Kentucky FHA loans can be an excellent option for first-time homebuyers and borrowers with lower incomes or less-than-perfect credit. They can also be an easy way to refinance. .

Features and benefits:

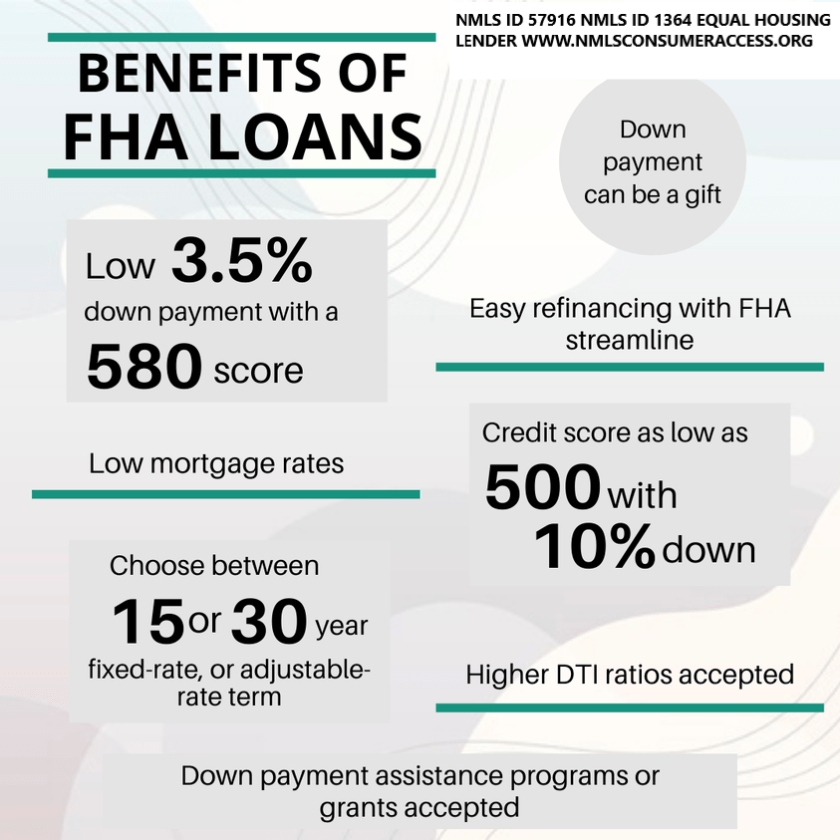

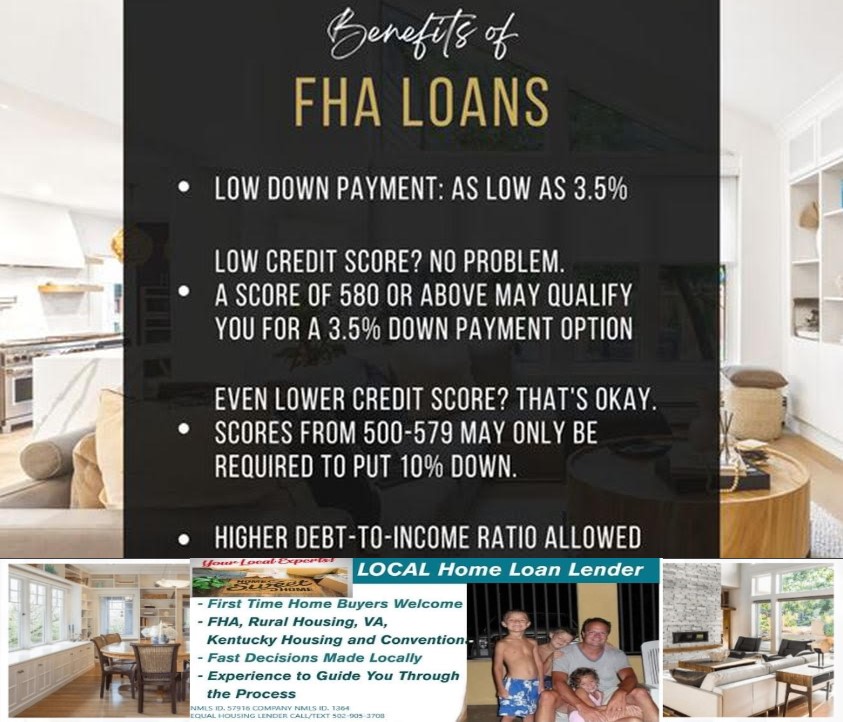

- Low down payment from borrower or other approved source1

- 580 credit score with 96.5 Financing and down to 500 score with 500 score on case by case

- Streamline option refinance with no appraisal

- Up to 6% seller contributions to pay your closing costs and prepaids

- AUS with FHA TOTAL Mortgage Scorecard

- Waivers for some ratio and documentation

Purchase, rate/term, or cash-out refinance of a primary residence. Program terms available may vary based on the state or county in which the financed

property is located. Mortgage insurance is required.

CONSIDERATIONS: Important information will be provided to you in the disclosures you receive after we have received your application and the loan

documents you are provided at loan closing. Please consult your tax advisor regarding the deductibility of interest.

Contributions may have limitations based upon occupancy and loan to value ratios and cannot be used for purposes of down payment, reserve

requirement or meet minimum contribution requirements

Programs for qualified borrowers. All borrowers are subject to credit approval, underwriting approval and product requirements, including loan to

value, credit score limits and other lender terms and conditions. Fees and charges may vary by state and are subject to change without notice. Some

restrictions may apply. Not a commitment to lend. 11/22

Getting An FHA Loan

In order to get an FHA loan to buy your next house, it’s a good idea to first check your credit score. That way, you can see what your maximum LTV would be through the FHA and decide whether an FHA loan might be right for you.

Depending on which FHA lender you’re working with, it may also be a good idea to get pre-qualified for an FHA loan. This can help you establish how much you’ll likely be able to borrow and what your interest rate may be.

Application and Underwriting

Once you’ve identified a home you want to purchase and are ready to formally apply for your mortgage loan, you’ll need to choose an FHA-approved lender and work through its individual application and underwriting process. The application process will include completion of a Uniform Residential Loan Application.

As part of your application, you’ll also need to get an appraisal for the home you’re buying, so your lender can ensure your loan won’t violate FHA’s LTV limits. From there, you’ll need to work through your individual lender’s underwriting process, which will include showing proof of income, running credit checks and demonstrating that you can afford your down payment.

Some of the documentation you’ll likely need to supply for underwriting include:

- A credit report

- Employment history for two years

- Income verification with recent pay stubs, bank statements and/or three years of tax returns

- Proof that you are using the loan for a primary residence

- An FHA-approved appraisal

After you complete your lender’s application process and underwriting, your lender can formally approve your loan and you can close on your home.

Who Should Consider FHA Loans

FHA loans don’t have stated income maximums or minimums, but are generally designed to benefit low- to moderate-income Americans who would have trouble qualifying for conventional financing or affording the down payment required by other loans.

Some potential cases when FHA loans can be particularly helpful include:

- First-time homebuyers who can’t afford a large down payment

- People who are rebuilding their credit

- Seniors who need to convert equity in their homes to cash

Types Of FHA Loans

There are more than a dozen home loan programs available through the FHA. Many of these programs are ideal for different borrowers in a variety of circumstances, offering everything from 30-year fixed-rate mortgages to adjustable rates, improvement loans, refinancing solutions and even reverse mortgages.

Some of the most popular FHA loan programs are:

- FHA Section 203(b) loan. The FHA’s most popular home loan program, offering fixed rates on properties from one to four units.

- FHA Section 203(k) loan. FHA mortgages designed to help homebuyers finance up to $35,000 in improvements to their new homes.

- Streamline Refinancing. An option for existing FHA borrowers to refinance their loans with streamlined underwriting.

FHA Loans Vs. Conventional Mortgages

Most conventional mortgages require down payments of at least 20% of a home’s purchase price in order to avoid paying private mortgage insurance, along with minimum credit scores of 620 to 640 in order to qualify. With private mortgage insurance (PMI) that helps homeowners pay their mortgage if they lose their jobs, some lenders require lower down payments.

FHA loans have two types of built-in mortgage insurance that allow borrowers to buy homes with as little as 3.5% down—or 10% if they have bad credit. In addition, these loans allow homebuyers to qualify for lower interest rates than they would get with conventional mortgages, all because their loans are federally insured.

| FHA Loan | Conventional Mortgage | |

| Minimum credit score | 500 | 620 |

| Minimum down payment | 3.5% if your credit score is 580 or higher; 10% for scores under 580 | 20% to avoid mortgage insurance |

| Maximum loan term | 30 years | 30 years |

| Mortgage insurance requirement | Two types of mortgage insurance required | Required if down payment is under 20% |

Pros of FHA Loans

- High maximum loan-to-value

- Competitive interest rates

- Multiple programs available

- Can qualify with bad credit

- Closing costs are sometimes paid by lenders

Cons of FHA Loans

- Mortgage insurance is required for extra cost

- Only available for a primary residence

- Must show proof of income

- Debt-to-income ratio must be under 43% (slightly lower than a conventional loan requires)

Bottom Line

The Federal Housing Administration (FHA) was created in the 1930s in response to the Great Depression to help Americans who couldn’t otherwise afford the dream of homeownership.

Today, the FHA continues to help Americans through more than a dozen loan programs that help Americans with low incomes or bad credit qualify for lower interest rates than they would otherwise get, and buy homes with much smaller down payments than those required by conventional lending tools. The FHA does this by working with approved lenders to insure loans across the country and by building two types of mortgage insurance into all of the loans that it insures.

So, if you have poor credit or are struggling to save for a down payment, you may want to consider using an FHA loan for your next home purchase.

Joel Lobb

Mortgage Loan OfficerIndividual NMLS ID #57916

American Mortgage Solutions, Inc.

Louisville, KY 40223Company NMLS ID #1364

click here for directions to our office

Text/call: 502-905-3708fax: 502-327-9119

email:

https://www.mylouisvillekentuckymortgage.com/