Kentucky FHA Loans: New Guidelines for Collections & Disputes 2026

Kentucky FHA Loans: New 2026 Guidelines

Collections, Disputes & Judgements Explained

If you’re a Kentucky first-time homebuyer with collections, disputes, or judgements on your credit report, you’re not alone—and you’re not disqualified from homeownership. The Federal Housing Administration (FHA) recently updated its lending guidelines to provide more flexibility and clarity around credit challenges.

Whether you’ve faced financial hardship, billing disputes, or collection accounts, understanding these new FHA rules could be the key to securing your Kentucky mortgage.

Understanding FHA Loans with Bad Credit, Disputes & Collections

What Are Disputed Accounts on Your Credit Report?

A disputed account appears on your credit report when you’ve officially challenged information you believe is inaccurate or incorrect. Many Kentucky borrowers don’t realize that disputed accounts can affect their ability to qualify for an FHA loan. The good news? FHA has clarified how these accounts will be evaluated going forward.

Collection Accounts & FHA Loan Qualification

Collection accounts are one of the biggest obstacles for Kentucky first-time homebuyers trying to get approved. Under the new 2026 FHA guidelines, the agency has provided specific underwriting rules that actually offer more opportunity than you might think.

Judgements on Credit Reports

If you have judgements on your credit report, FHA underwriters will evaluate them carefully, but they don’t automatically disqualify you. The new guidelines provide specific direction on how these accounts are assessed during the mortgage approval process.

New FHA Guidelines for Collections, Judgements & Disputes

Collection Account Rules: The $2,000 Threshold

Here’s how FHA Fannie Mae’s DU (Desktop Underwriter) system now handles collection accounts:

If your collection accounts total $2,000 or more cumulatively:

- Pay in Full — The collection debt(s) must be paid in full prior to or at closing, OR

- Payment Plan — You can establish a payment arrangement with the creditor, and the monthly payment is included in your debt-to-income ratio, OR

- 5% Payment Calculation — Include a monthly payment of 5% of the outstanding balances of each collection account in your debt-to-income ratio

If your collection accounts total less than $2,000: These may be treated more favorably during underwriting, though FHA DU will still require verification.

💡 Important for Kentucky Borrowers: If you’re married and in a community property state, collection accounts from your spouse are also counted toward this threshold—even if they’re a non-borrowing spouse.

Manual Underwriting Triggers

Certain credit situations require manual underwriting instead of automated approval. Your Kentucky FHA application will likely be manually reviewed if:

- $1,000 or more in disputed derogatory credit accounts appears on your credit report

- 20% or greater decline in self-employed income

- Mortgage lates within the last 12 months

While manual underwriting takes longer, it doesn’t mean you’ll be denied. Many Kentucky borrowers with credit challenges are successfully approved through manual underwriting because a trained loan officer can explain your circumstances and compensating factors.

Payment History Requirements for FHA Approval

FHA has strict (but achievable) payment history standards:

- All mortgage and installment loan payments must be on time within the last 12 months

- No more than two 30-day late payments within the last 24 months

- No derogatory credit on revolving accounts (credit cards, lines of credit) in the last 12 months

- Collection accounts must be addressed per the guidelines above

Additional 2026 FHA Updates

New Well Water Testing Requirements

If you’re purchasing a Kentucky home with a private well, be aware of updated FHA requirements for well water testing:

Well water tests must now be:

- Performed by a disinterested third party (not you, the seller, or anyone with a financial interest in the transaction)

- Conducted using a method acceptable to your local health authority

- Documented before approval

Well water testing is now required for:

- Newly constructed properties and/or new wells

- Properties with deficiencies in the well or water quality identified by an appraiser

- Areas where water safety issues have been reported or are known

- Properties near dumps, landfills, industrial sites, farms, or hazardous waste areas

- Properties where the well and septic system are less than 100 feet apart

Overtime, Bonus & Tip Income: Simplified Calculations

Good news for Kentucky borrowers with variable income: FHA has clarified how overtime, bonuses, and tips are calculated for loan qualification.

Your overtime, bonus, or tip income will be calculated as the LESSER of:

- Average income earned over the previous 2 years (or the total time if earned less than 2 years), OR

- Average income earned over the previous year

Commission & Business Expense Requirements Removed

FHA has completely eliminated previous requirements regarding unreimbursed business expenses and commission income or automobile allowances. This aligns FHA guidelines with current IRS tax law, making it easier for self-employed borrowers and those with commission-based income to qualify.

Interested Party Contribution (IPC) Limits

Under the 2026 guidelines, mortgagees and third-party originators are now explicitly included in IPC limits. This means:

- Lenders cannot contribute toward your down payment to artificially lower your upfront costs

- Exception: Premium pricing credits don’t count against IPC limits—unless the lender is also acting as the seller, agent, builder, or developer

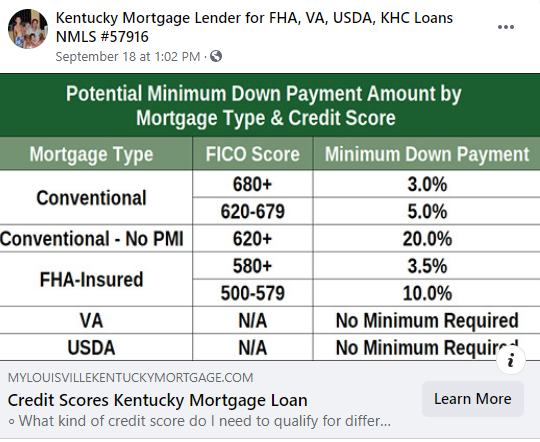

DTI Requirements & Qualification

31% of your gross monthly income can go toward housing costs. 43% of your gross monthly income can go toward all monthly debts.

No compensating factors required to meet these ratios, making FHA one of the most accessible loan programs for Kentucky borrowers.

Documentation You’ll Need for Underwriting

If your Kentucky FHA application requires manual underwriting due to credit challenges, be prepared to provide:

Employment & Income Documentation

- Verbal Verification of Employment (VOE)

- Paystubs covering the most recent 30-day period

- W2s for the past 2 years

- 2-year employment history

Housing & Credit History

- Verification of Rent (VOR) or 12 months of cancelled checks if credit report doesn’t show last 12 months of housing payment history

- Letter of Explanation (LOX) for any derogatory credit or late payments within the last 24 months

Cash Reserves

- At least 1 month in reserves from your own funds (cannot be a gift)

- 3 months required if purchasing a 3-4 unit property

Ready to Get Approved for a Kentucky FHA Loan?

With over 20 years of experience helping Kentucky families overcome credit challenges to achieve homeownership, I specialize in FHA loans for borrowers with collections, disputes, judgements, late payments, and more.

📞 502-905-3708 (Call or Text)

I offer free FHA mortgage applications with same-day approvals. Let’s discuss your options today.

About Joel Lobb – Kentucky Mortgage Loan Officer

With over 20 years of mortgage industry experience, I’ve helped more than 1,300 Kentucky families secure homeownership through FHA, VA, USDA, KHC, and Fannie Mae programs.

Licensing & Credentials

- License Type: Kentucky Mortgage Loan Only

- NMLS Personal ID: 57916

- Company NMLS ID: 1738461

- Verify License: www.nmlsconsumeraccess.org

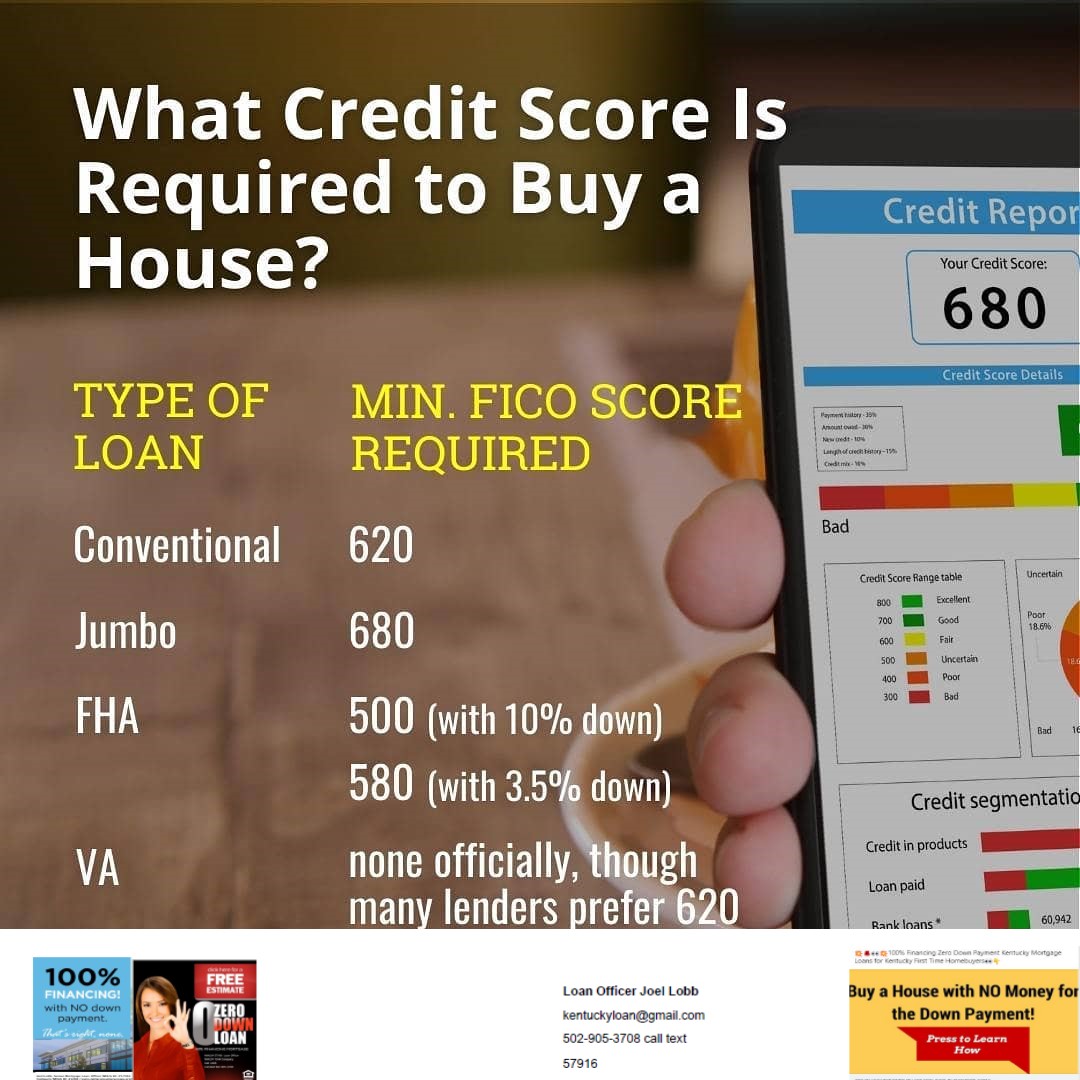

Kentucky FHA Loan Programs Available

- ✓ Collections & Disputed Accounts

- ✓ Judgements

- ✓ Bad Credit & Low Credit Scores

- ✓ Late Payments (within 24 months)

- ✓ Self-Employed & Variable Income

- ✓ Down Payment Assistance (KHC Programs)

- ✓ First-Time Homebuyer Programs

FHA Loans & Collections

Your Guide to Disputed Accounts & Collections 2026

Step 1: Check Total

Add up all collection accounts on your credit report

Step 2: Compare

Is your total more or less?

Step 3: Choose Path

Select your payment strategy

What Triggers Manual Underwriting?

If you have $1,000 or more in disputed derogatory accounts, your application will be reviewed by a human underwriter instead of automated approval. This isn’t bad news—it means your circumstances can be explained!

$1,000+ Disputes

Disputed derogatory accounts trigger manual review

Self-Employment Drop

20% or greater income decline

Recent Mortgage Lates

Late payments in the last 12 months

Good News

Manual review = opportunity to explain!

What FHA Requires

All mortgage & installment payments on time in the last 12 months

No more than 2 late payments (30 days) within the last 24 months

No derogatory credit on revolving accounts (credit cards) in the last 12 months

Collections must be addressed per the $2,000 threshold rules

Your Maximum DTI Limits

Housing costs only

All monthly debts

No compensating factors required to meet these ratios