Joel Lobb specializes in a wide array of mortgage loans, including:

– **FHA Loans**: These loans are a great fit for buyers with lower credit scores or those who can afford only a minimal down payment.

– **VA Loans**: Tailored for veterans and active military members, offering favorable terms with little to no down payment.

– **USDA Loans**: Designed for rural home buyers, providing 100% financing options.

– **KHC Loans**: In collaboration with the Kentucky Housing Corporation, these loans come with down payment assistance, making them ideal for first-time buyers.

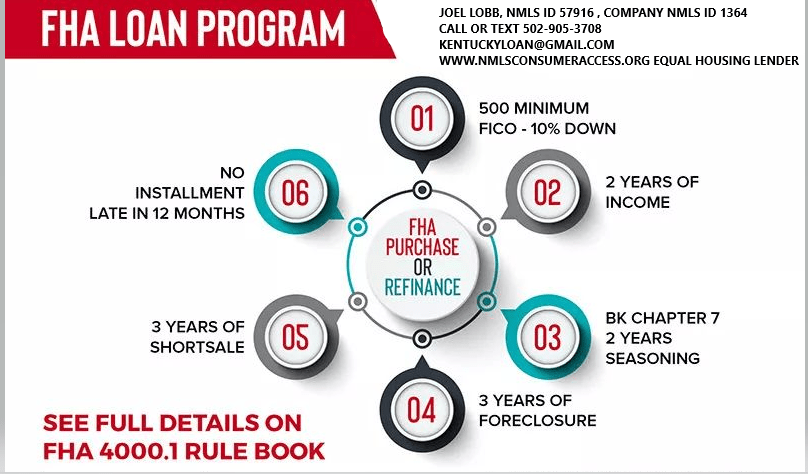

Complete Guide to FHA Loan Requirements in Kentucky

FHA loans are a popular choice for many first-time homebuyers in Kentucky. This is due to their flexible qualifying criteria. If you’re considering an FHA loan in the Bluegrass State, understanding the key qualifying factors is crucial. Here’s a comprehensive guide to the criteria you need to know:

- Credit Score Requirements:

- FHA loans are known for accommodating borrowers with lower credit scores. The minimum required credit score can vary. Typically, a credit score of 580 or higher is needed to qualify for the minimum down payment of 3.5%. Borrowers with credit scores between 500 and 579 might still qualify. They will need a higher down payment, usually around 10%.

- Down Payment:

- The minimum down payment for an FHA loan in Kentucky is 3.5% of the home’s purchase price. This is advantageous for buyers who may not have substantial savings for a larger down payment, making homeownership more accessible.

- Work History:

- Lenders typically look for a steady 2 year employment history when considering FHA loan applications. A consistent work history is beneficial. It is preferable to have worked with the same employer or within the same field. This helps demonstrate financial stability and the ability to repay the loan.

- Debt-to-Income Ratio (DTI):

- The debt-to-income ratio is a crucial factor in mortgage approval. For FHA loans, the maximum allowable DTI ratio is typically around 40% to 45% of your gross monthly income. It can go higher up to 56% with good credit scores, a large down payment, or a shorter-term loan. Lenders may also consider higher ratios in certain cases if compensating factors are present.

- Bankruptcy and Foreclosure:

- FHA loans have lenient guidelines regarding bankruptcy and foreclosure. Generally, borrowers with a past bankruptcy may qualify for an FHA loan after two years. This is possible if they have re-established good credit and demonstrated responsible financial behavior. For foreclosures, the waiting period is usually three years.

- Mortgage Term:

- FHA loans offer various mortgage term options, including 15-year, 20 year, 25 year and 30-year fixed-rate loans. The choice of term depends on your financial goals and ability to manage monthly payments.

- Occupancy: Primary residences with 1-4 units. Not for investment properties or second homes.

- Mortgage Insurance on the loan for life of loan. Larger down payments and shorter terms will reduce the upfront mi and monthly mi premiums

- can be used for refinances, not only for purchases.

- No income limits nor property restrictions on where home is located

- Can close within 30 days typically with good appraisal and title work

FHA Loan Requirements in Kentucky for Credit scores, Down payment, Debt Ratio and work history below

| Requirement | Details |

|---|---|

| Credit Score | – 580+: Eligible for a 3.5% down payment. – 500-579: Requires a 10% down payment. |

| Down Payment | Minimum of 3.5% for qualified buyers; 10% for lower credit scores below 580 to 500 score range |

| Debt-to-Income Ratio (DTI) | – Ideal: 45% or lower on front end ratio or housing ratio. – Acceptable: Up to 57% with compensating factors. There are two ratios. Front end and back end with front end being maxed at 45% and the backed end ratio being 56.99% with an AUS approval. If manually underwritten, see guidelines here |

| Employment History | Must provide at least **2 years of consistent employment—College transcripts can supplement with a less than 2 year work history |

Key Benefits of FHA Loans in Kentucky

- Low Credit Score Requirements

- FHA loans accept borrowers with credit scores as low as 500. However, a score of 580+ qualifies you for the lowest down payment option.

- Low Down Payment Options

- You can purchase a home with as little as 3.5% down if you meet credit requirements, making FHA loans more accessible than conventional loans.

- Competitive Interest Rates

- FHA loans typically offer rates comparable to conventional mortgages. They may even offer lower rates. This could save you money over the life of the loan.

- Flexible Loan Uses

- With an FHA 203(k) loan, you can bundle home purchase and renovation costs into a single mortgage.

- Assumable Loans

- FHA loans can be transferred to a new buyer. This feature is especially valuable if you sell your home when interest rates are higher.

Understanding these qualifying criteria can help you navigate the FHA loan application process in Kentucky more effectively. Working with an experienced mortgage professional can provide valuable guidance. They offer assistance tailored to your specific financial situation and homeownership goals.

Joel Lobb Mortgage Loan Officer

Email – kentuckyloan@gmail.com

Email – kentuckyloan@gmail.com  Call/Text – 502-905-3708

Call/Text – 502-905-3708Joel Lobb

Mortgage Loan Officer – Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

Kentucky Local Home Loan Lender Services

First-Time Home Buyers Welcome

First-Time Home Buyers Welcome FHA, Rural Housing (USDA), VA, and Kentucky Housing Corporation (KHC) Loans

FHA, Rural Housing (USDA), VA, and Kentucky Housing Corporation (KHC) Loans Conventional Loan Options Available

Conventional Loan Options Available Fast Local Decision-Making

Fast Local Decision-Making Experienced Guidance Through the Home Buying Process

Experienced Guidance Through the Home Buying Process

(www.nmlsconsumeraccess.org).

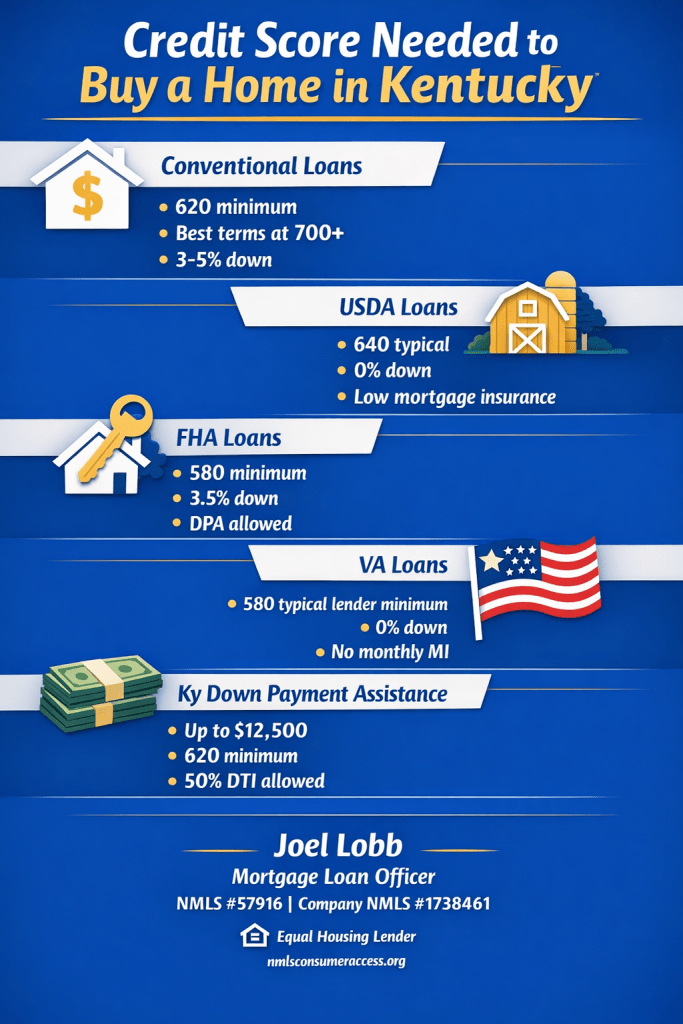

MINIMUM CREDIT SCORES REQUIRED FOR KENTUCKY FHA, VA, USDA MORTGAGE LOANS

-

Kentucky FHA Loans: Kentucky FHA loans are known for their lenient credit score requirements, making them accessible to borrowers with lower credit scores. However, a minimum score of 500 to 580 is typically required, depending on the down payment.

-

Kentucky VA Loans: VA loans offer flexible credit score requirements, while on paper VA states they don’t require a minimum score to insure the mortgage loan, most lenders preferring a FICO score of 620 or higher. Veterans, active-duty service members, and eligible spouses can benefit from VA loan options.

-

Kentucky USDA Loans: USDA loans are designed for rural homebuyers and require no minimum FICO score , but most lenders will want a credit score of 640 or higher. These loans offer zero down payment options for eligible properties.

-

KHC Mortgage Loans: Kentucky Housing Corporation (KHC) mortgage loans may vary in credit score requirements depending on the lender. It’s essential to work with a knowledgeable mortgage broker like Joel Lobb to understand specific lender guidelines. KHC requires a minimum 620 credit score for FHA, VA, USDA and 660 for Conventional loan programs

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

Credit Score Requirements for Kentucky Home Buyers

What Credit Score Do You Need to Buy a House in Kentucky?

There is no single “magic number.” The credit score needed depends on the loan program (Conventional, USDA, FHA, VA, or Kentucky Housing Corporation down payment assistance). Here’s how it works in the real world for Kentucky buyers.

Conventional Loans in Kentucky

- Minimum credit score generally starts at 620.

- Most lenders prefer higher scores for 3%–5% down options.

- Best pricing and easier approvals are typically with strong credit (often 700+).

- Mortgage insurance (PMI) usually improves as scores increase.

USDA Rural Housing Loans in Kentucky

- Many lenders target around 640 for automated approval through GUS (Guaranteed Underwriting System).

- Manual underwriting may be possible when automated approval is not available.

- 0% down payment required (eligible rural/suburban areas).

- Typical fees include a 1% upfront guarantee fee and 0.35% annual fee (paid monthly).

USDA can be one of the best value options for Kentucky buyers with limited cash, provided the property is in an eligible area and the file meets income and underwriting requirements.

Kentucky FHA Loans

- As low as 580 credit score with 3.5% down (typical baseline).

- Gift funds, grants, and down payment assistance may be allowed.

- Mortgage insurance is generally higher than USDA or VA, but rates can still be competitive.

- Common waiting periods: 2 years after bankruptcy and 3 years after foreclosure (standard guideline).

Kentucky VA Loans

- VA does not set a minimum credit score in its guidelines, but most lenders do.

- Many VA lenders target around 580+ (lender overlay varies).

- 0% down and no monthly mortgage insurance.

- Clear CAIVRS is required (for federal delinquency screening).

Kentucky Down Payment Assistance (KHC)

- Kentucky Housing Corporation (KHC) often offers up to $12,500 down payment assistance (program terms and funding can change).

- Typically structured as a second mortgage paid back over 15 years.

- Minimum credit score is commonly 620 across many KHC options; KHC conventional often requires 660.

- Maximum debt-to-income ratios are commonly around 50/50 (program and investor rules apply).

Next step: get a clear pre-approval target

If you share your approximate credit score range, income type, and whether you’re looking in Louisville, Lexington, or rural Kentucky, I can point you to the most realistic program and the exact score threshold that will matter for approval.

FHA vs Conventional Loans: A Guide for Kentucky Buyers

FHA vs. Conventional Loans: Which Is Better for Kentucky Homebuyers?

Compare FHA and conventional loans for Kentucky homebuyers. Learn credit requirements, down payments, mortgage insurance, and which loan fits your situation.

When comparing FHA loans vs conventional loans in Kentucky, the decision comes down to four core factors: credit score, down payment, debt-to-income ratio, and mortgage insurance. Both loan programs are widely used across Louisville, Lexington, Northern Kentucky, and rural areas, but they serve very different borrower profiles.

FHA Loans: Built for Flexibility

Kentucky FHA loans are designed for buyers who need more flexibility. FHA financing is often a strong option for borrowers with credit scores under 680, limited savings, or little to no cash reserves after closing. FHA also allows buyers to qualify sooner after major credit events, including foreclosures that are three to seven years old and short sales that occurred two to four years ago.

Another major advantage of FHA loans in Kentucky is gifting. The entire down payment and most closing costs can be covered with gift funds from approved sources. This makes FHA especially popular with first-time homebuyers and buyers using down payment assistance programs.

FHA Mortgage Insurance (MIP) Breakdown:

- Upfront mortgage insurance premium: 1.75% of loan amount (rolled into the loan)

- 30-year loans with less than 5% down: 0.85% annually

- 30-year loans with 5%+ down: 0.80% annually

- 15-year loans: 0.45% to 0.70% annually (depending on down payment)

Conventional Loans: For Stronger Credit

Kentucky conventional loans are best suited for borrowers with stronger credit and more money saved. Conventional financing generally favors buyers with credit scores above 680, at least five percent down, and reserves remaining after closing. Borrowers with foreclosures over seven years old or short sales that occurred five to seven years ago typically fit conventional guidelines more easily.

One of the biggest advantages of conventional loans is mortgage insurance flexibility. Unlike FHA, there is no upfront mortgage insurance premium. Monthly private mortgage insurance can be lower for borrowers with strong credit, and PMI automatically drops off once the loan reaches roughly 80 percent loan-to-value. FHA mortgage insurance, by contrast, usually lasts for the life of the loan when the down payment is less than ten percent.

Quick Comparison Table

| Factor | FHA Loans | Conventional Loans |

|---|---|---|

| Credit Score Required | 580+ 3.5% down payment (some lenders 500+ 10% down payment) | 720+ typically |

| Down Payment | 3.5% (with 580+ score) | 3-5% minimum, typically 5% |

| Mortgage Insurance | Required on all loans (lifetime with <10% down) | Only if less than 20% down; drops at 80% LTV |

| Upfront Insurance Premium | 1.75% | None |

| Gift Funds | 100% of down payment allowed | Limited or restricted |

| Max Debt-to-Income | Up to 56.99% (with compensating factors) | Typically 45% |

| Property Types | Owner-occupied only | Owner-occupied and investment |

| Appraisal Standards | Stricter | More flexible |

The Bottom Line

FHA loans are ideal for Kentucky buyers rebuilding credit, using gift funds, or purchasing with limited savings. Conventional loans reward borrowers with stronger credit, larger down payments, and long-term equity goals.

Most homeowners do not keep a mortgage for 30 years. Because many refinance or sell within five to seven years, FHA’s lifetime mortgage insurance is often less of a concern than it appears on paper. In many cases, the lower interest rate and easier approval standards outweigh the insurance cost.

|

Joel Lobb

Mortgage Broker – FHA, VA, USDA, KHC, Fannie Mae

EVO Mortgage • Helping Kentucky Homebuyers Since 2001

|

Call/Text: 502-905-3708 Call/Text: 502-905-3708 Email: kentuckyloan@gmail.com Email: kentuckyloan@gmail.com Website: www.mylouisvillekentuckymortgage.com Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave, Louisville, KY 40204 Address: 911 Barret Ave, Louisville, KY 40204NMLS #57916 | Company NMLS #1738461 |

| Free Info & Homebuyer Advice → |

|

Kentucky Mortgage Loan Expert

FHA | VA | USDA | KHC Down Payment Assistance | Fannie Mae

Equal Housing Lender. This is not a commitment to lend. All loans are subject to credit approval and program requirements.

|

Best Mortgage Options: Kentucky VA, FHA, USDA, and Fannie Mae

Comparing Kentucky VA loans to Kentucky USDA, FHA, and Fannie Mae loans in Kentucky

Kentucky VA loans Compared to Kentucky USDA, FHA, and Fannie Mae loans in Kentucky

When comparing Kentucky VA loans to Kentucky USDA, FHA, and Fannie Mae loans in Kentucky, several factors come into play. These factors include credit score requirements, income considerations, work history, and debt ratios. They also involve how each loan type treats bankruptcy and foreclosure. Let’s delve into the benefits and differences of each loan type:

Kentucky Mortgage Credit Score Requirements:

- Kentucky VA Loan: VA loans typically have more flexible credit score requirements compared to conventional loans. While there’s no specific minimum score set by VA , most Kentucky VA lenders often look for a credit score of 620 or higher. I can do VA loans down to a 580 credit score.

- Kentucky USDA Loan: USDA loans also offer flexibility, with no minimum score required per USDA guidelines, but most Kentucky USDA lenders will want a 640 score or higher. I Can do Kentucky USDA loans down to a 580 credit score on a manual underwrite.

- Kentucky FHA Loan: FHA loans are known for accommodating borrowers with lower credit scores, often accepting scores as low as 500 with a 10% down payment or 580 with a 3.5% down payment.

- Kentucky Fannie Mae Loan: Fannie Mae loans usually require a minimum credit score of 620 or higher, although some lenders may have slightly different requirements.

Kentucky Mortgage Income and Work History:

- Kentucky VA Loan: VA loans consider your stable income and employment history but may be more lenient if you have a history of military service or steady employment. 2 years of employment needed for loan application-minimal job gaps

- Kentucky USDA Loan: USDA loans often have income limits based on the area’s median income, and you need a stable income source. 2 years of employment needed for loan application-minimal job gaps

- Kentucky FHA Loan: FHA loans consider your income stability and work history, with guidelines that vary by lender. 2 years of employment needed for loan application-minimal job gaps

- Kentucky Fannie Mae Loan: Fannie Mae loans typically require a stable income and employment history, similar to conventional loans. 2 years of employment needed for loan application-minimal job gaps

Kentucky Mortgage Debt Ratio Requirements:

- Kentucky VA Loan: VA loans generally have more lenient debt-to-income (DTI) ratio requirements, often allowing for a higher DTI compared to conventional loans. VA loans can get approved on much higher debt to income ratios vs FHA, USDA and Fannie Mae loans. 65% or higher in some situations but if manual underwrite, will want the ratios closer to 41% with good residual income for VA loan. VA loans are the only type of loans that require a residual income…FHA, Fannie Mae, USDA does not have residual income requirements

- Kentucky USDA Loan: USDA loans have very strict DTI ratio limits, typically around 41% to 45% max on the backend ratio and 33% or less on the front end. By far the most restrictive on debt ratios vs FHA, VA, and Fannie Mae loans

- Kentucky FHA Loan: FHA loans also have relatively flexible DTI ratio limits (56% back end ratio possible on a AUS approval), making them accessible to borrowers with moderate levels of debt. Front end ratio max 45%

- Fannie Mae Loan: Fannie Mae loans follow standard DTI ratio guidelines similar to conventional loans. TYpically the second most restrictive on debt ratios right behind USDA loans on tighter debt to income ratio requirements, with the max back-end ratio no more than 50% –Front end ratio max 45%

Kentucky Mortgage Bankruptcy and Foreclosure Requirements:

- Kentucky VA Loan: VA loans are more forgiving of past bankruptcy or foreclosure, often requiring a waiting period of 2 years for Chapter 7 bankruptcy and 1-2 years for foreclosure.

- Kentucky USDA Loan: USDA loans have specific waiting periods after bankruptcy (3 years for Chapter 7) and foreclosure (3 years).

- Kentucky FHA Loan: FHA loans have shorter waiting periods after bankruptcy (2 years for Chapter 7) and foreclosure (3 years).

- Kentucky Fannie Mae Loan: Fannie Mae loans typically require longer waiting periods after bankruptcy (4-7 years) and foreclosure (7 years).

Advantages and Disadvantages of Kentucky VA loans, USDA, Fannie Mae and FHA:

- Kentucky VA Loan Advantages: Zero down payment, competitive interest rates, no private mortgage insurance (PMI) requirement, lenient credit and DTI ratios, and flexible eligibility criteria for veterans and active-duty service members.

- Kentucky VA Loan Disadvantages: Funding fee (although it can be rolled into the loan), limited to eligible veterans, service members, and some spouses.

- Kentucky USDA Loan Advantages: Zero down payment, lower interest rates, flexible credit requirements, and available in eligible rural areas.

- Kentucky USDA Loan Disadvantages: Limited to rural properties, income limits, and property eligibility criteria.

- Kentucky FHA Loan Advantages: Low down payment (3.5%), flexible credit requirements, competitive interest rates, and accessible to first-time homebuyers.

- Kentucky FHA Loan Disadvantages: Mortgage insurance premiums (MIP), stricter property standards, and limits on loan amounts.

- Kentucky Fannie Mae Loan Advantages: Available for a wide range of properties, competitive interest rates, and options for low down payments.

- Kentucky Fannie Mae Loan Disadvantages: Stricter credit and DTI requirements, potential for private mortgage insurance (PMI), and limited flexibility for borrowers with past financial challenges.

In summary, choosing the right loan type depends on your specific financial situation, eligibility criteria, and property location. VA loans offer excellent benefits for eligible veterans and service members, while USDA, FHA, and Fannie Mae loans provide alternatives with their own advantages and considerations.

Joel Lobb Mortgage Loan Officer

Text/call: 502-905-3708

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

How to Access KHC’s $12,500 Down Payment Assistance

Kentucky Down Payment Assistance

This type of loan is administered by KHC in the state of Kentucky. They typically have $12,500 down payment assistance year around, that is in the form of a second mortgage that you pay back over 15 years at a interest rate of 4.75% depending on your income in the household.

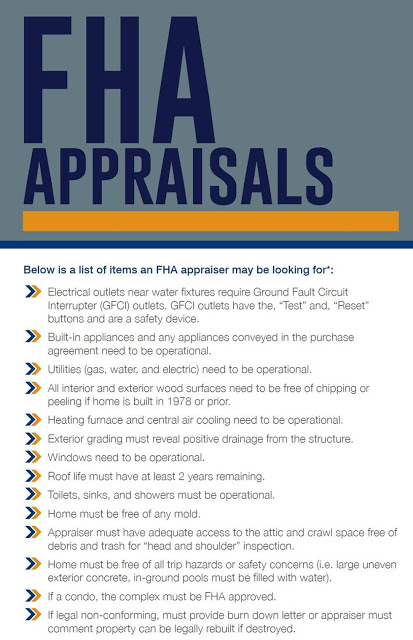

Kentucky FHA Appraisal Requirements For A Mortgage Loan Approval.

- Ordered through a third party source. Interested/vested parties may not initiate the appraisal. I.E> buyers, sellers, realtors, loan officer, family members

- Property must meet HUD’s minimum property standards. i.e.: permanent heat source, utilities must be on and in working order at time of inspection

- Flips < 90 days – not allowed Per HUD -If current owner owned less than 90 days FHA will not insure. Sometimes a second appraisal will be required by FHA investor if sold within the last 6 months for a large profit. Receipts of work done may be needed to substantiate increase in value of home in short-time period.

- Transferred appraisal – ok

- Appraisal valid 120 days – 30 day extension possible*

- Property eligibility – No location restrictions.

- New Construction Available

FHA MORTGAGE LOANS AND FLIPPING RULE FOR APPRAISALS

Resales Occurring 90 Days or Fewer after Acquisition:

Not eligible for FHA financing

Resales occurring between 91 days and 180 Days after Acquisition:

Obtain 2nd appraisal if resold between 91 to 180 days after acquisition

Obtain 2nd appraisal if resale price is 100% or more over price paid by seller

If 2nd appraisal is more than 5% lower than value of first appraisal, the lower value must be used

Borrower not allowed to pay for 2nd appraisal

Exceptions to FHA Flipping Rules:

Property purchased by an employer or relocation company due to relocation of an employee

Resales by HUD – REO program

Sales by other government agencies (i.e., IRS, court-ordered, DEA, etc.)

Sales of non-profit agencies approved to purchase HUD properties

Acquisition due to inheritance

Sales of properties by federally chartered financial institutions

Sales of properties by GSE’s

Sales of properties by local or state governments

Sales by builders selling a new home

Sales of properties in federally declared disaster areas

NOTE: Mortgage Company must obtain a 12-month chain of title to document time restrictions above.

VA MORTGAGE AND FLIPPING RULE

No Flipping Rules – Overlays may apply or at Underwriter’s discretion

USDA RURAL HOUSING MORTGAGE FLIPPING RULES

Lender is responsible to ensure that any recently sold property’s value is strongly supported when a significant

increase between sale and purchase occurs.

Lender must ensure that the appraisal value is supported with validated comps and protect the borrower from

predatory lending.

Fannie Mae Appraisal Flipping Rules

No Flipping Rules – Lender overlays may apply

Freddie Mac

No Flipping Rules – Lender overlays may apply

Applies to case numbers assigned on or after June 1, 2022

Updates the initial appraisal validity period from 120 days to 180 days from the effective date of the appraisal report;

Extends the appraisal update validity period from 240 days to one year from the effective date of the initial appraisal report;

Allows the appraisal update to be ordered AFTER an appraisal expires; and

Eliminates the optional 30-day extension.

✨This is big news for FHA ✨

The guideline change also puts FHA appraisal expirations on par with conventional loan expiration dates.

Kentucky FHA appraisals can take home buyers by surprise. That’s why we’ve put together some good-to-know info about the process. Feel free to use this to help educate your clients.

Senior Loan Officer