What are the requirements to qualify for a Kentucky FHA Mortgage in 2020?

Kentucky FHA loan is a mortgage that is insured by the Government agency under Housing and Urban Development that is called FHA or short for Federal Housing Administration. The loan was established for Kentucky Home buyers will very little or no money down home loans with more lenient credit score and income requirements and tends to be more forgiving about credit history with regard to bankruptcy and foreclosures, higher debt to income ratios and job history with limited work history for home buyers will only 2 years work history or less.

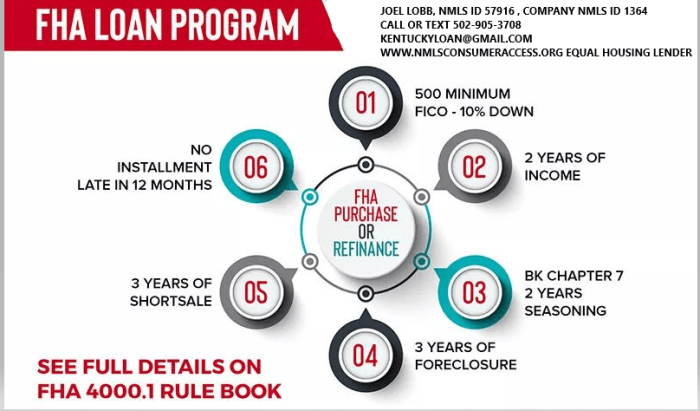

Kentucky FHA Credit Score Requirements and Down Payment Requirements

The Kentucky FHA home loan program may accept credit scores as low as 580 and require at least a 3.5 percent down payment of the sales price on a purchase. If you have a credit score below 580, then a 10 percent down payment or more may be acceptable some FHA lenders in Kentucky , providing you meet all program guidelines in regards to debt to income ratios, assets, and income requirements . The loan cannot be used for rental properties and does allow for co-signers if they are related.

Remember, these guidelines are set forth by FHA and all lenders do not have to offer these guidelines, to whereas they may a higher credit score or more money down or income restrictions on how much you can qualify for.

Kentucky FHA Mortgage Loans and Bankruptcy or Foreclosure

In case you had a blemish on your credit report with a bankruptcy, short sale or foreclosure, follow these guidelines.

Kentucky FHA loans requires a passage of two years since the discharge date of a chapter 7 bankruptcy. A chapter 13 bankruptcy may be acceptable after at least 12 months of an on time pay-back period and the borrower has received permission from bankruptcy court to enter the mortgage transaction, and you qualify with the new house payment along with other debts on the credit report.

Three years must pass if you went through a short sale or foreclosure. The date starts when the home was sold, not when you entered the transaction toward foreclosure or short sale period. Sometimes the house will not sell to 1-2 years later after the foreclosure and this is when the passage date starts. Keep this in mind on your next FHA loan pre-approval if you have had a bankruptcy or foreclosure in the past.

Kentucky FHA Loans and Mortgage Insurance

FHA loans have two forms of mortgage insurance which protects the lender for any losses suffered if the borrower defaults on the payment. ne is called upfront mortgage insurance premium (UFMIP) which has a rate of 1.75% of the loan amount. The fee can be added to the loan amount or paid in full as part of your closing costs. In addition, FHA loans also have a 0.8-0.85% (of the loan amount) monthly mortgage insurance. In most cases, this mortgage insurance remains for the life of the loan. To eliminate the mortgage insurance, the borrower must refinance the loan into a non-FHA loan program and have 20% equity in the property.

In addition to the down payment requirements on a FHA loan, they’re closing costs and prepaids to pay at closing. The seller can contribute up to 6% of the sales price to help the buyer with closing costs and prepaid expenses. Closing costs vary from lender to lender and your prepaids would be the same no matter which lender you choose because this is a function of the property ‘s home insurance premium quote you obtain and the property tax bill on the home set by PVA.

Sometimes the lender can pay a credit toward these expenses at closing with a lender credit which lets the lender credit back to you with a higher rate to reduce the costs of the loan’s costs at closing for out of pocket expenses.

All Kentucky FHA loans are assumable, which means that when the homeowner sells a home, the buyer may be able to take on the existing loan and terms (e.g.: balance, rate and remaining loan amount). Of course, anyone interested in the assumable loan feature must go through the approval process (credit check, income verification) with the current lender on the property. This is a very rare occurrence because most sellers are going to sell the home for more than they owe on it.

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people. NMLS ID# 57916, (www.nmlsconsumeraccess.org). USDA Mortgage loans only offered in Kentucky.

All loans and lines are subject to credit approval, verification, and collateral evaluation