Understanding how to get the best mortgage rates today in Kentucky involves several factors. You need to learn the differences between Kentucky FHA, VA, USDA, and conventional home loans. Each loan type has its own criteria, benefits, and rate determinants. Here’s an overview of how to obtain the best rates for each:

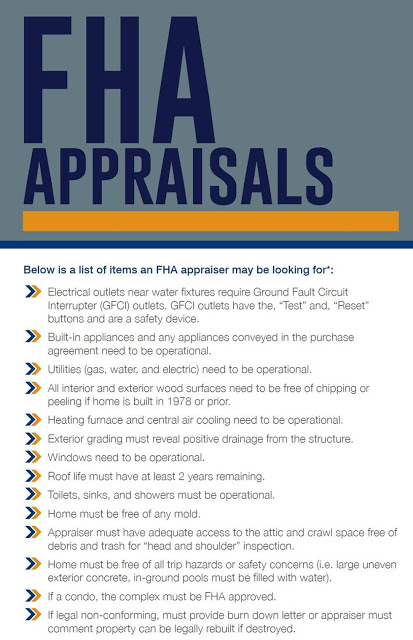

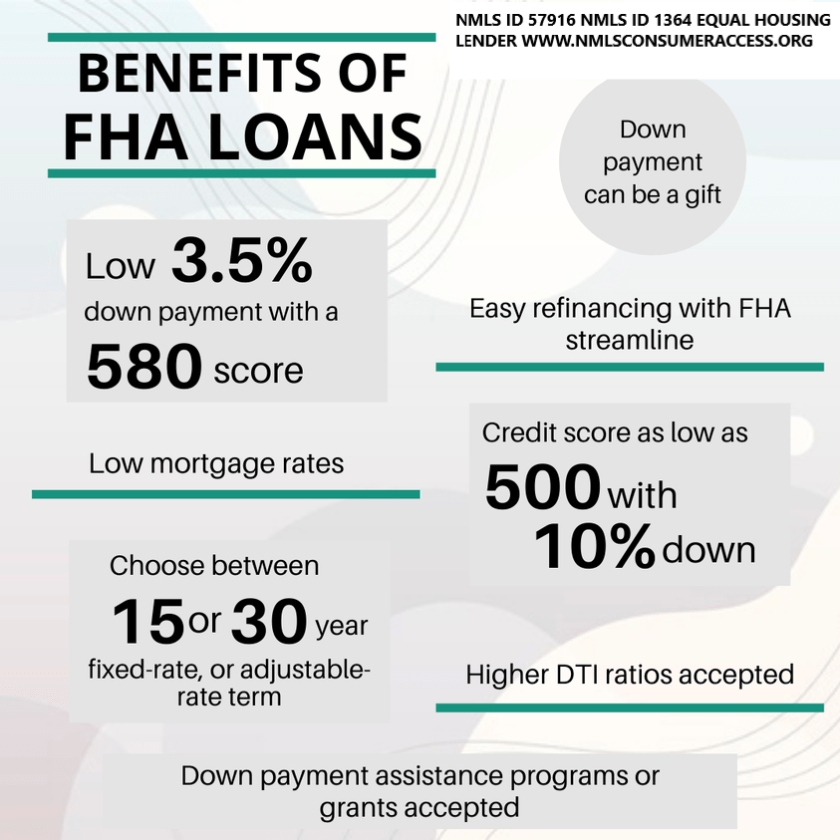

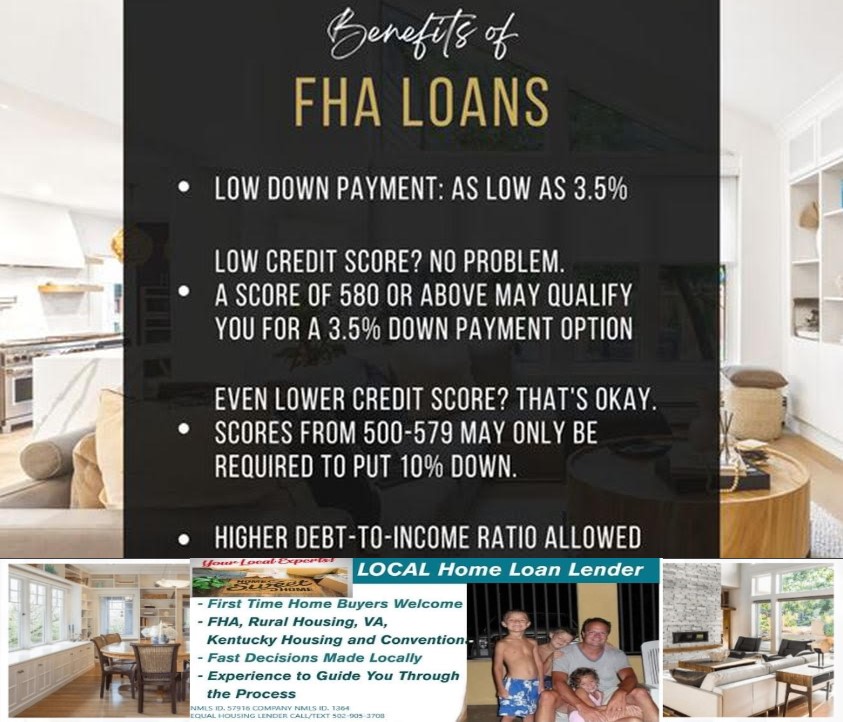

1. Kentucky FHA Loans

Federal Housing Administration (FHA) loans are popular among Kentucky first-time homebuyers. They offer flexible credit requirements. They also require low down payments.

Best Practices to Secure the Best Rates:

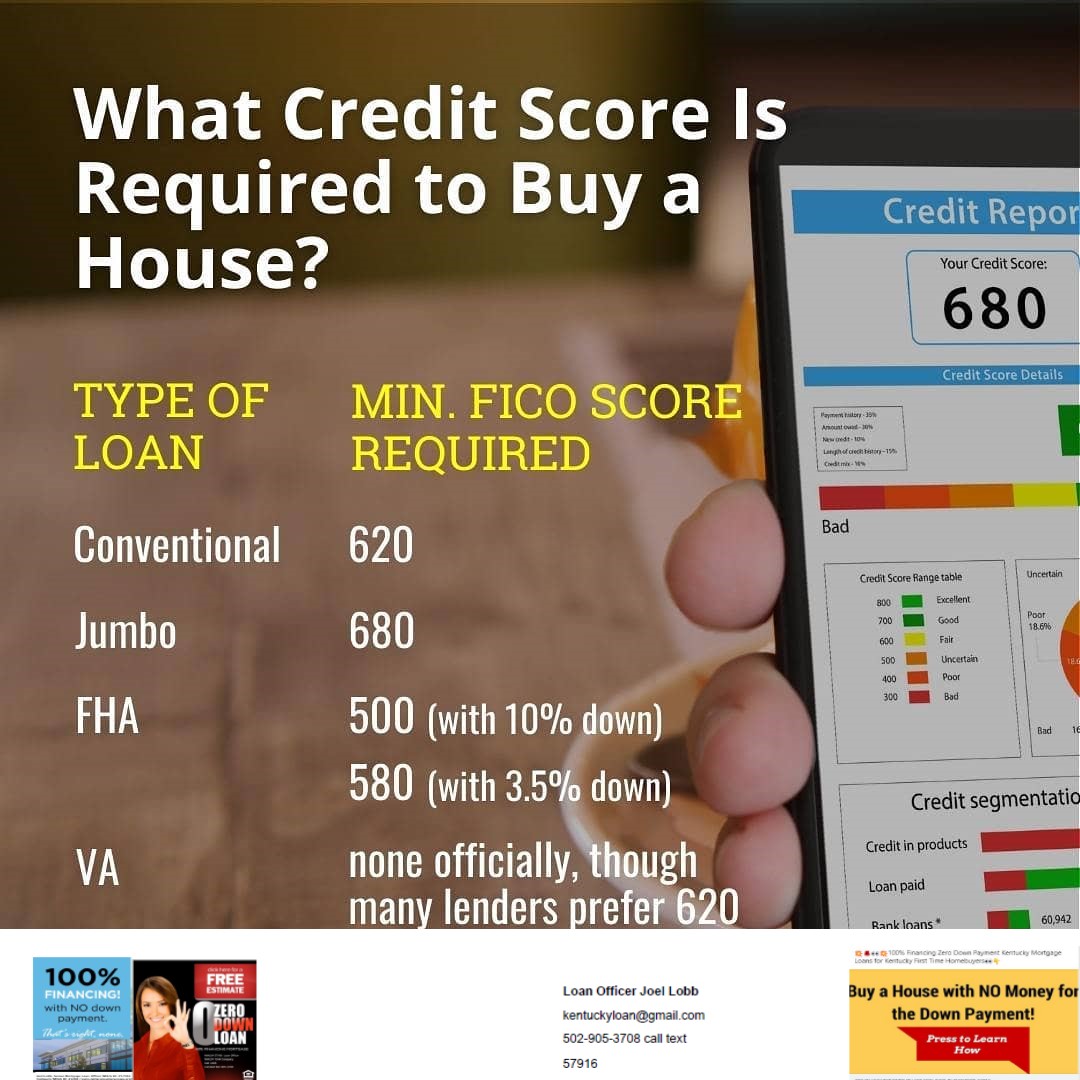

- Credit Score: Aim for a score of 720 or higher. While Kentucky FHA loans accept lower scores, higher scores typically secure better rates.

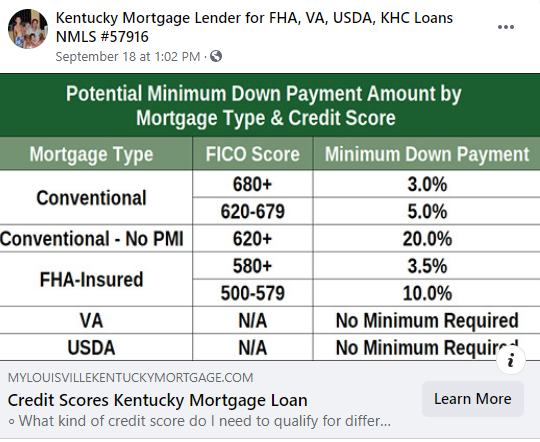

- Down Payment: Putting down more than the minimum 3.5% can sometimes lower the interest rate. 500 is the minimum score with 10 % down and 580 and above score will you get you to a minimum down payment of 3.5%

- Debt-to-Income Ratio (DTI): Maintain a DTI of 56.99% or lower to increase your chances of getting a favorable rate.

- Shopping Around: Compare offers from different lenders in Kentucky for FHA lenders. Each lender may have different rates and terms for FHA loans.

- Larger Loan amounts: will yield better rates. A lender will get you a better rate if the loan is larger due to they will make more money on the loan vs a small loan amount.

2. Kentucky VA Loans

Veterans Affairs (VA) loans are available to veterans, active-duty service members, and certain members of the National Guard and Reserves. These loans often offer lower rates and do not require a down payment or private mortgage insurance (PMI).

Best Practices to Secure the Best Kentucky VA loan Rates:

- Credit Score: A score of 720 or higher is generally preferred, although some lenders might accept lower scores. No minimum score set by VA lenders in Kentucky

- Service History: Ensure your service record meets the eligibility requirements. 2 year work history usually needed

- Loan Comparison: Even within VA loans, rates can vary between lenders. Obtain multiple quotes to find the best rate.

- Funding Fee: Understanding the VA funding fee and including it in your budget can help in comparing the true cost of loans.

3. Kentucky USDA Loans

United States Department of Agriculture (USDA) loans are designed for rural and suburban homebuyers who meet certain income requirements.

Best Practices to Secure the Best Kentucky USDA Loan Rates:

- Credit Score: Aim for a score of 720 or higher to access better rates. No minimum score for USDA loans

- Income Limits: Ensure your income falls within the USDA’s eligibility guidelines for your area.

- Property Location: The home must be in an eligible rural or suburban area. Use the USDA’s property eligibility tool to confirm.

- Guaranteed Loan Program: USDA offers both direct and guaranteed loan programs. The guaranteed loan program often has more favorable terms.

4. Kentucky Conventional Loans

Conventional loans are not insured or guaranteed by the government and typically require higher credit scores and down payments. They are much more sensitive to down payments. Credit score is important for getting the best rate. Debt to income ratio is also crucial for loan approval. They will typically have a higher rate than government backed mortgage loans in Kentucky like FHA, VA, and USDA. However, the mortgage insurance is cheaper. It is not for the life of the loan and requires less red tape to close.

Best Practices to Secure the Best Conventional loan Rates:

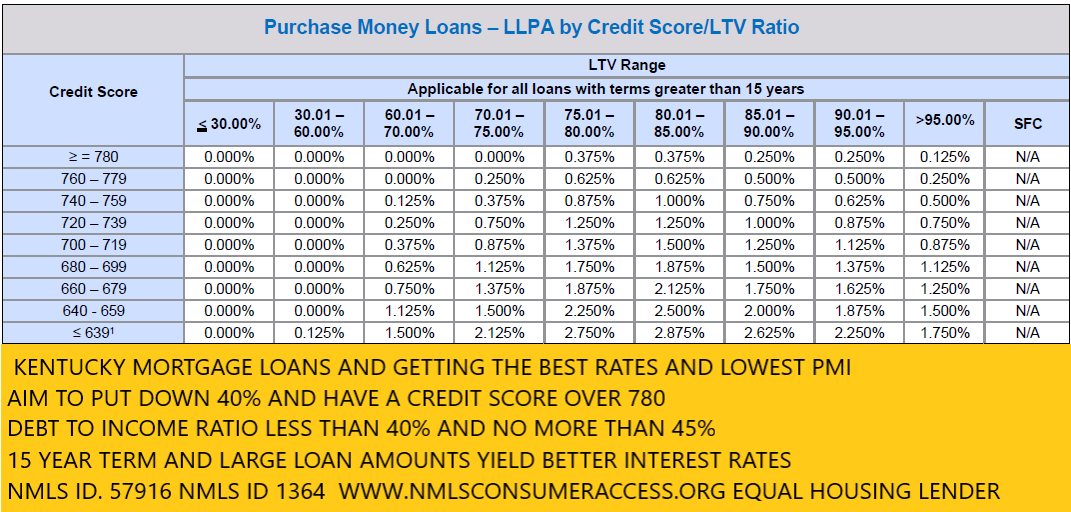

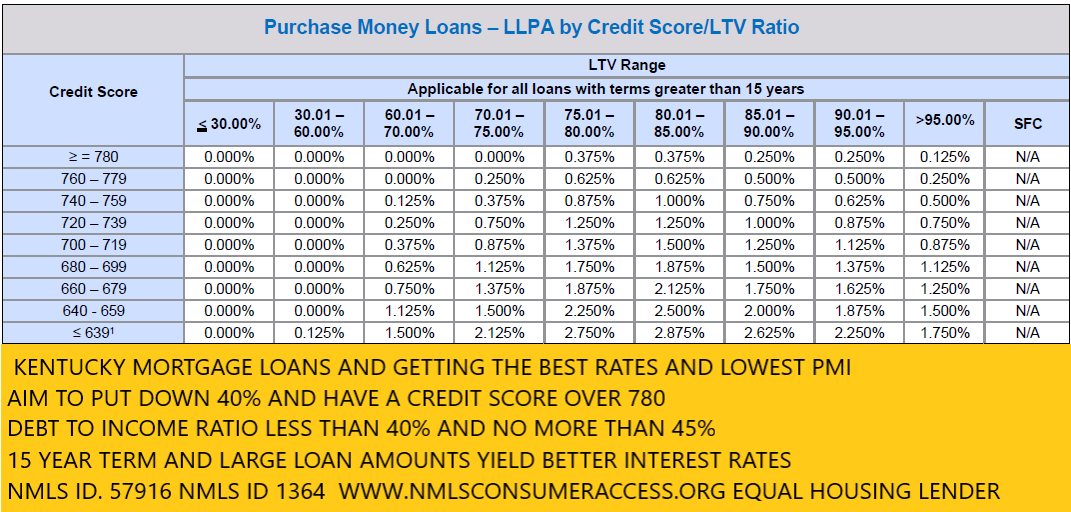

- Credit Score: A score of 780 or higher is ideal to secure the best rates. Minimum credit score for Conventional loans in Kentucky is 620

- Down Payment: A larger down payment (40% or more) can significantly lower your interest rate and eliminate PMI.

- DTI Ratio: A DTI ratio of 45% or lower is preferred.

- Loan Term: Consider shorter loan terms (15 or 20 years) for lower rates, though monthly payments will be higher.

- Large Loan Amounts: Larger Loan Amounts will yield better rates vs a small loan amount.

General Tips for All Loan Types to get the lowest Mortgage Rates in Kentucky

- Credit Score, debt ratio, : Maintain a strong credit history, stable income, and low debt levels.

- Rate Shopping: Use online comparison tools and consult multiple lenders. Rates can vary significantly with each lender.

- Points: Consider paying points to lower your interest rate. This is an upfront fee that can reduce your monthly payments over the loan term.

- Pre-approval: Get pre-approved for a mortgage to understand what rate you qualify for and to strengthen your offer when shopping for a home.

- Locking Loan: Lock in for a shorter term. For example, lock in the rate for 30 days vs 60 days and you will get a better rate. Be aware if you go past the lock the date, you will be subject to worse case pricing.

By understanding the specific requirements and best practices for each loan type, you can position yourself to secure the most favorable mortgage rates in Kentucky.–

NMLS ID# 57916, (www.nmlsconsumeraccess.org).

| Joel LobbMortgage Broker – FHA, VA, USDA, KHC, Fannie MaeEVO Mortgage • Helping Kentucky Homebuyers Since 2001 |

Call/Text: 502-905-3708 Call/Text: 502-905-3708 Email: kentuckyloan@gmail.com Email: kentuckyloan@gmail.com Website: www.mylouisvillekentuckymortgage.com Website: www.mylouisvillekentuckymortgage.com Address: 911 Barret Ave, Louisville, KY 40204 Address: 911 Barret Ave, Louisville, KY 40204NMLS #57916 | Company NMLS #1738461 |

| Free Info & Homebuyer Advice → |

| Kentucky Mortgage Loan ExpertFHA | VA | USDA | KHC Down Payment Assistance | Fannie MaeEqual Housing Lender. This is not a commitment to lend. All loans are subject to credit approval and program requirements. |