Kentucky FHA Credit Score Requirements and Down Payment Requirements

The Kentucky FHA home loan program may accept credit scores as low as 580 and require at least a 3.5 percent down payment of the sales price on a purchase. If you have a credit score below 580, then a 10 percent down payment or more may be acceptable some FHA lenders in Kentucky , providing you meet all program guidelines in regards to debt to income ratios, assets, and income requirements . The loan cannot be used for rental properties and does allow for co-signers if they are related.

Remember, these guidelines are set forth by FHA and all lenders do not have to offer these guidelines, to whereas they may a higher credit score or more money down or income restrictions on how much you can qualify for.

Kentucky FHA Mortgage Loans and Bankruptcy or Foreclosure

In case you had a blemish on your credit report with a bankruptcy, short sale or foreclosure, follow these guidelines.

Kentucky FHA loans requires a passage of two years since the discharge date of a chapter 7 bankruptcy. A chapter 13 bankruptcy may be acceptable after at least 12 months of an on time pay-back period and the borrower has received permission from bankruptcy court to enter the mortgage transaction, and you qualify with the new house payment along with other debts on the credit report.

Three years must pass if you went through a short sale or foreclosure. The date starts when the home was sold, not when you entered the transaction toward foreclosure or short sale period. Sometimes the house will not sell to 1-2 years later after the foreclosure and this is when the passage date starts. Keep this in mind on your next FHA loan pre-approval if you have had a bankruptcy or foreclosure in the past.

Kentucky FHA Loans and Mortgage Insurance

FHA loans have two forms of mortgage insurance which protects the lender for any losses suffered if the borrower defaults on the payment. ne is called upfront mortgage insurance premium (UFMIP) which has a rate of 1.75% of the loan amount. The fee can be added to the loan amount or paid in full as part of your closing costs. In addition, FHA loans also have a 0.8-0.85% (of the loan amount) monthly mortgage insurance. In most cases, this mortgage insurance remains for the life of the loan. To eliminate the mortgage insurance, the borrower must refinance the loan into a non-FHA loan program and have 20% equity in the property.

In addition to the down payment requirements on a FHA loan, they’re closing costs and prepaids to pay at closing. The seller can contribute up to 6% of the sales price to help the buyer with closing costs and prepaid expenses. Closing costs vary from lender to lender and your prepaids would be the same no matter which lender you choose because this is a function of the property ‘s home insurance premium quote you obtain and the property tax bill on the home set by PVA.

Sometimes the lender can pay a credit toward these expenses at closing with a lender credit which lets the lender credit back to you with a higher rate to reduce the costs of the loan’s costs at closing for out of pocket expenses.

All Kentucky FHA loans are assumable, which means that when the homeowner sells a home, the buyer may be able to take on the existing loan and terms (e.g.: balance, rate and remaining loan amount). Of course, anyone interested in the assumable loan feature must go through the approval process (credit check, income verification) with the current lender on the property. This is a very rare occurrence because most sellers are going to sell the home for more than they owe on it.

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people. NMLS ID# 57916, (www.nmlsconsumeraccess.org). USDA Mortgage loans only offered in Kentucky.

All loans and lines are subject to credit approval, verification, and collateral evaluation

Credit Scores Needed To Qualify For A Kentucky Mortgage Loan Approval?

USDA , Fannie Mae Home Loans

In “Credit Scores and Credit Report”

What Credit Score do You Need to qualify for a FHA VA KHC USDA Kentucky Mortgage

Louisville Kentucky Mortgage Loans

What Credit Score do You Need to qualify for a FHA VA KHC Kentucky Mortgage What Credit Score do You Need to Buy a Kentucky Home? When it comes to mortgages and credit scores, there are two really…

What Credit Score do You Need to qualify for a FHA VA KHC Kentucky Mortgage What Credit Score do You Need to Buy a Kentucky Home? When it comes to mortgages and credit scores, there are two really…

Source: Credit Scores Needed To Qualify For A Kentucky Mortgage Loan Approval?

FHA’s New Student Loan Rule Could Impact Mortgage Borrowers

Last month, the FHA changed its rules for how it deals with student loan deferments and mortgage applications.

Source: FHA’s New Student Loan Rule Could Impact Mortgage Borrowers

But some of that leniency, at least when it comes to student loan debt, changed on September 14, when the FHA tightened its requirements for how mortgage lenders treat deferred student loan debt. In the past, student loan debt that was deferred for more than 12 months before the mortgage closing date wasn’t counted in the debt-to-income ratio. Now, 2% of that debt is included in the calculation, which could raise some borrowers’ debt-to-income ratio above the threshold to qualify for a FHA home loan. In the past, if you had $45,000 in student loan debt deferred, zero of it would be counted as debt. Now 2%, or $900, would be included in the ratio as a payment you owe each month.

“Effectively, the FHA is attempting to promote responsible borrowing by accounting for debt that will ultimately need to be addressed,” says Megan Greuling, a spokeswoman at LendingTree.com. “Once a deferred loan payment is eventually due, a borrower’s income may not support both the FHA home loan and the new student loan payment.”

Nobody is expecting the new rule to prevent the majority of people applying for FHA loans to get rejected. But there are people who have a high amount of student loan debt who may be shut out of the FHA program because of the new rule. After all, according to Edvisors, the average student loan debt a 2015 graduate will have to pay back is slightly more than $35,000 for a bachelor’s degree, $51,000 for a Master’s and $71,000 for a Ph.D. And that’s not to mention the countless people who graduate school with loans in excess of $100,000.

THERE ARE OPTIONS TO DEAL WITH NEW RULE

For mortgage borrowers who have student loans in deferment, there are options. According to mortgage experts, because the FHA is calculating the monthly student loan payment to be 2% of what is in deferment, borrowers who get their loans out of deferment and start paying them back will likely see a lower debt-to-income ratio. That’s because the chances are high that the payment you make each month is actually going to be less than 2% of the loan or loans in deferment. Doing that effectively lowers your debt-to-income ratio, which could be what you need to get approval for a FHA mortgage. Susan Paul of Better Homes and Gardens Real Estate Move Time Realty says borrowers can also get documentation directly from the student loan company for loans in deferment to show the actual payment they will make once the loan comes due.

Another option, says Bill Banfield, a Quicken Loans vice president, is to shop for a smaller or cheaper home, put off the purchase until the borrower has money to put down, reduce some of the student loan debt before purchasing or target other areas to improve the debt-to-income ratio.

Because this rule is for FHA mortgages, borrowers can also apply for non-government backed mortgages as an alternative, says Greuling. While other mortgage loans typically have higher down payment requirements than the 3.5% the FHA loan requires, there are some banks and mortgage lending institutions that will qualify borrowers with low down payments. She pointed to Fannie Mae, which owns a majority of conventional mortgages, and its My Community program for first-time buyers. Borrowers only need a 3 percent down payment. “If you’re a student debt-holding hopeful homebuyer, speak with several different lenders and ask as many questions as needed to get a clear picture. Each scenario is different and loan programs have different requirements,” says Greuling.

Whether borrowers with student loan debt plan to apply for a FHA mortgage or a conventional one, it’s a good idea to understand what their student loan payment will be once it comes out of deferment. Because student loans represent money that people borrow and don’t have to think about for years, it’s easy to forget about it when it comes time to shop for a new home. But if borrowers have a sense of what their student loan payments are going to be, knowing that amount of ahead of time will help for planning and budgeting purposes. After all, the last thing a borrower wants is to end up with a mortgage and a student loan that they can’t make the payments on.

Congress Passes VA Loan Bill for Kentucky VA Home Buyers

Congress Passes VA Loan Bill for Kentucky VA Home Buyers

The President is expected to sign H.R. 299, the “Blue Water Navy Vietnam Veterans Act.” This legislation includes language which will eliminate the cap on the VA home loan guarantee. Veterans, under this legislation, will be able to purchase any home they qualify for using the VA home loan (with zero down payment).As introduced, the legislation would slightly increase some of the guarantee fees for all veterans using the VA loan program, in order to pay for the healthcare component. NAR opposed this language, and in conjunction with other groups, was able to mitigate the impact of these increases. NAR will continue to work with the VA on implementing the loan limit provision and assuring all veterans have access to the home loan benefit.

Louisville Kentucky Mortgage Loans

via Congress Passes VA Loan Bill for Kentucky VA Home Buyers

Congress Passes VA Loan Bill for Kentucky VA Home Buyers

The President is expected to sign H.R. 299, the ‘Blue Water Navy Vietnam Veterans Act.’ This legislation includes language which will eliminate the cap on the VA home loan guarantee.