2020 KY USDA Rural Housing Income Limits for Kentucky Counties for the Guaranteed RHS Loan

Rural Housing Requirements For USDA Loans In Kentucky

Kentucky Mortgage USDA Loans Zero Down Home Loans Still Exist

Louisville Kentucky Mortgage Loans

via Rural Housing Requirements For USDA Loans In Kentucky

Kentucky Mortgage USDA Loans Zero Down Home Loans Still Exist

A Complete Guide to Closing Costs in Kentucky

Kentucky First-Time Home Buyer Programs | USDA, FHA, VA & KHC Loans

Mortgage Costs for A Kentucky Mortgage Loan

|

View original post 262 more words

Kentucky FHA Down Payment Requirements, Credit Scores and Mortgage Insurance

How Credit Scores Impact Kentucky FHA Loan Down Payment Requirements

Kentucky Home Buyers credit scores are one of the largest factors in determining the amount of a down payment for an FHA loan. A credit score of 580 or higher, 3.5 percent is the minimum required for a down payment. Anyone with a credit score of 500 to 579 will have to save 10 percent for a down payment to obtain an FHA loan.

What Are Mortgage Insurance Requirements on Kentucky FHA Loans?

FHA loans are required to pay mortgage insurance premiums, often known as upfront mortgage insurance premiums and monthly annual premiums.

- Upfront mortgage insurance premium: 1.75 percent of the loan amount and is paid when the borrower gets the loan. The premium can be rolled into the mortgage.

- Annual mortgage insurance premium: 0.45 percent to 1.05 percent, depending on the term of the loan (15 years vs. 30 years), the loan amount and the initial loan-to-value ratio, or LTV. This premium amount is divided by 12 and paid monthly.

For a homeowner who borrows $150,000, this means the upfront mortgage insurance premium would be $2,625 and your annual premium would range from $675 ($56.25 per month) to $1,575 ($131.25 per month), depending on the length of the mortgage.

Unlike traditional mortgage insurance premiums, homeowners are required to pay FHA premiums for the entire term of the mortgage. The only time you can stop paying them is to refinance into a non-FHA loan or to sell the house.

Down Payment Gifts and Rules for Kentucky FHA Loans Kentucky borrowers choose an FHA loan can receive money as a gift to help towards the total amount of the down payment.

There are several rules that homeowners need to keep in mind. Gifts can come from friends, family members, labor unions and employers, according to data from the Department of Housing and Urban Development (HUD).

Even non-profit organizations can provide money for a contribution toward a down payment.

In addition, each state offers various assistance programs for down payments for both FHA buyers in Kentucky lacking the down payment.

People obtaining an Kentucky FHA loan are also eligible for these programs. I.e. Kentucky Housing Dap Funds, Welcome Grants In Kentucky

How is an FHA loan different from a regular mortgage?

FHA loans also have lower down payment percentages than conventional mortgages, and the interest rates are typically lower. At time, you can even qualify for an FHA loan with a lower credit score. FHA minimum down payment is 3.5% with a 580 credit score and if credit score is between 500 to 579 FHA will require 10% down payment.

Is an FHA loan the right fit for me?

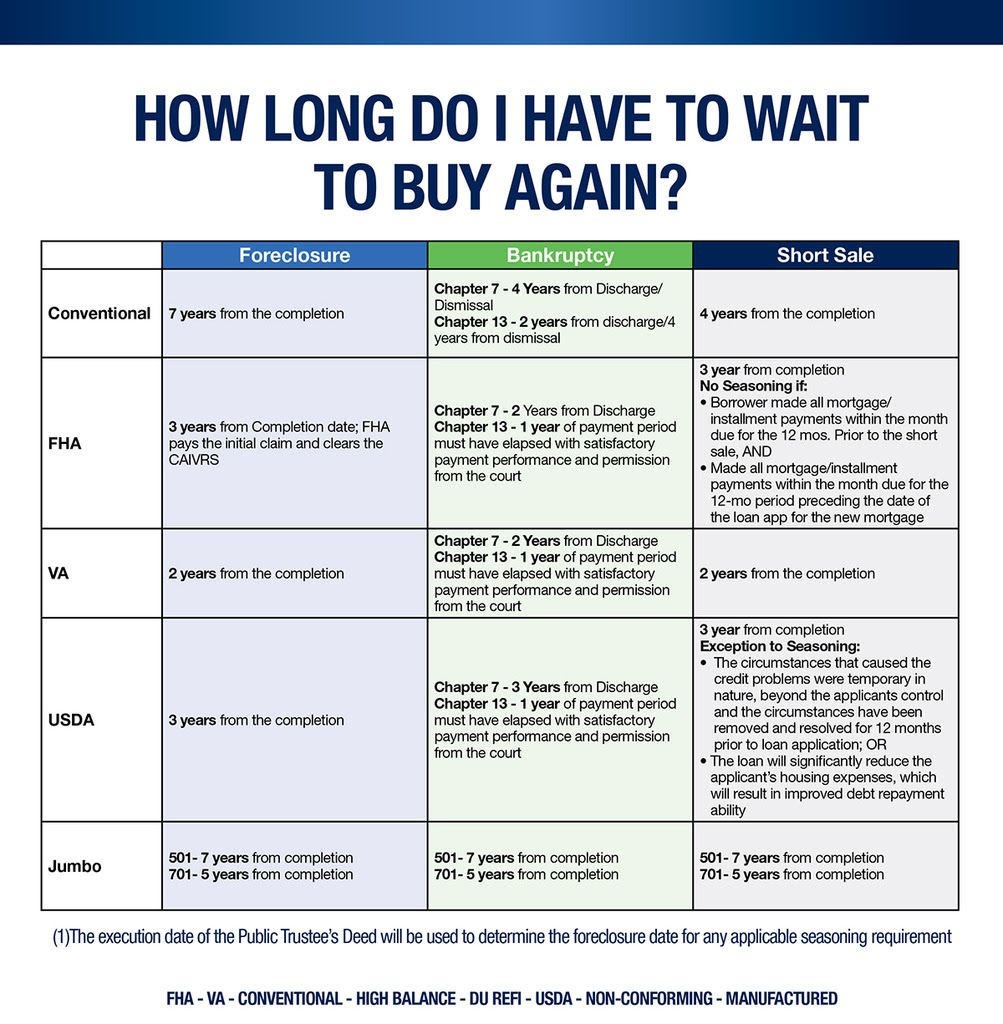

An FHA loan may be for you if you are looking for a lower down payment, if you’re credit score isn’t perfect or you tried for a conventional loan and you got denied. Typically credit scores below 620, debt ratios higher than 45%, and a bankruptcy or foreclosure in that has been discharged for at least 2-3 years, 2 years for a bankruptcy and 3 years for foreclosure, you need to be looking at an FHA loan.

How does Kentucky FHA Mortgage Rates work?

Kentucky FHA mortgage loans are backed by the Federal Housing Administration under the umbrella of HUD. FHA loans were developed to help borrowers that don’t have a large down payment and a weaker credit profile to buy and refinance their home mortgage loan.

Kentucky FHA rates are backed by the government, so they are typically lower than other mortgage rates in the secondary market like Conventional loans and portfolio loans at banks, but fall in line compatible to other backed government loans in the secondary market likeUSDA, VA, mortgage loans. Most people seeking FHA mortgages will get a 30 year, 20 year of 15 year fixed rate loan with the security of the house payment not changing.

Lower Credit Standards and Credit Scores for FHA loans

FHA mortgages will go down to a 500 credit score with at least 10% down payment, and if your credit score is higher than 580, you can put the minimum of 3.5% down payment. Additionally, you need to be only 2 years removed from a Chapter 7 bankruptcy, or 1 year from a Chapter 13 bankruptcy.

Mortgage Insurance on FHA loans

Mortgage insurance is required on most FHA loans and is usually for life of loan with everyone paying the same. If you have a higher credit score and a larger down payment, it would make sense to look at doing a conventional mortgage loan because they are based on your credit score, money down, and debt to income ratio and not for life of loan.

You can get a lower FHA mortgage insurance premium and not have to finance the premiums for life of the loan if you put more than 10% down payment and finance on a 15 year term.

Why would you consider a FHA mortgage?

My best opinion is this. If you have a bankruptcy that is less than 4 years, have a credit score lower than 660, and very little money down, I would recommend at looking to do a FHA mortgage Loan. Your chances of getting approved with likely result in a loan approval as opposed to doing a conventional loan backed by Fannie Mae.

Why would you consider a Conventional Loan?

My best opinion is this. If you have a bankruptcy over 4 years or longer, at least 5% down payment, a credit score of 680 or higher, I would look doing a conventional mortgage loan.

I can help you understand what mortgage is correct for you. Please contact me below and I will be happy to answer any questions.

Senior Loan Officer

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant’s eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916http://www.nmlsconsumeraccess.org/

Can you get a mortgage loan while in a Chapter 13 Bankruptcy:

Can you get a mortgage loan while in a Chapter 13 Bankruptcy:

Kentucky Mortgage Underwriting Guidelines updated

Kentucky FHA Mortgage Loans Guidelines

FHA Changes for Mortgage Loans in Kentucky

FHA Changes for Mortgage Loans in Kentucky

Kentucky First-Time Home Buyer Programs | USDA, FHA, VA & KHC Loans

Minimum Credit Scores for a Kentucky FHA loan.

All Kentucky FHA loans will soon require a 500 credit score for all Kentucky Home buyers or homeowners looking to refinance who have a debt to income ratio over 55% percent.

Kentucky FHA Loans with FICO scores under 620 will remain FHA-eligible, but you must show compensating factors or reasons to approve the loan. Compensating factors would be large down payments in excess of 10%, or a lot of money in savings or reserves after the loan is made.

Kentucky FHA loans and Foreclosure Rules

Currently, a Kentucky homebuyer or home owners can get a FHA-insured financed three years after a foreclosure or short-sale. FHA will now require that only borrowers who (1) have re-established credit, and (2) can provide a fully-documented loan application will qualify for a Kentucky FHA loan

Furthermore, the group will examine the cause of the foreclosure to determine whether it was…

View original post 108 more words

Kentucky First Time Home Buyer (Louisville, Ky)

Related Articles

Kentucky First Time Home Buyer Loan Programs (mylouisvillekentuckymortgage.com)

Louisville Kentucky First Time Home Buyer Programs and Resources (mylouisvillekentuckymortgage.com)

Louisville Ky Mortgage Lender FHA/VA KHC USDA Kentucky Mortgage: Louisville Kentucky First Time Home Buyer Programs… (mylouisvillekentuckymortgage.com)

Louisville VA, FHA, USDA, KHC , Fannie Mae Mortgage Guide: Louisville Ky Mortgage Lender FHA/VA KHC USDA Kent… (mylouisvillekentuckymortgage.com

Louisville Kentucky Mortgage Loans

via Kentucky First Time Home Buyer (Louisville, Ky)

Related Articles

- Kentucky First Time Home Buyer Loan Programs (mylouisvillekentuckymortgage.com)

- Louisville Kentucky First Time Home Buyer Programs and Resources (mylouisvillekentuckymortgage.com)

- Louisville Ky Mortgage Lender FHA/VA KHC USDA Kentucky Mortgage: Louisville Kentucky First Time Home Buyer Programs… (mylouisvillekentuckymortgage.com)

- Louisville VA, FHA, USDA, KHC , Fannie Mae Mortgage Guide: Louisville Ky Mortgage Lender FHA/VA KHC USDA Kent… (mylouisvillekentuckymortgage.com

2020 KENTUCKY FIRST TIME HOME BUYER PROGRAMS

2020 Kentucky first time home buyer programs, FHA loan Kentucky, First time home buyer, Kentucky FHA loan,