FHA Mortgage Insurance Premium (MIP) guidelines is correct. As of March 2025, FHA loans require an upfront MIP of 1.75% of the loan amount. The annual MIP rates and their duration are influenced by factors. These factors include the loan term, loan amount, and loan-to-value (LTV) ratio.

Annual MIP Rates for FHA Loans with Terms Greater Than 15 Years:

- Loan Amounts ≤ $726,200:

- LTV ≤ 90%: Annual MIP of 0.50% for 11 years.

- LTV > 90% and ≤ 95%: Annual MIP of 0.50% for the life of the loan.

- LTV > 95%: Annual MIP of 0.55% for the life of the loan.

- Loan Amounts > $726,200:

- LTV ≤ 90%: Annual MIP of 0.70% for 11 years.

- LTV > 90% and ≤ 95%: Annual MIP of 0.70% for the life of the loan.

- LTV > 95%: Annual MIP of 0.75% for the life of the loan.

Annual MIP Rates for FHA Loans with Terms 15 Years or Less:

- Loan Amounts ≤ $726,200:

- LTV ≤ 90%: Annual MIP of 0.15% for 11 years.

- LTV > 90%: Annual MIP of 0.40% for the life of the loan.

- Loan Amounts > $726,200:

- LTV ≤ 78%: Annual MIP of 0.15% for 11 years.

- LTV > 78% and ≤ 90%: Annual MIP of 0.40% for 11 years.

- LTV > 90%: Annual MIP of 0.65% for the life of the loan.

1 – Email – kentuckyloan@gmail.com

2. Call/Text – 502-905-3708

Joel Lobb

Mortgage Loan Officer – Expert on Kentucky Mortgage Loans

Website: www.mylouisvillekentuckymortgage.com

Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave., Louisville, KY 40204

Address: 911 Barret Ave., Louisville, KY 40204

Evo Mortgage

Company NMLS# 1738461

Personal NMLS# 57916

For assistance with Kentucky mortgage loans, reach out via email, call, or text Joel Lobb directly.

Kentucky Local Home Loan Lender Services

First-Time Home Buyers Welcome

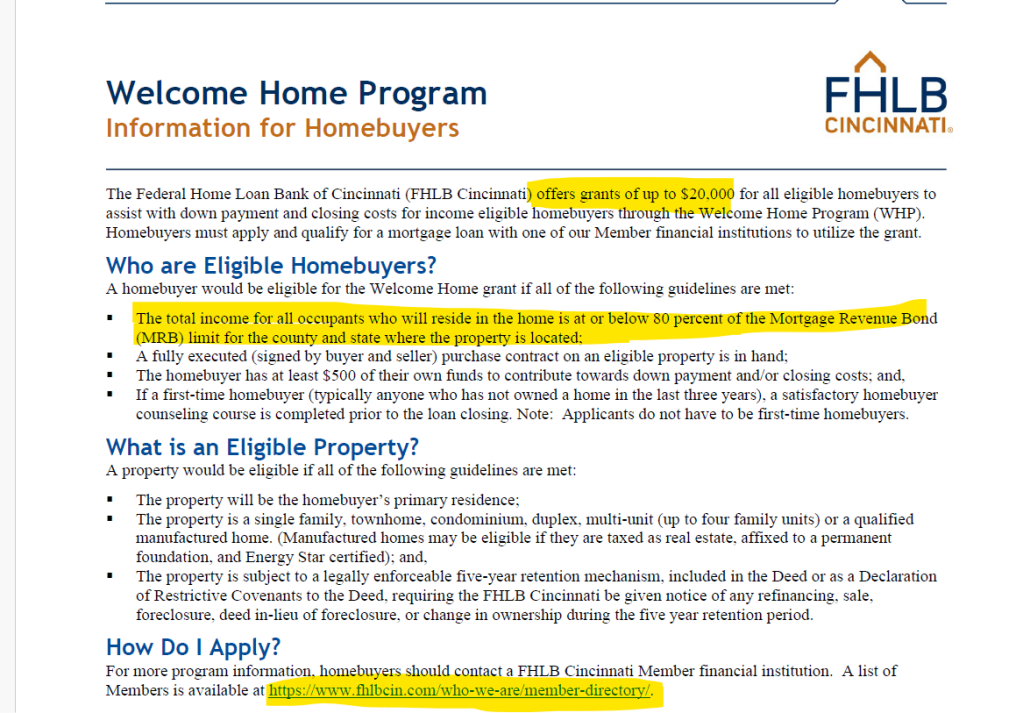

First-Time Home Buyers Welcome FHA, Rural Housing (USDA), VA, and Kentucky Housing Corporation (KHC) Loans

FHA, Rural Housing (USDA), VA, and Kentucky Housing Corporation (KHC) Loans Conventional Loan Options Available

Conventional Loan Options Available Fast Local Decision-Making

Fast Local Decision-Making Experienced Guidance Through the Home Buying Process

Experienced Guidance Through the Home Buying Process