What Credit Score do You Need to qualify for a FHA VA KHC USDA Kentucky Mortgage.

via What Credit Score do You Need to qualify for a FHA VA KHC USDA Kentucky Mortgage.

Realty Times – Get a HUD Home for $100 Down.

Call it the U.S. Department of $100 Down Housing.

HUD like other federal agencies, are anxious to unload properties they hold, because they can be a financial drain.The U.S. Department of Housing and Urban Development (HUD) is offering its foreclosed homes for a mere $100 down from now until October 2012.

Of course you’ll have to qualify for a mortgage, you may have to pays some closing costs, the deal isn’t available everywhere and the condition of the homes is strictly “as-is.”

If you can handle those qualifiers, here’s the deal:

• You can only buy HUD homes. Go to the HUD Homes For Sale web page.

• You must use a HUD-registered real estate broker or agent.

• You must qualify for and use Federal Housing Administration (FHA) financing.

• You must plan to be an “owner-occupant,” buying the property to live in and not as an investment.

• The home’s purchase price must be no more than the appraised value of the property. If you bid a higher price you can pay the difference in cash, minus $100.

• The $100 down incentive must be on the executed contract. That means you have to specifically request the incentive. Your real estate agent should be aware of this provision.

• In some cases, HUD will also cover up to 3 percent of the closing costs.

• The $100 down payment program is eligible for the FHA 203(k) loans. The loans allow borrowers to use a portion of their purchase loan to repair and renovate run-down homes.

That’s a good thing because HUD homes are sold in an “as-is” condition — what you see is pretty much what you get. You could find a diamond in the rough or fool’s gold. HUD homes often include a property condition report, but that is not a warranty.

The property report can resemble a home inspection report, but HUD home buyers are always encouraged to get a home inspection to determine just what “as is” is.

The deal is offered in states in two HUD regions:

Arkansas

Colorado

Iowa

Kansas

Louisiana

Missouri

Minnesota

Montana

Nebraska

New Mexico

North Dakota

Oklahoma

South Dakota

Texas

Wisconsin

Wyoming

Utah

Alabama

Florida

Georgia

Kentucky

Illinois

Indiana

Mississippi

North Carolina

South Carolina

Tennessee

Published: November 10, 2011

Use of this article without permission is a violation of federal copyright laws.

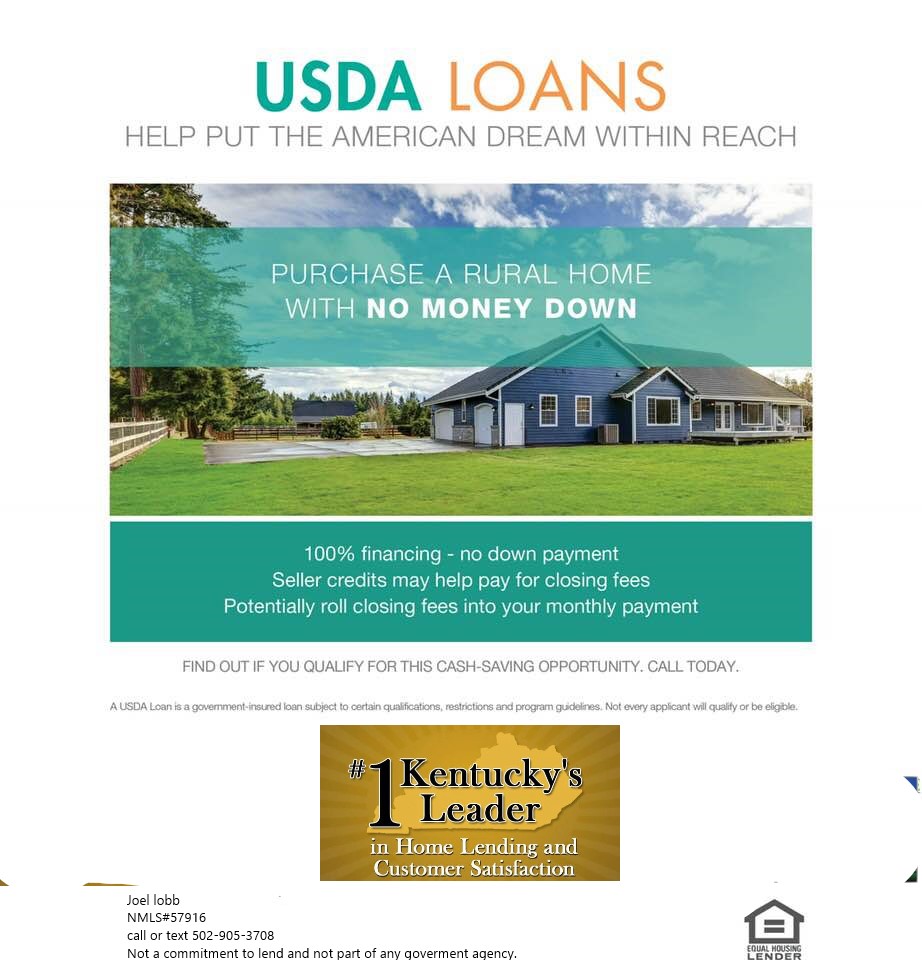

USDA Home Loans in Kentucky?

Kentucky USDA Home Loans supplies 100% financing for a home purchase, or refinancing in a USDA designated area.

Many large metropolitan cities have suburban areas that qualify for the USDA mortgage program. Click Here for an interactive map of eligible areas in Kentucky here!

The KY USDA home loans are perfect for first time buyers for many reasons. They have low interest rates, absolutely no down payment, no mortgage insurance, flexible credit guidelines, and most of the closing costs can be worked into the overall amount of the loan.

Advantages of a USDA vs. FHA & Other Loans

The USDA Home Loan program offers many advantages that traditional mortgage programs simply do not offer. First of all, all USDA home loans come with low interest rates, 100% financing, and require zero down payment. In fact, the USDA home loan program is the only home loan program in the country, besides the military, that requires absolutely no money for the purchase of a home. Instead, these funds can be used to pay to furnish the home, closing costs, make home renovations.

USDA home loans also have very flexible credit guidelines compared to most traditional lenders, with non-traditional credit histories being accepted. FHA home loans require a minimum of 3.5% down payment and have relatively high monthly mortgage insurance premiums.

Kentucky USDA Income Eligibility

Because USDA home loans are designed for moderate, to low income families, there are income limit restrictions. To be eligible for a USDA loan, your adjusted annual household income cannot exceed 115% of the median average income for that area.

This means if your total household income is above the average median income for that area, you may not be able to qualify. However, there are special deductions in place, such as childcare expenses, caring for elderly family members, or children in college, that can help to reduce your overall annual income. The borrower’s total housing and other consumer credit payments should account for no more than 4% of the total income. Income limits vary by county. Check your county Kentucky income limits here!

USDA Credit Eligibility

While it is true that USDA home loan program offers some the most credit flexible guidelines available, you still will need to have a minimum credit score of 620 to 640 to qualify.

However, some lenders may accept a credit score of as low as 580, if you can prove that some of your debts were circumstantial, temporary in nature, or beyond your control.

You must also have any bankruptcies or foreclosures discharged in the last 3 years, no outstanding tax liens and no accounts that have gone to collections within the past 12 months.

Joel LobbSenior Loan Officer(NMLS#57916) Company ID #1364 | MB73346

http://mylouisvillekentuckymortgage.com/

text or call my phone: (502) 905-3708

email me at kentuckyloan@gmail.com

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people.

NMLS ID# 57916, (www.nmlsconsumeraccess.org). USDA Mortgage loans only offered in Kentucky.

All loans and lines are subject to credit approval, verification, and collateral evaluation