Is an Kentucky FHA loan right for you?

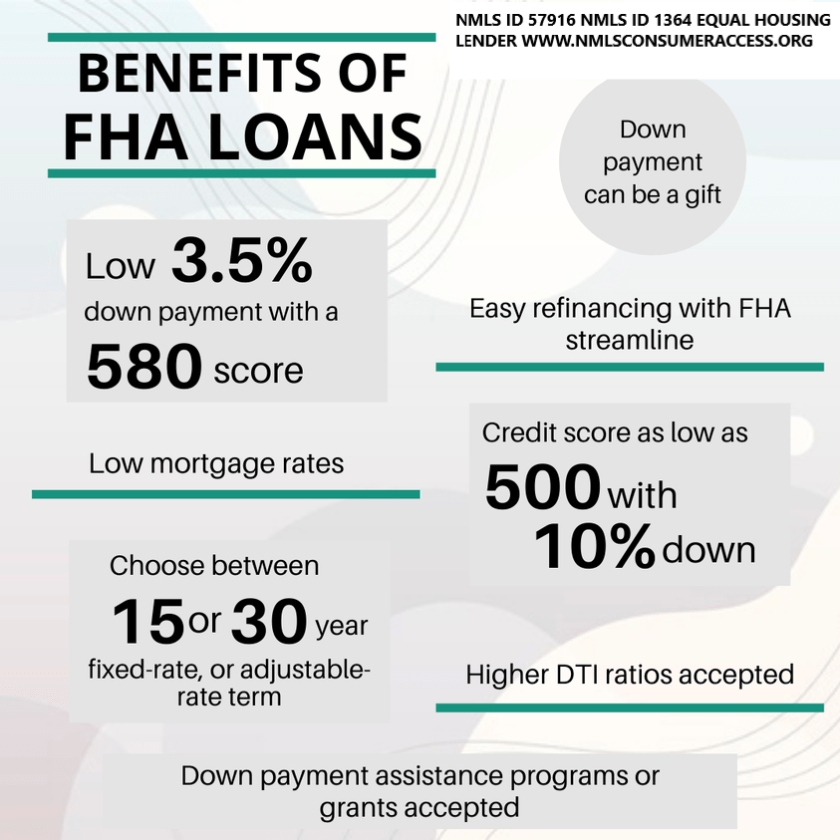

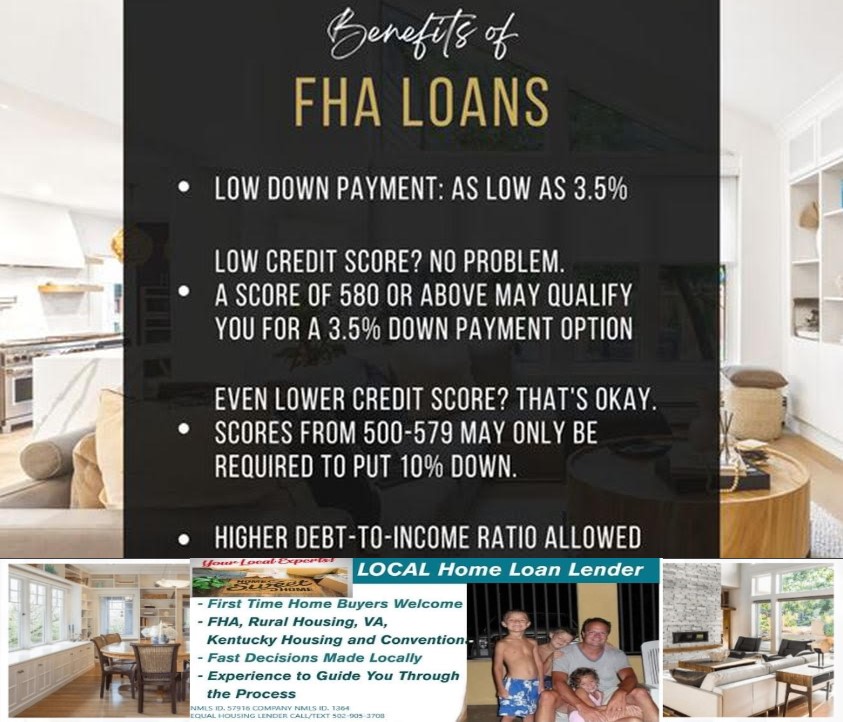

Here are some benefits of Kentucky FHA loans 🤩

✅ Low down payment options

✅ Down payment assistance programs available

✅ Higher DTI ratios acceptedFHA requires you to establish that the income is in fact stable. I am covering Time on Job, Part Time Income, Seasonal Income and Job Gaps below.Time on JobThere is not a minimum length of time a borrower must have held a position for the income to be eligible. However, the application must identify the most recent 2 years of employment.If the borrower’s employment history indicates that they were in school or in the military, then the borrower must provide evidence supporting this such as college transcripts or discharge papers.The current type of employment has to be supported by the college transcripts or discharge papers showing that he borrower’s training enabled them to gain employment in their field of training.Part Time Income

Part-time and second job income can be used to qualify if documentation is obtained to prove that the borrower has worked the part-time job uninterrupted for the past two years, and plans to continue.For Qualifying purposed, “part-time” income refers to jobs taken to supplement the borrower’s main income from regular employment, such as a second job that is less than 40 hours per week.Income: Is averaged over the previous 2 years. If there was a pay rate increase and we can document the increase in pay, you can average the new pay rate over 12 months.Seasonal IncomeSeasonal income may be acceptable for qualifying. It is not unusual to have out-of-season income from unemployment income. If the borrower has a 2 year history and continuance is probable, this type of income may be allowed to qualify the borrower.The key here is history and continuance.Job GapsThe borrower must provide a signed explanation for gaps in employment as follows:Income can be considered effective if the following can be verified:1. Borrower has been employed in the current job for at least six months at the time of the case number assignment AND2. A two year work history prior to the absence from employment.What does FHA stand for?

FHA stands for Federal Housing Administration, and the FHA is a government agency that insures mortgages. It was created just after the Great Depression, at a time when homeownership was prohibitively expensive and difficult to achieve because so many Americans lacked the savings and credit history to qualify for a loan. The government stepped in and began backing mortgages with more accessible terms. Approved lenders began funding FHA loans, which offered more reasonable down payment and credit score standards.

Today, government-backed mortgages still offer a safety net to lenders—because a federal entity (in this case, the FHA) is guaranteeing the loans, there’s less financial risk if a borrower defaults on their payments. Lenders are then able to loosen their qualifying guidelines, making mortgages available to middle and low income borrowers who might not otherwise be approved under conventional standards.

What’s the difference between FHA and conventional loans?

Home loans fall into two broad categories: government and conventional. A conventional loan is any mortgage that is not insured by a federal entity. Because private lenders assume all the risk in funding conventional loans, the requirements to qualify for these loans are more strict. Generally speaking, FHA loans might be a good fit if you have less money set aside to fund your down payment and/or you have a below-average credit score. While low down payment minimums and competitive interest rates are still possible with a conventional loan, you’ll need to show a strong credit score to qualify for those advantages.

Each loan type has advantages and disadvantages—including different mortgage insurance requirements, loan limits, and property appraisal guidelines—so choosing the one that works best for you really depends on your financial profile and your homebuying priorities.

FHA loans pros and cons

FHA loans are meant to make homeownership more accessible to people with fewer savings set aside and lower credit scores. They can be a great fit for some borrowers, particularly first time homebuyers who often need lower down payment options, but you should weigh the costs and benefits of any mortgage before committing. Here’s a breakdown of the key pros and cons when it comes to FHA loans:

Pros Cons Low down payment. Down payments make up the majority of cash to close in any purchase loan, and saving up for one can be a significant barrier for some borrowers. FHA loans make it possible to put down as little as 3.5% upfront and still get competitive rates. Mandatory MIP payments. FHA loans are more lenient, but they also come with insurance costs to mitigate risk to the lender. You’ll have to pay Mortgage Insurance Premiums (MIP) no matter what—either for 11 years or for the life of your loan, depending on your down payment. Lower credit score. Credit scores can be a major hurdle when it comes to conventional loans, but borrowers with credit scores starting at 500 can qualify for FHA loans. Less competitive. Sometimes sellers can be more hesitant to accept FHA loans. In a competitive market, you might not win out against conventional loan bids. Higher DTI accepted. Your debt-to-income (DTI) ratio gives lenders an understanding of other major financial obligations in your life. This ratio is a key factor in any loan application because it indicates your ability to afford a mortgage based on current household income and existing debt. Again, FHA loans offer more leniency here and borrowers at or below 43% DTI can qualify. Stricter property standards. To offset risk and further protect lenders, FHA loans have strict criteria when it comes to assessing the condition of any property being purchased with an FHA loan. The downside? The house you want to buy might not qualify for an FHA loan. The upside? You’re less likely to be financially burdened by a home that requires expensive repairs or updates. No income limitations. It’s a common misconception that FHA loans are only available to first-time homebuyers or borrowers with limited income—but they’re not. There’s no maximum income limit that would disqualify you from this type of loan. Loan limits: FHA loan limits are typically lower than conventional loan limits, which means you might not be able to get funding for more expensive houses. This isn’t necessarily a bad thing, since it helps ensure that borrowers get loans they can afford to repay. How to qualify for an FHA loan

Qualifying for an FHA loan is generally easier than qualifying for a conventional loan, but you’ll still need to meet some basic minimum standards set by the FHA. While the government insures these loans, the funding itself comes through FHA-approved lenders each lending institution may have slightly different qualifying guidelines for its borrowers. Keep in mind that, while these FHA standards offer a basic framework, you’ll need to confirm the individual qualifying rules with your specific lender.

Credit score minimum 500. Your exact credit score will play a big role in determining your down payment minimum; typically, the higher your credit score, the lower your down payment and the more favorable your interest rate.

Debt-to-income ratio at or below 56.9%. DTI is a standard way of comparing the amount of money you earn to the amount you spend paying off other debts, and FHA loans are more lax on this number.

Steady income and proof of employment. Being able to provide at least 2 years of income and employment records is a standard requirement for all loans.

Down payment between 3.5%-10%. The down payment minimum for an FHA loan is typically lower than conventional loan, and can be as little as 3.5% depending on your credit score and lender.

Property standards apply. You won’t qualify for an FHA loan if the house you want to buy doesn’t pass the appraisal process, which is more strict with this type of loan than conventional mortgages.

Maximum FHA loan amount. The amount of money you borrow cannot exceed the FHA loan limits; this number changes based on your county and is determined by how expensive the local market is; the maximum FHA loan limit in 2021 is $420,000 (check HUD resources to confirm the latest limits.)

Joel Lobb

Senior Loan Officer

(NMLS#57916)American Mortgage Solutions, Inc.

10602 Timberwood Circle, Suite 3

Louisville, KY 40223text or call my phone: (502) 905-3708

email me at kentuckyloan@gmail.comThe view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency.

The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people. NMLS ID# 57916, (http://www.nmlsconsumeraccess.org). Mortgage loans only offered in Kentucky.

All loans and lines are subject to credit approval, verification, and collateral evaluation and are originated by lender. Products and interest rates are subject to change without notice.Kentucky FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans.