Bad Credit Home Loans in Kentucky

Many Kentucky homebuyers assume a low credit score automatically disqualifies them from buying a home. That assumption is incorrect. Several mortgage programs are specifically designed to help buyers with past credit issues qualify for financing sooner than expected.

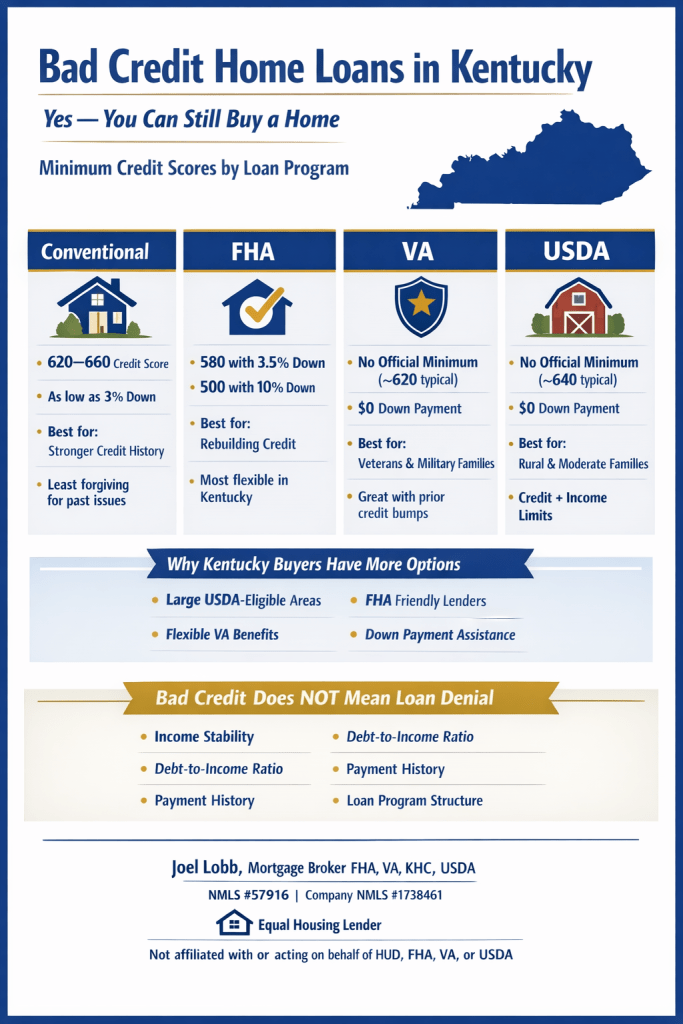

In Kentucky, the most common loan options for buyers with bad or fair credit include FHA, VA, USDA, and select conventional loan programs. Each option has different credit score thresholds, down payment requirements, and underwriting flexibility.

Minimum Credit Score Requirements by Loan Type

Conventional loans typically require a minimum credit score between 620 and 660, depending on the program and automated underwriting results. While down payments can be as low as 3 percent, conventional loans are generally the least forgiving when it comes to recent late payments, collections, or limited credit history.

FHA loans in Kentucky are the most common solution for buyers rebuilding credit. FHA financing allows approvals with credit scores as low as 580 with only 3.5 percent down. In limited cases, buyers with scores down to 500 may qualify with a 10 percent down payment, provided the overall risk profile is strong.

Eligible service members and veterans may benefit from VA loans in Kentucky, which do not have an official minimum credit score requirement set by the agency. Most lenders look for scores around 620, but VA loans remain one of the most flexible options available, offering zero down payment and no monthly mortgage insurance.

For buyers purchasing outside major metro areas, USDA loans in Kentucky can provide 100 percent financing with competitive interest rates. While there is no official minimum credit score, most USDA lenders require a 640 score for automated approval, along with meeting income and household eligibility guidelines.

Why Kentucky Buyers Often Qualify With Lower Credit Scores

- Large portions of Kentucky qualify for USDA rural housing loans

- FHA loans are widely accepted by Kentucky lenders

- VA loans provide exceptional flexibility for eligible veterans

- Down payment assistance programs can be layered correctly with the right loan structure

What Mortgage Underwriters Actually Review

Mortgage approval is based on the full financial picture, not just the credit score. Underwriters evaluate income stability, work history, debt-to-income ratio, recent payment behavior, available assets, and how the loan is structured.

In many cases, a borrower with a lower credit score but strong income stability and clean recent payment history can be a stronger approval than someone with a higher score and excessive debt.

Bottom Line for Kentucky Homebuyers

Bad credit does not automatically mean loan denial. The right loan program, structured correctly from the start, often matters more than the credit score alone. Many Kentucky buyers qualify months or even years sooner than they expect once their options are reviewed properly.

NMLS #57916 | Company NMLS #1738461

Equal Housing Lender.

This is not a commitment to lend. All loans are subject to credit approval and program requirements.