KENTUCKY HUD HOMES SALES INCENTIVES

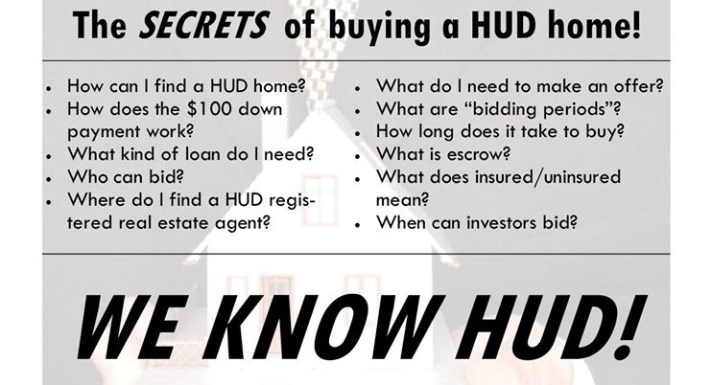

| For a limited time, FHA offers sales incentives on HUD homes that will make these homes more affordable for home buyers when purchasing a property using FHA-insured financing. The incentives VARY from State to State but may include low down payments; sales allowances that can be used to pay closing costs, make repairs, or pay down the mortgage amount; broker bonuses for owner-occupant sales. The benefits of FHA financing are low down payments; competitive interest rates; flexible credit qualifying. To find a HUD-Approved Lender, and for the latest sales incentives in your areas, visit HUDhomestore.com The program incentives are subject to change without prior notice. | |

|

Sales Incentives (subject to change without prior notice) |

Participating States |

|

$100 Down Payment! Available to Owner Occupant Homebuyers when purchasing a property using FHA-insured financing. |

Kentucky HUD Homes for Sale By FHA |

Search Results for HUD Homes in KY |

|

|

201-405318 409 Mildred Ave South Shore, KY 41175 Greenup County |

201-585835 2215 Sharon Rd Ashland, KY 41101 Boyd County |

201-648672 882 Whippoorwill Ro Paintsville, KY 41240 Johnson County |

201-443322 99 Falls Br Belfry, KY 41514 Pike County |

201-612315 2718 Cumberland Ave Ashland, KY 41102 Boyd County |

201-654741 801 E Broad Street Central City, KY 42330 Muhlenberg County |

|

201-492365 9655 Marshall Rd Ryland Hght, KY 41015 Kenton County |

201-619887 2878 1st Street Petersburg, KY 41080 Boone County |

201-662018 711 Aqua Shores Dr Shelbyville, KY 40065 Shelby County |

|

201-569915 1840 Holman St Covington, KY 41014 Kenton County |

201-631020 465 Kennedy Rd New Haven, KY 40051 Larue County |

201-663813 1501 Old Henderson Rd Providence, KY 42450 Webster County |

201-574687 2444 Bardstown Rd Lawrenceburg, KY 40342 Anderson County |

Joel Lobb

Mortgage Loan Officer

Individual NMLS ID #57916

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

https://www.mylouisvillekentuckymortgage.com/

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant’s eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916http://www.nmlsconsumeraccess.org/

Some products and services may not be available in all states. Credit and collateral are subject to approval. Terms and conditions apply. This is not a commitment to lend. Programs, rates, terms and conditions are subject to change without notice. The content in this marketing advertisement has not been approved, reviewed, sponsored or endorsed by any department or government agency. Rates are subject to change and are subject to borrower(s) qualification.