- First-Time HomeBuyer Louisville Kentucky Mortgage Programs

First Time Buyer (11)

First Time Home Buyer in Kentucky Zero Down (14)

First Time Home Buyers Louisville (7)- First Time Home Buyer in Kentucky Zero Down

- First Time Home Buyer Loans–Kentucky

- First Time home Buyer PRgoams

- First Time Home Buyer Programs Louisville Kentucky

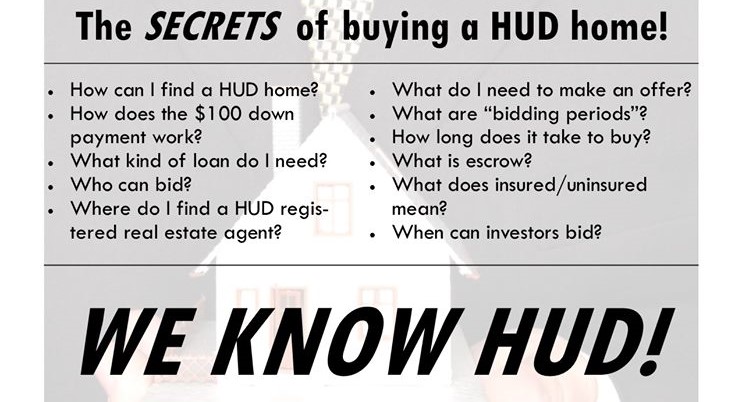

Kentucky HUD Homes for Sale with the FHA $100 Down Program

KENTUCKY HUD HOMES SALES INCENTIVES

| For a limited time, FHA offers sales incentives on HUD homes that will make these homes more affordable for home buyers when purchasing a property using FHA-insured financing. The incentives VARY from State to State but may include low down payments; sales allowances that can be used to pay closing costs, make repairs, or pay down the mortgage amount; broker bonuses for owner-occupant sales. The benefits of FHA financing are low down payments; competitive interest rates; flexible credit qualifying. To find a HUD-Approved Lender, and for the latest sales incentives in your areas, visit HUDhomestore.com The program incentives are subject to change without prior notice. | |

|

Sales Incentives (subject to change without prior notice) |

Participating States |

|

$100 Down Payment! Available to Owner Occupant Homebuyers when purchasing a property using FHA-insured financing. |

Kentucky HUD Homes for Sale By FHA |

Search Results for HUD Homes in KY |

|

|

201-405318 409 Mildred Ave South Shore, KY 41175 Greenup County |

201-585835 2215 Sharon Rd Ashland, KY 41101 Boyd County |

201-648672 882 Whippoorwill Ro Paintsville, KY 41240 Johnson County |

201-443322 99 Falls Br Belfry, KY 41514 Pike County |

201-612315 2718 Cumberland Ave Ashland, KY 41102 Boyd County |

201-654741 801 E Broad Street Central City, KY 42330 Muhlenberg County |

|

201-492365 9655 Marshall Rd Ryland Hght, KY 41015 Kenton County |

201-619887 2878 1st Street Petersburg, KY 41080 Boone County |

201-662018 711 Aqua Shores Dr Shelbyville, KY 40065 Shelby County |

|

201-569915 1840 Holman St Covington, KY 41014 Kenton County |

201-631020 465 Kennedy Rd New Haven, KY 40051 Larue County |

201-663813 1501 Old Henderson Rd Providence, KY 42450 Webster County |

201-574687 2444 Bardstown Rd Lawrenceburg, KY 40342 Anderson County |

Joel Lobb

Mortgage Loan Officer

Individual NMLS ID #57916

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

https://www.mylouisvillekentuckymortgage.com/

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant’s eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916http://www.nmlsconsumeraccess.org/

Some products and services may not be available in all states. Credit and collateral are subject to approval. Terms and conditions apply. This is not a commitment to lend. Programs, rates, terms and conditions are subject to change without notice. The content in this marketing advertisement has not been approved, reviewed, sponsored or endorsed by any department or government agency. Rates are subject to change and are subject to borrower(s) qualification.

How to Ditch FHA Mortgage Insurance Premiums

Originally Posted On: https://thelindleyteam.com/how-to-ditch-fha-mortgage-insurance-premiums/ When you get a mortgage, you’re signing a million sheets of paper and agreeing to pay a lot…

Source: How to Ditch FHA Mortgage Insurance Premiums

When you get a mortgage, you’re signing a million sheets of paper and agreeing to pay a lot of things that you may not understand at the time. Closing costs, down payments, inspections, real estate agent fees, home insurance, escrow, and so on and so forth. One of the numbers that may have gotten rolled into that list is mortgage insurance premiums.

If you got an FHA loan, you’re almost certainly paying FHA mortgage insurance premiums. Read on to learn more about what these are, how much you might be paying each month, and how you can get out from under them.

What Are FHA Mortgage Insurance Premiums?

Before the Federal Housing Administration was founded, in order to qualify to buy a house, mortgage applicants had to have excellent credit and a large down payment. This made it harder for people to buy homes, so the FHA was established to make this process easier for first-time homebuyers. The FHA does not actually give loans they just insure them.

Mortgage insurance is a policy that protects your lender in case you default on your loan. It allows lenders to make higher-risk loans without worrying about losing money. You pay the premiums for that insurance policy as a part of your agreement with the loan.

Mortgage Insurance Rates

If your loan was $625,000 or less and you got a thirty-year fixed-rate mortgage and you paid less than 5 percent on a down payment, you’ll have an annual mortgage insurance premium of 0.85 percent of your loan. If you put down more than 5 but less than 10 percent, you’ll pay 0.8 percent for the life of the loan. If you put down more than 10 percent, you’ll pay 0.8 percent for the first eleven years of the loan

For loans less than $625,000 with a fifteen-year fixed-rate note where you paid less than 10 percent down, you’ll pay 0.7 percent of your loan amount every year for the life of the loan. If you paid more than 10 percent, you’ll pay 0.45 percent every year for the first eleven years.

If you have a mortgage greater than $625,000 with a thirty-year fixed-rate loan and you paid less than 10 percent down, you’ll pay 1 percent of your mortgage every year for the life of the loan. If you paid more than 10 percent down, you’ll pay a slightly higher 1.05 percent, but only for the first eleven years.

And finally, if your loan is greater than $625,000, you have a 15-year fixed-rate mortgage, and you paid less than ten percent down, you’ll pay 0.95 percent of your loan every year for the life of the loan. If you paid more than 10 percent but less than 22 percent, you’ll pay 0.7 percent for the first eleven years of the loan. And if you paid more than 22 percent, you’ll pay 0.45 percent every year for the first eleven years.

How to Get Out of Mortgage Insurance

The good news is that you aren’t stuck forever. Once you get about 20 percent equity in your house, either through improvements or paying down the loan, you can refinance your mortgage. With that 20 percent, you should be able to get a mortgage that doesn’t require FHA protection.

Even if you don’t yet have 20 percent equity in the house, you may be able to refinance into a lower mortgage insurance premium bracket. If you can get 10 percent to put down on your new mortgage, for instance, you may be able to drop to a lower monthly percentage that you’re paying.

Reappraise

Depending on where you live and what work you’ve done on the house, you may be able to get 20 percent equity without having to pay all that money in. If property values in your area are on the rise, your home may be worth more now than when you bought it. The same goes for home improvements, and that total may leave you with more than 20 percent equity in your home so you can refinance out of your mortgage insurance.

A great way to determine if this is the case for you is to have your home appraised again. A home appraisal will cost somewhere between $300 and $400. If you’re paying $520 a month for mortgage insurance premiums (1 percent on a $625,000 loan), this will pay for itself immediately.

How to Refinance

Once you get 20 percent equity in your house, no matter how you do it, you can refinance into a new mortgage. Start by shopping around and applying for a new mortgage with three or four lenders. This will give you an idea of what sort of interest rates you’re looking at and what your new monthly payment should be.

Once you find a lender you like, lock in your interest rate and start on the process of getting the loan closed. You’ll need a fair amount of paperwork for both the application and closing processes. Your last several pay stubs, tax returns, credit reports, and statements of your assets and outstanding debts are a good place to start.

Kentucky FHA Mortgage Guidelines Changes for 2015

Did You Know that Kentucky Mortgage FHA Income Requirements changed in October 2015? • Job Changes – FHA loan rules instruct lenders to, favorably consider a borrower for a mortgage if he/she changes jobs frequently within the same line of work, but continues to advance in income or benefits. In this instance, income stability takes precedence over job stability. And FHA loan applicants who have been out of a job for a while but have since returned to employment may have their income considered effective and stable when recently returning to work after an extended absence if he/she: Note: An acceptable employment situation includes an individual who took several years off from employment to raise children, then returned to the workforce. • Employment Gaps – For borrowers with gaps – FHA does not require a minimum length of time that a borrower must have held a position of employment. However, the lender must verify the borrowers employment for the most recent two full years, and the borrower must: When analyzing the probability of continued employment, the lender must examine –the borrowers past employment record

Joel Lobb

phone: (502) 905-3708

|

Louisville Kentucky Mortgage Rates

Louisville Kentucky Mortgage Rates.

via Louisville Kentucky Mortgage Rates.

Senior Loan Officer

phone: (502) 905-3708

Frequently Asked Questions about FHA Kentucky Home Loans

Frequently Asked Questions about FHA Kentucky Home Loans.

via Frequently Asked Questions about FHA Kentucky Home Loans.

FHA to 50%…up to 55% with comp factors and a strong borrower

Manual UW’s on FHA/ to 620 Score

FHA purchases and R/t refi’s down to a 580 with DU Approved Eligible

—

Senior Loan Officer

phone: (502) 905-3708

FHA Back to Work Extenuating Circumstances Works!

FHA Back to Work Extenuating Circumstances Works, FHA Back to Work Program, Success Story, FHA Loans