• Per AUS Findings.

FHA FAQ link

ML 2014 – 02 on Manual Underwriting was incorporated into the HUD Handbook 4000.1. Additional source for questions will be the FAQ’s. Use “manual underwriting and compensating factors” to search.

Kentucky FHA Manual Underwriting Guidelines for Loan Approval

Many Kentucky homebuyers are told “no” because their FHA loan needs a manual underwrite. That does not mean the loan is dead. It means the file requires stronger documentation, a clean structure, and an underwriter who knows how to present compensating factors correctly.

If your loan is a manual downgrade, a Refer/Eligible, or has risk flags that require manual underwriting, this page explains what matters, what HUD expects, and how approvals get done in the real world.

Looking for standard FHA guidelines instead? Kentucky FHA loan requirements. Need down payment help? Kentucky down payment assistance. Prefer no down payment? Kentucky USDA loans. Veteran financing? Kentucky VA loans.

What is FHA manual underwriting in Kentucky?

Manual underwriting is the full human review of an FHA file when an automated recommendation is not available, is Refer/Eligible, or when HUD requires a downgrade due to specific credit, housing, or documentation factors. The underwriter must evaluate the borrower’s complete profile, document the story, and support the decision with acceptable compensating factors under HUD Handbook 4000.1.

Common reasons a Kentucky FHA loan becomes a manual underwrite

- Limited credit history or non-traditional credit

- Extenuating circumstances affecting credit or income

- Chapter 13 with limited seasoning or trustee complexity

- Disputed derogatory accounts totaling more than $1,000

- Frequent job changes in the last 12 months

- Documentation issues the AUS cannot evaluate

Verification of rent (VOR) requirements

All manual underwritten FHA loans require a verified housing payment history. If the borrower rents, the file typically needs verification of rent. If the borrower is living rent-free, the file needs a detailed letter of explanation describing the arrangement and housing stability.

Kentucky FHA manual underwriting ratios and compensating factors

These tiers are commonly used in practice for manual underwrites, with compensating factors used to justify higher debt-to-income ratios when permitted.

| Decision credit score | Max ratios (front/back) | Compensating factors needed |

|---|---|---|

| 620 and above | 31/43 | None required |

| 620 and above | 33/45 | Energy-efficient home stretch ratios may apply when documented |

| 620 and above | 37/47 | One compensating factor |

| 620 and above | 40/40 | No discretionary debt with strong recent pay history (documented) |

| 620 and above | 40/50 | Two compensating factors |

Examples of acceptable compensating factors

- Verified and documented reserves equal to at least three total monthly mortgage payments

- Minimal payment shock with a documented 12-month housing payment history (generally no more than one 30-day late)

- Residual income meeting VA residual income benchmarks for household size and region

- Verified additional income likely to continue but not used for qualifying, when it would reduce ratios if included

Using residual income as a compensating factor

Residual income can be a strong compensating factor in manual underwriting. It is calculated by starting with total gross monthly income and subtracting taxes, payroll deductions, the proposed mortgage payment, all recurring debts, estimated maintenance/utilities, and job-related expenses such as child care. The remaining amount is residual income. Household size generally includes all occupants in the home.

Residual income is often benchmarked against VA residual income charts. If the residual meets or exceeds the applicable benchmark for household size and region, it can strengthen the manual underwrite decision.

When an FHA file must be downgraded to manual underwriting

Even if an FHA file receives an automated approve/eligible recommendation, HUD requires a manual downgrade when certain risk factors are present. Common triggers include:

- Information or documentation cannot be evaluated by the AUS

- New information impacts insurability and was not considered by AUS

- Disputed derogatory accounts totaling $1,000 or more

- Bankruptcy discharge within two years of case number assignment

- Short sale, foreclosure, or deed-in-lieu within three years of case number assignment

- Mortgage payment history patterns requiring downgrade under FHA rules

- Undisclosed mortgage debt discovered

- Business income decline exceeding 20% over the analysis period

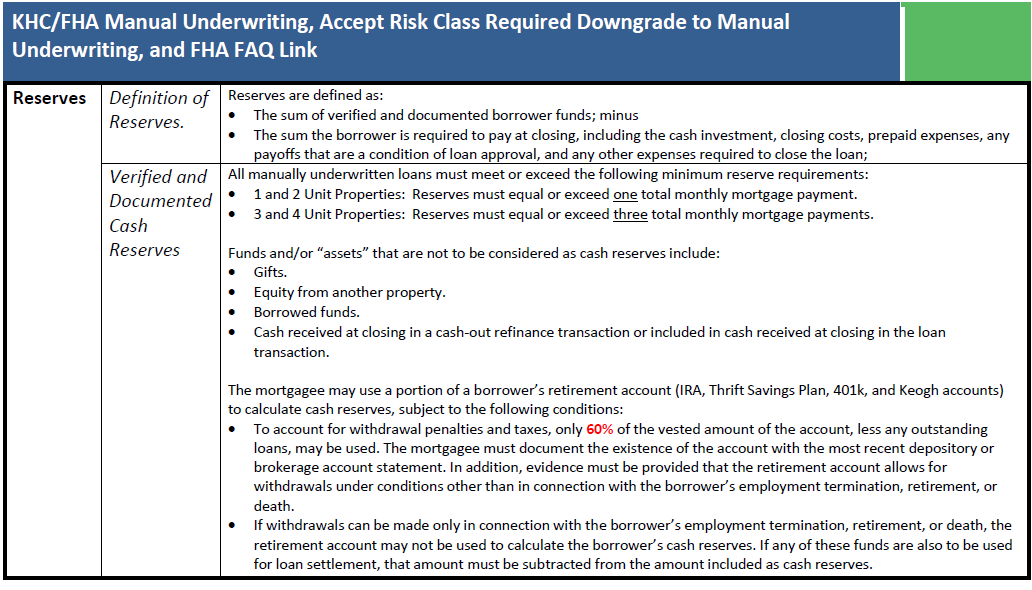

Reserve guidance for Kentucky FHA manual underwrites

Reserve expectations are typically driven by AUS findings and HUD guidance. In manual underwriting, reserves are also frequently used as a compensating factor to support approval, especially when ratios are stretched.

Need a second look on a Kentucky FHA manual underwrite?

If your borrower has been declined elsewhere, has a manual downgrade, or was told the loan is “too complicated,” submit the scenario for review. You will get a straightforward answer: what works, what does not, and what documentation is required to move forward.

Start a Kentucky FHA pre-approval or send a scenario for review.

NMLS #57916 | Company NMLS #1738461 | Equal Housing Lender | nmlsconsumeraccess.org