When you think credit score, you probably think FICO

Since the Fair Isaac Corporation introduced its FICO scoring system in 1989, “What is my FICO score?” has become a common question. FICO scores have burrowed their way into all kinds of lending decisions, most notably mortgages, credit cards, and rentals.

But over the last decade or so, FICO’s market dominance has been challenged by a newcomer called VantageScore. As the result of a collaboration between the three major credit reporting agencies (CRAs) — Experian, Equifax, and TransUnion — VantageScore uses similar scoring methods to FICO but with slightly different results.

So what are the differences, and more importantly, do they really matter to you, the consumer? The short answer: usually no. But you might want to look at different scores for different needs or goals.In this article, we’ll cover the five main differences between FICO and VantageScore and tell you which one to watch.

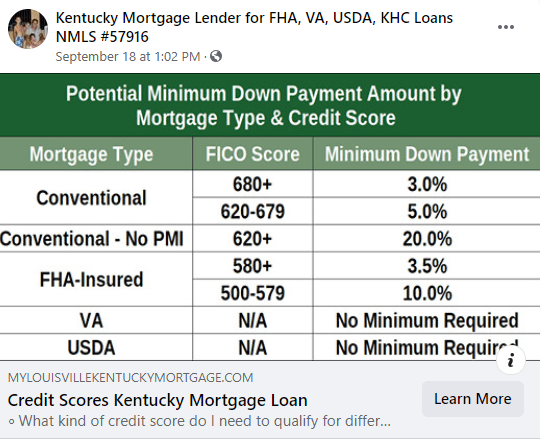

What credit score is needed to buy a house?

1. Difference in scoring models

FICO and VantageScore aren’t the only scoring models on the market. Lenders use a multitude of scoring methods to determine your creditworthiness and make financial decisions. But despite the numerous options, FICO and VantageScore are likely the only scores you’ll ever personally see.How do FICO and VantageScore rate you? Both use the same basic criteria:

- Payment history

- Length of credit

- Types of credit

- Credit usage

- Recent inquiries

Although both FICO and VantageScore consider much of the same information, they gather their data in different ways.

FICO bases its scoring model on credit reports from millions of consumers at once. They gather these reports from the three major credit bureaus and analyze the reports’ anonymous consumer data to generate an accurate scoring model.Alternatively, VantageScore uses a combined set of consumer credit files, also obtained from those same three credit bureaus, to come up with a single formula.

Both FICO and VantageScore issue scores ranging from 300 to 850. In the past, VantageScore has used a range of 501 to 990, but the range was adjusted when VantageScore 3.0 was issued in 2013. VantageScore’s numerical rankings now match FICO’s, which makes it easier for consumers and lenders to implement the VantageScore model — plus, it’s less confusing for consumers who check both their FICO score and VantageScore.

2. Variance in scoring requirements

If you don’t have a long history of credit, VantageScore is the score you want to monitor. Before it’s able to establish your credit score, FICO requires at least six months of credit history and at least one account reported to a CRA within the last six months. VantageScore only requires one month of history and one account reported within the past two years.

Because VantageScore allows a shorter credit history and a long period for reported accounts, it’s able to issue credit ratings to millions of consumers who wouldn’t qualify for FICO scores. Considering how everyone from employers to landlords wants to see your credit score these days, if you’re new to credit or haven’t been using it recently, VantageScore might be able to prove your trustworthiness before FICO has enough data to issue a rating.

3. Significance of late payments

A history of late payments will impact both your FICO score and your VantageScore. Both models consider these factors:

- How recently the last late payment occurred

- How many of your accounts have had late payments

- How many payments you’ve missed on an account

However, while FICO treats all late payments the same, VantageScore judges them differently — it penalizes late mortgage payments more harshly than other types of credit.If you’ve had late payments on your credit cards, they will have about the same impact on both your FICO and your VantageScore. But if you’ve had late payments on your mortgage, you might find you have a higher FICO score than VantageScore.

4. Impact of credit inquiries

You’ve probably heard you shouldn’t open too many credit cards in a short period of time. One reason for this is every time you apply for a credit card, the lender does a “hard inquiry” to check your creditworthiness.

VantageScore and FICO both penalize consumers who have multiple hard inquiries in a short period of time, and they both do “deduplication.” Deduplication is important for things like auto loans, where your application may be sent to multiple lenders, thereby resulting in multiple inquiries. Both FICO and VantageScore don’t count each of these inquiries separately — they deduplicate them, or consider them one inquiry. However, the timespan they use for deduplication differs.

FICO uses a 45-day span to deduplicate your credit inquiries. VantageScore limits its focus to only a 14-day range. VantageScore also looks at multiple hard inquiries for all types of credit, including credit cards. FICO considers only mortgages, auto loans, and student loans.

Inquiries aren’t your biggest concern when it comes to your credit score, but they do have an impact. If you want to buy a house or a car, restrict hard inquiries as much as possible to avoid lowering your credit score.

5. Influence of low-balance collections

VantageScore and FICO both have penalties for accounts sent to collection agencies. However, FICO might give you a bit more of a break when it comes to low-amount collection accounts.

FICO ignores all collections where the original balance was under $100. It also doesn’t count collection accounts you’ve paid off. VantageScore, on the other hand, ignores only paid collection accounts, regardless of the original balance amount.

Keep your credit high

Regardless of the differences between FICO and VantageScore, the essential advice for keeping your credit score high remains the same:

- Avoid late payments. Pay your bills, and pay them on time.

- Keep your credit balances low. Don’t max out your credit cards, and try to keep your cumulative balance to less than 30% — the lower the better.

- Apply for new credit only when you have to. Don’t open a bunch of new cards in a short period of time, and don’t close old accounts without good reason.

Which credit scores do mortgage lenders use to qualify people for a mortgage?

While it’s common knowledge that mortgage lenders use FICO scores, most people with a credit history have three FICO scores, one from each of the three national credit bureaus (Experian, Equifax, and TransUnion).

- Which FICO Score is Used for Mortgages

Most lenders determine a borrower’s creditworthiness based on FICO® scores, a Credit Score developed by Fair Isaac Corporation (FICO™). This score tells the lender what type of credit risk you are and what your interest rate should be to reflect that risk. FICO scores have different names at each of the three major United States credit reporting companies. And there are different versions of the FICO formula. Here are the specific versions of the FICO formula used by mortgage lenders:

- Equifax Beacon 5.0

- Experian/Fair Isaac Risk Model v2

- TransUnion FICO Risk Score 04

Lenders have identified a strong correlation between Mortgage performance and FICO Bureau scores (FICO score). FICO scores range from 300 to 850. The lower the FICO score, the greater the risk of default.

Which Score Gets Used?

Since most people have three FICO scores, one from each credit bureau, how do lenders choose which one to use?

For a FICO score to be considered “usable”, it must be based on adequate, concrete information. If there is too little information, or if the information is inaccurate, the FICO score may be deemed unusable for the mortgage underwriting process. Once the underwriter has determined if a score is usable or not, here’s how they decide which score(s) to use for an individual borrower:

- If all three scores are different, they use the middle score

- If two of the scores are the same, they use that score, regardless of whether the two repeated scores are higher or lower than the third score

Lenders have identified a strong correlation between Mortgage performance and FICO Bureau scores (FICO score). FICO scores range from 300 to 850. The lower the FICO score, the greater the risk of default.

If it helps to visualize this information:

| Identifying the Underwriting Score | ||||

|---|---|---|---|---|

| Example | Score 1 | Score 2 | Score 3 | Underwriting Score |

| Borrower 1 | 680 | 700 | 720 | 700 |

Joel Lobb (NMLS#57916)

Senior Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle Suite 3

Louisville, KY 40223

Company ID #1364 | MB73346

Text/call 502-905-3708

kentuckyloan@gmail.com

If you are an individual with disabilities who needs accommodation, or you are having difficulty using our website to apply for a loan, please contact us at 502-905-3708.

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant’s eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916http://www.nmlsconsumeraccess.org/

NMLS Consumer Access for Joel Lobb

Joel Lobb, American Mortgage Solutions (Statewide)

Joel has worked with KHC for 12 of his 20 years in the mortgage lending business. Joel said, “A lot of my clients would not have been able to purchase a home of their own or possibly delayed their purchase due to lack of down payment but with the $6,000 DAP loan program, this gets them into a house sooner and starts their path to homeownership while building equity instead of throwing their money away.”

When you’re ready to purchase a home in Joel’s area, contact him at:

Phone: 502-905-3708

Email: Kentuckyloan@gmail.com

Website: www.mylouisvillekentuckymortgage.com